- Japan

- /

- Professional Services

- /

- TSE:2492

Japanese Stocks That Could Be Trading At A Discount In August 2024

Reviewed by Simply Wall St

Japan’s stock markets have seen modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%. Amid speculation about potential interest rate hikes from the Bank of Japan, investors are closely watching for signs of undervalued opportunities in this evolving market landscape. In such conditions, identifying stocks that may be trading at a discount involves looking for companies with strong fundamentals and growth potential that haven't yet been fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Funai Soken Holdings (TSE:9757) | ¥2328.00 | ¥4642.82 | 49.9% |

| Hagiwara Electric Holdings (TSE:7467) | ¥3540.00 | ¥6771.88 | 47.7% |

| Kotobuki Spirits (TSE:2222) | ¥1762.50 | ¥3434.73 | 48.7% |

| Densan System Holdings (TSE:4072) | ¥2786.00 | ¥5369.58 | 48.1% |

| Hibino (TSE:2469) | ¥3465.00 | ¥6883.48 | 49.7% |

| West Holdings (TSE:1407) | ¥2615.00 | ¥5041.57 | 48.1% |

| Kadokawa (TSE:9468) | ¥2926.50 | ¥5625.58 | 48% |

| Visional (TSE:4194) | ¥8940.00 | ¥17152.15 | 47.9% |

| Fudo Tetra (TSE:1813) | ¥2461.00 | ¥4679.89 | 47.4% |

| TORIDOLL Holdings (TSE:3397) | ¥3700.00 | ¥7371.68 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

Infomart (TSE:2492)

Overview: Infomart Corporation operates an online business-to-business (BtoB) e-commerce trading platform for the food industry in Japan, with a market cap of ¥69.25 billion.

Operations: Infomart's revenue segments include ¥5.52 billion from B2B-PFES and ¥8.79 billion from B to B-PF FOOD.

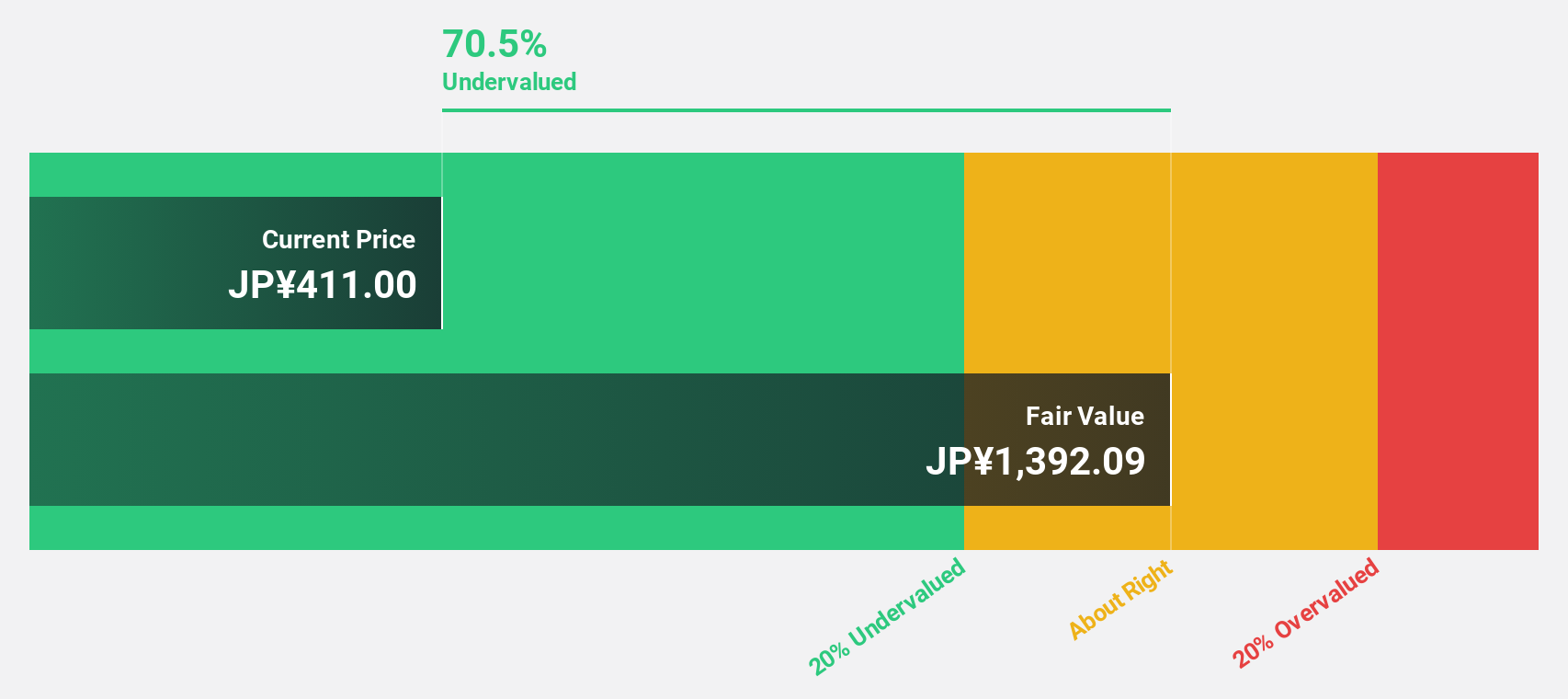

Estimated Discount To Fair Value: 30.6%

Infomart is trading at ¥306, significantly below its estimated fair value of ¥440.65, indicating it may be undervalued based on cash flows. Despite recent share price volatility, the company has shown strong earnings growth of 36.7% over the past year and is forecasted to grow earnings by 41.07% annually over the next three years, outpacing the Japanese market's projected growth rate. Analysts agree that the stock price could rise by 46%.

- Our expertly prepared growth report on Infomart implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Infomart.

PARK24 (TSE:4666)

Overview: PARK24 Co., Ltd. operates and manages parking facilities in Japan and internationally, with a market cap of ¥295.98 billion.

Operations: PARK24 generates revenue primarily from operating and managing parking facilities both domestically and internationally.

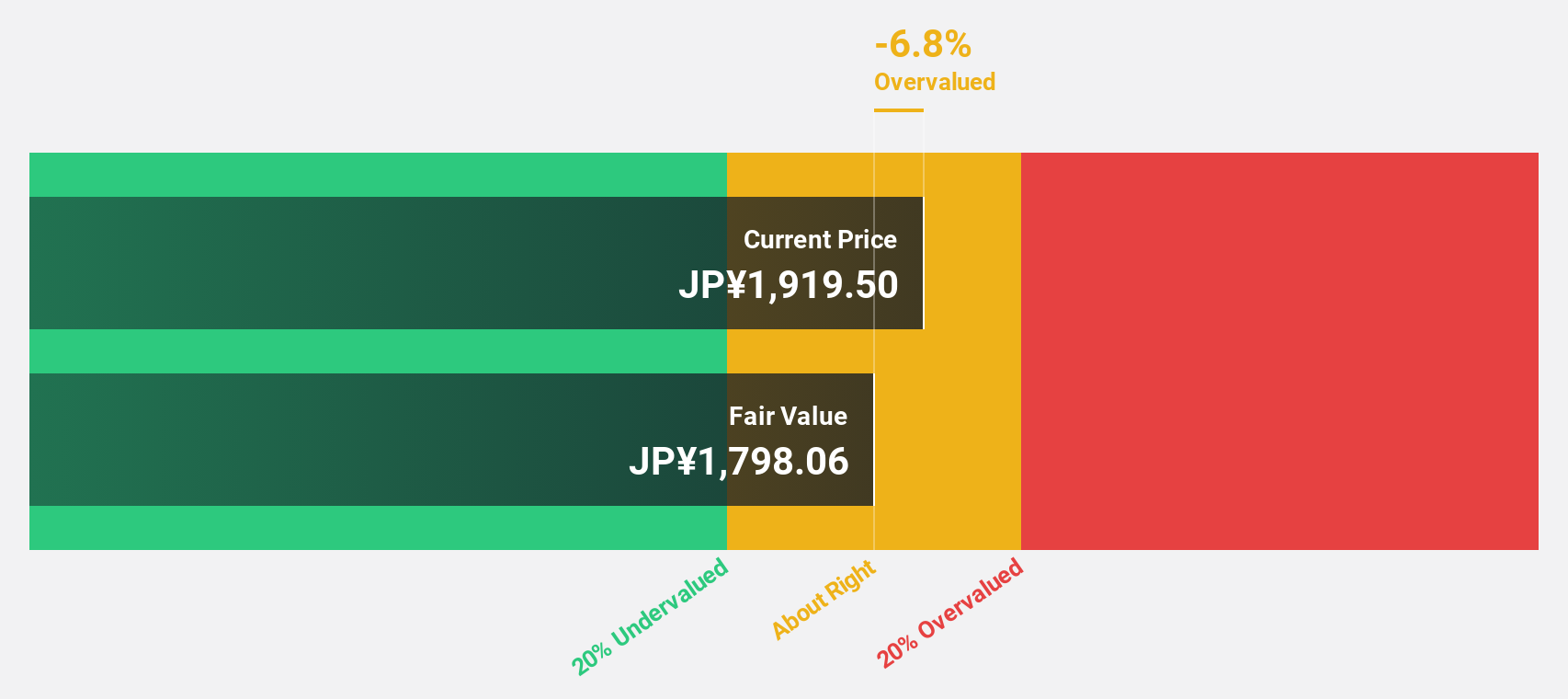

Estimated Discount To Fair Value: 19.5%

PARK24, trading at ¥1735, is undervalued compared to its estimated fair value of ¥2155.88. The company has a high level of debt but shows promising financial health with a forecasted return on equity of 25.6% in three years. Earnings are expected to grow at 12.9% annually, outpacing the Japanese market's growth rate of 8.5%. Despite slower revenue growth (5.8% per year), the stock remains an attractive option based on cash flow valuation.

- According our earnings growth report, there's an indication that PARK24 might be ready to expand.

- Get an in-depth perspective on PARK24's balance sheet by reading our health report here.

Kawasaki Heavy Industries (TSE:7012)

Overview: Kawasaki Heavy Industries, Ltd. operates in aerospace systems, energy solutions and marine engineering, precision machinery and robotics, rolling stock, and motorcycle and engine businesses both in Japan and internationally with a market cap of ¥837.67 billion.

Operations: The company's revenue segments include Aerospace Business (¥435.40 billion), Power Sports & Engine (¥594.38 billion), Energy Solutions & Marine (¥388.09 billion), Precision Machinery / Robot (¥249.35 billion), and Vehicle (¥196.26 billion).

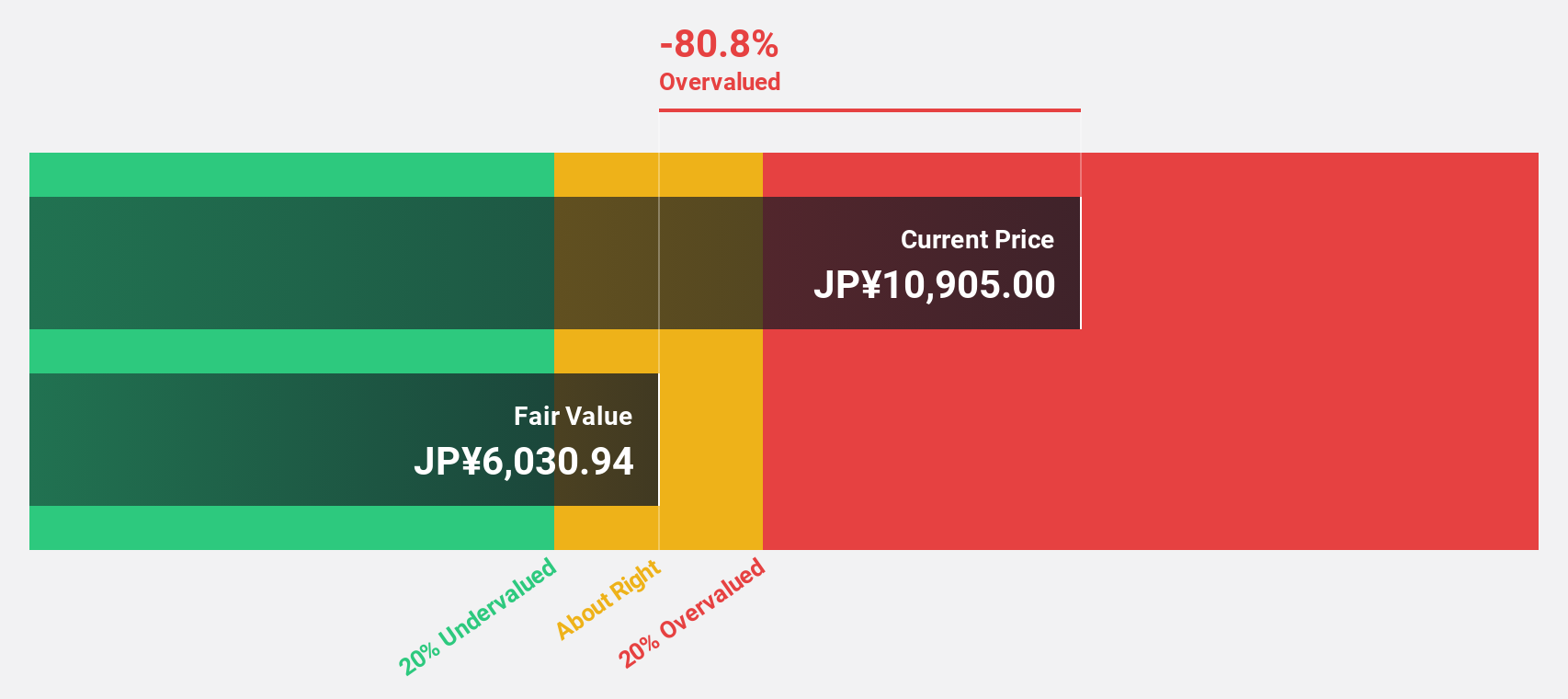

Estimated Discount To Fair Value: 25.4%

Kawasaki Heavy Industries, trading at ¥5001, is undervalued compared to its estimated fair value of ¥6699.95. Despite a volatile share price and low profit margins (1.7%), the company shows strong earnings growth prospects at 21.88% per year, outpacing the Japanese market's 8.5%. However, its debt isn't well covered by operating cash flow and a dividend yield of 2.8% isn't supported by free cash flows, indicating potential financial constraints despite significant undervaluation based on cash flows.

- Insights from our recent growth report point to a promising forecast for Kawasaki Heavy Industries' business outlook.

- Navigate through the intricacies of Kawasaki Heavy Industries with our comprehensive financial health report here.

Where To Now?

- Investigate our full lineup of 82 Undervalued Japanese Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2492

Infomart

Operates an online business to business (BtoB) EC trading platform for the food industry in Japan.

High growth potential with excellent balance sheet.