- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7723

3 Global Dividend Stocks Yielding Over 3.2%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by declining U.S. consumer confidence and mixed economic signals from major regions, investors are increasingly seeking stability amid uncertainty. With most U.S. stock indexes experiencing declines and persistent inflation weighing on spending, dividend stocks yielding over 3.2% present an appealing option for those looking to generate steady income in a volatile environment. When considering dividend stocks, it's crucial to focus on companies with strong fundamentals that can sustain payouts even during challenging economic conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.49% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.94% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.18% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.96% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.84% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.27% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

Click here to see the full list of 1424 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

NIPPON PARKING DEVELOPMENTLtd (TSE:2353)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NIPPON PARKING DEVELOPMENT Co., Ltd. offers consulting services for parking lots both in Japan and internationally, with a market cap of ¥65.43 billion.

Operations: NIPPON PARKING DEVELOPMENT Co., Ltd. generates revenue through its Parking Lot Business at ¥17.48 billion, Ski Resort Business at ¥8.59 billion, and Theme Park Business at ¥7.04 billion.

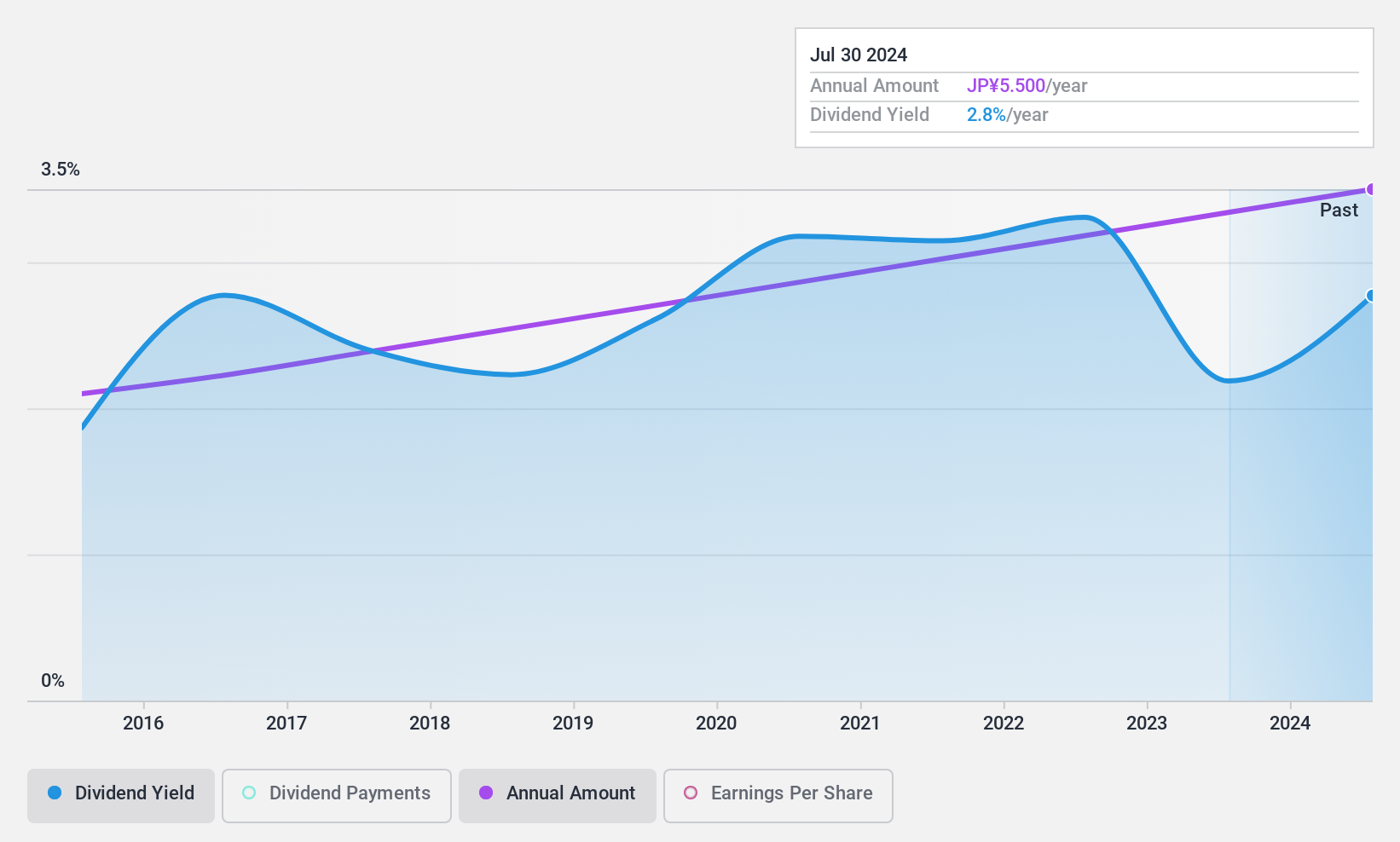

Dividend Yield: 3.2%

Nippon Parking Development Ltd. has consistently increased its dividends over the past decade, maintaining stability with minimal volatility. However, a high cash payout ratio of 344.3% indicates dividends are not well covered by cash flows, raising sustainability concerns despite a low earnings payout ratio of 34.2%. The dividend yield of 3.23% is below Japan's top quartile payers at 3.84%, suggesting it may not be the most competitive option for income-focused investors seeking higher yields.

- Dive into the specifics of NIPPON PARKING DEVELOPMENTLtd here with our thorough dividend report.

- Upon reviewing our latest valuation report, NIPPON PARKING DEVELOPMENTLtd's share price might be too optimistic.

WIN-Partners (TSE:3183)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WIN-Partners Co., Ltd. distributes medical devices to medical institutions primarily in Japan through its subsidiaries, with a market cap of ¥37.81 billion.

Operations: WIN-Partners Co., Ltd. generates revenue primarily from its Medical Equipment Sales Business, amounting to ¥82.61 billion.

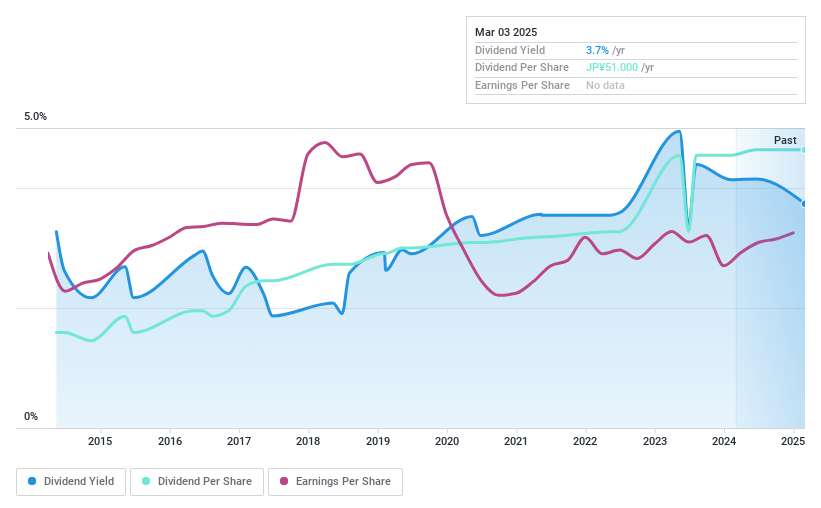

Dividend Yield: 3.7%

WIN-Partners' dividends have been volatile over the past decade, with a payout ratio of 69.9% indicating they are covered by earnings. The dividend yield of 3.71% is slightly below the top quartile in Japan's market. A recent share buyback program aims to enhance shareholder returns and capital efficiency, potentially benefiting long-term investors despite an unstable dividend history. The stock trades at a discount to its estimated fair value, which may appeal to value-conscious investors.

- Delve into the full analysis dividend report here for a deeper understanding of WIN-Partners.

- Our valuation report unveils the possibility WIN-Partners' shares may be trading at a premium.

Aichi Tokei Denki (TSE:7723)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aichi Tokei Denki Co., Ltd. specializes in providing water and gas meters along with related equipment both in Japan and internationally, with a market cap of ¥27.68 billion.

Operations: Aichi Tokei Denki Co., Ltd. generates revenue through its core operations of supplying water and gas meters, as well as associated equipment, to markets within Japan and abroad.

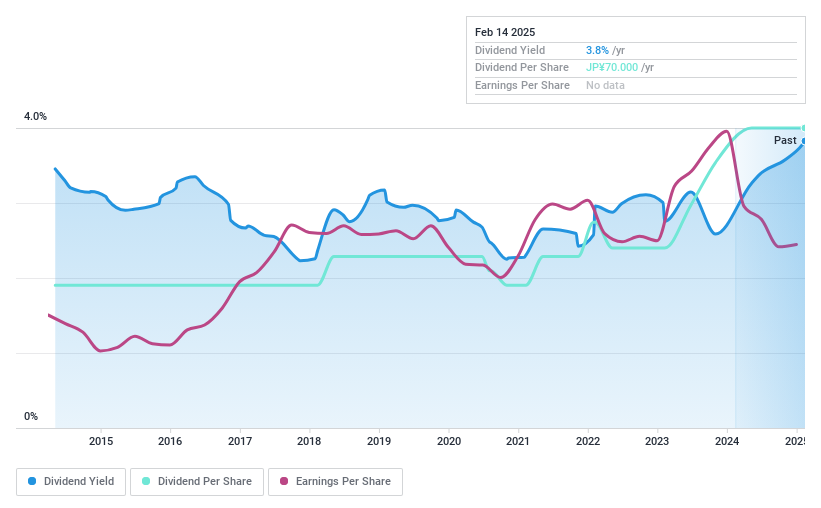

Dividend Yield: 3.5%

Aichi Tokei Denki's dividend yield of 3.49% is below the top quartile in Japan, and its profit margins have declined from last year. Despite a decade of increased dividends, payments have been volatile with significant annual drops. The payout ratios—39.7% for earnings and 37.5% for cash flows—indicate dividends are well covered, suggesting sustainability despite an unstable track record. The stock trades significantly below its estimated fair value, appealing to value investors.

- Click to explore a detailed breakdown of our findings in Aichi Tokei Denki's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Aichi Tokei Denki shares in the market.

Summing It All Up

- Click through to start exploring the rest of the 1421 Top Global Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7723

Aichi Tokei Denki

Engages in the provision of water and gas meters, and related equipment in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives