- Japan

- /

- Commercial Services

- /

- TSE:2304

Little Excitement Around CSS Holdings,Ltd.'s (TSE:2304) Earnings As Shares Take 28% Pounding

CSS Holdings,Ltd. (TSE:2304) shares have had a horrible month, losing 28% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

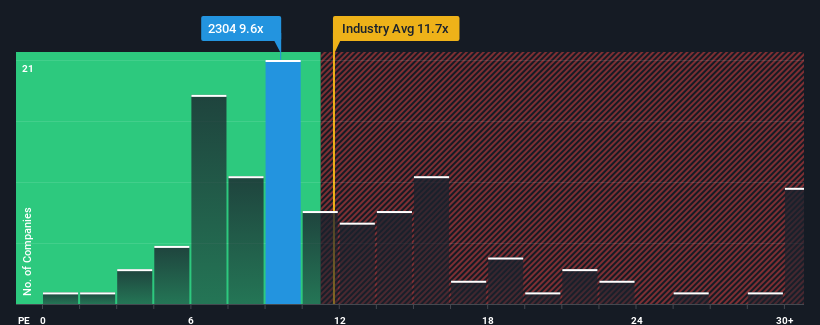

Although its price has dipped substantially, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider CSS HoldingsLtd as an attractive investment with its 9.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for CSS HoldingsLtd as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for CSS HoldingsLtd

Is There Any Growth For CSS HoldingsLtd?

In order to justify its P/E ratio, CSS HoldingsLtd would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 32% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 9.8% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that CSS HoldingsLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

CSS HoldingsLtd's P/E has taken a tumble along with its share price. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that CSS HoldingsLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for CSS HoldingsLtd you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2304

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026