- Japan

- /

- Interactive Media and Services

- /

- TSE:2371

Top 3 High Growth Tech Stocks in Japan for Potential Portfolio Boost

Reviewed by Simply Wall St

Japan's stock markets have shown modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%, amidst speculation about the Bank of Japan’s commitment to normalizing its monetary policy. As economic indicators continue to support a hawkish stance from the BoJ, investors are increasingly looking at high-growth tech stocks for potential portfolio boosts in this dynamic market environment. In such conditions, a good stock is often characterized by strong fundamentals, innovative capabilities, and resilience to market fluctuations—qualities that are particularly pertinent in Japan’s burgeoning tech sector.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| SHIFT | 20.25% | 32.08% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 66.91% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

GNI Group (TSE:2160)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GNI Group Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally with a market cap of ¥116.89 billion.

Operations: GNI Group Ltd. focuses on the research, development, manufacture, and sale of pharmaceutical drugs across Japan and international markets. The company operates with a market cap of ¥116.89 billion.

GNI Group's recent approval of Avatrombopag Maleate Tablets for thrombocytopenia in China marks a significant milestone, expanding their portfolio alongside ETUARY and Nintedanib. With revenue forecasted to grow at 28.7% annually, outpacing the JP market's 4.3%, the company demonstrates robust growth potential. Their earnings are expected to rise by 24.2% per year, significantly above the market average of 8.5%. Notably, GNI Group invested heavily in R&D, with ¥1B allocated last quarter alone to drive innovation in rare disease treatments.

- Get an in-depth perspective on GNI Group's performance by reading our health report here.

Explore historical data to track GNI Group's performance over time in our Past section.

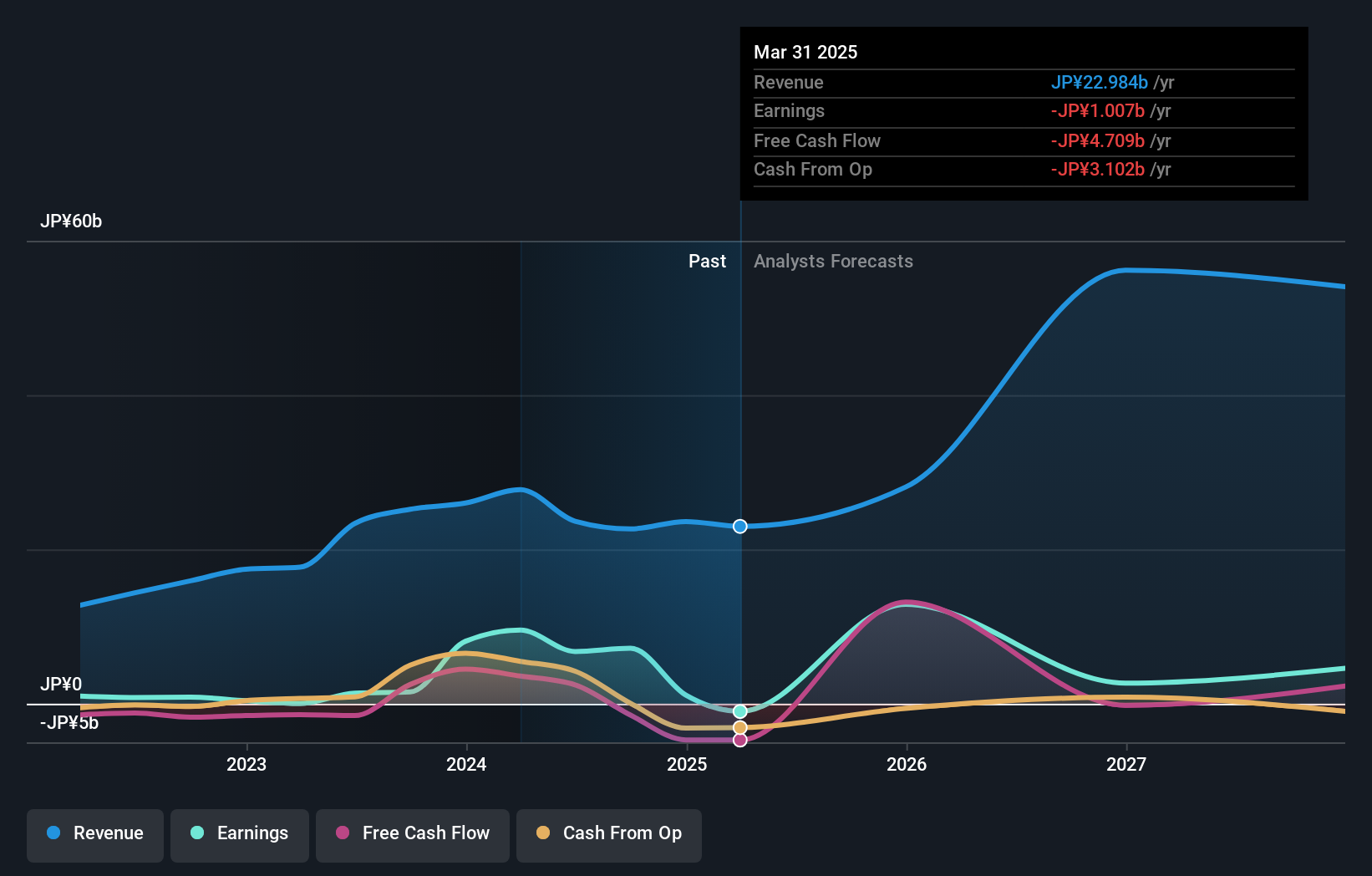

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc., along with its subsidiaries, offers purchase support and restaurant review services in Japan, with a market cap of ¥485.41 billion.

Operations: Kakaku.com, Inc. generates revenue primarily through its purchase support and restaurant review services in Japan. The company leverages its platform to facilitate consumer decision-making and provide detailed reviews of dining establishments.

Kakaku.com stands out in Japan's tech sector with revenue growth forecasted at 8.7% annually, surpassing the JP market's 4.3%. Their earnings are expected to grow by 8.9% per year, reflecting strong performance compared to the market average of 8.5%. Notably, Kakaku.com invested significantly in R&D, allocating ¥1B last quarter alone to drive innovation across their platforms. The company also repurchased shares as part of their remuneration strategy, indicating confidence in their financial health and future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Kakaku.com.

Assess Kakaku.com's past performance with our detailed historical performance reports.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare businesses with a market cap of ¥1.18 trillion.

Operations: OMRON generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion). The company focuses on diverse sectors including automation, healthcare, and social systems solutions globally.

OMRON continues to innovate within Japan's tech sector, particularly in industrial automation. Their strategic partnership with Digimarc Corporation leverages digital watermarks and machine vision technology to enhance efficiency and accuracy in manufacturing processes. Despite an expected revenue growth rate of 5.2% annually, OMRON's earnings are forecasted to grow significantly at 48.6% per year, indicating robust future potential. With substantial R&D investments amounting to ¥1B last quarter alone, the company remains committed to driving technological advancements and maintaining a competitive edge in the market.

- Click to explore a detailed breakdown of our findings in OMRON's health report.

Gain insights into OMRON's historical performance by reviewing our past performance report.

Make It Happen

- Get an in-depth perspective on all 129 Japanese High Growth Tech and AI Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kakaku.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2371

Kakaku.com

Engages in the provision of purchase support, restaurant review, and other services in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.