- Japan

- /

- Commercial Services

- /

- TSE:2331

Why Alsok (TSE:2331) Is Up 8.0% After Considering Upward Revisions to Earnings and Dividends

Reviewed by Sasha Jovanovic

- On November 5, 2025, Alsok Co., Ltd. held a board meeting to consider upward revisions to its financial results forecasts for fiscal year ending March 2026, along with possible adjustments to interim and year-end dividend forecasts, following its recent H1 2026 earnings call.

- The consideration of increased financial and dividend projections often signals management’s confidence in future performance, leading to heightened investor focus ahead of these key announcements.

- We'll explore how Alsok's potential revisions to financial outlook and dividends could influence its current investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is AlsokLtd's Investment Narrative?

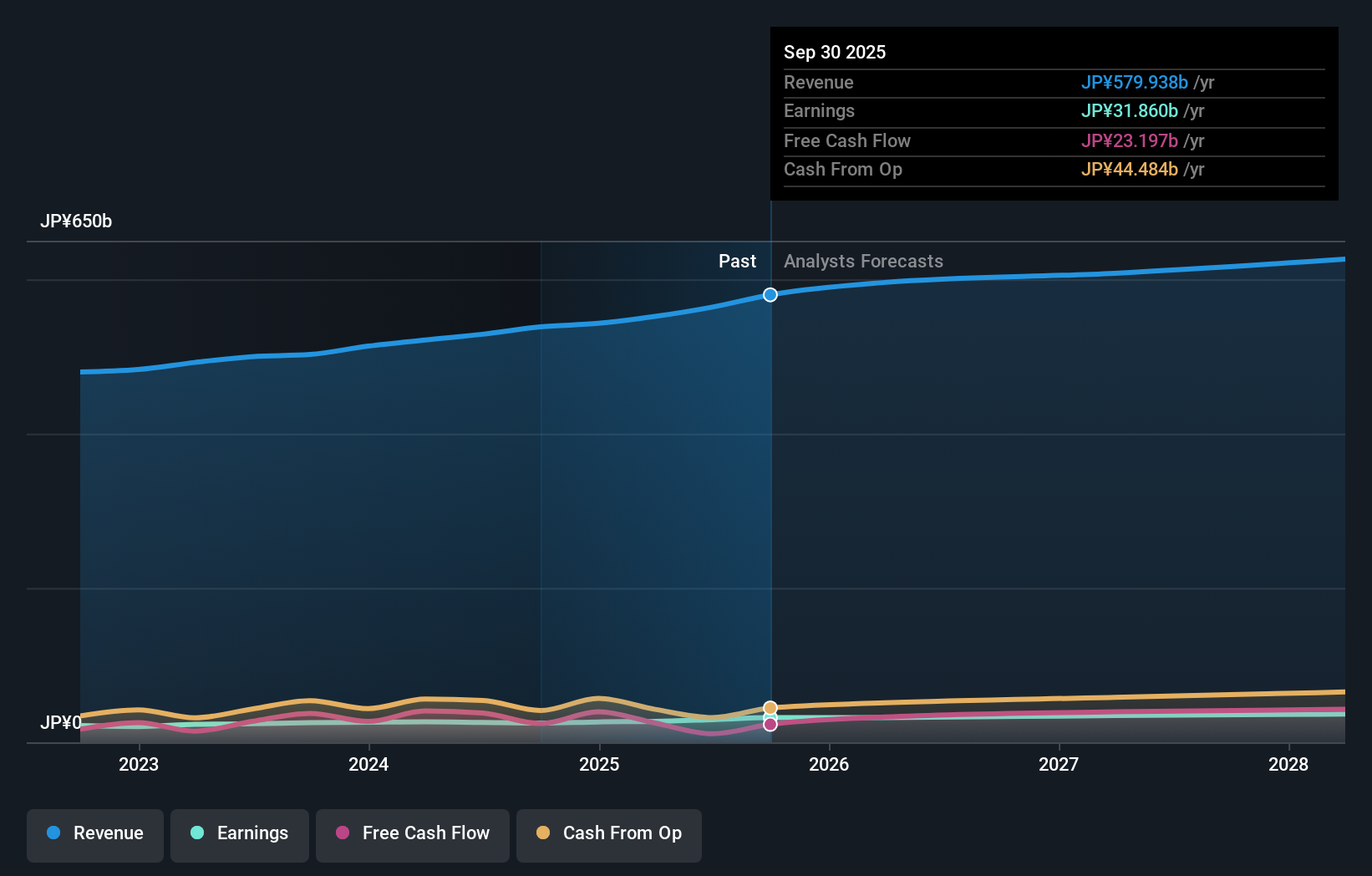

For anyone looking at Alsok Ltd., the big-picture thesis remains grounded in steady, if unspectacular, growth paired with a focus on returning capital to shareholders, reflected in a history of buybacks and consistent, if fluctuating, dividends. The recent board meeting to consider upwards revisions to the company’s financial and dividend outlook could bring short-term momentum, especially in light of the pre-existing view that Alsok trades below estimated fair value. This signals a possible shift: the most immediate catalysts become any forthcoming upward revision to forecasts or dividends, both of which could spark a re-rating given the otherwise muted revenue and earnings growth expectations. However, the biggest risk, Alsok’s relatively sluggish growth compared to its industry and the broader market, doesn’t disappear overnight. If the announced changes are modest, market enthusiasm may quickly fade, especially as concerns linger about the company’s ability to deliver sustained, above-market returns.

On the other hand, risks around slow revenue growth persist for Alsok Ltd. shareholders.

Exploring Other Perspectives

Explore another fair value estimate on AlsokLtd - why the stock might be worth as much as 53% more than the current price!

Build Your Own AlsokLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AlsokLtd research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AlsokLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AlsokLtd's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2331

AlsokLtd

Engages in the electronic, stationed, and transportation security services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives