- Japan

- /

- Professional Services

- /

- TSE:2181

Does Persol Holdings (TSE:2181)’s Dividend Hike Reflect Lasting Earnings Strength or Short-Term Optimism?

Reviewed by Sasha Jovanovic

- Persol Holdings Co.,Ltd. recently announced a dividend increase to ¥5.50 per share for the second quarter of the fiscal year ending March 31, 2026, up from ¥4.50 paid for the same period last year, with payments starting December 10, 2025.

- This dividend boost highlights the company's focus on returning value to shareholders and may signal management confidence in future earnings strength.

- We'll explore how the higher dividend payout may reinforce Persol Holdings' investment narrative, especially its implications for sustainable financial performance.

Find companies with promising cash flow potential yet trading below their fair value.

Persol HoldingsLtd Investment Narrative Recap

To be a shareholder in Persol Holdings, you would need to be optimistic about its ability to drive sustained growth through innovation in staffing and workforce solutions, while maintaining profitability despite rising costs. The recent dividend increase is a positive signal for shareholder returns, but it doesn't materially shift the key near-term catalyst, which remains the technology-driven advancements in the Career SBU, nor does it reduce the foremost risk of margin pressures from higher SG&A expenses or competitive hiring markets.

Among recent announcements, the May guidance for both mid-year and year-end dividends at ¥5.50 per share underscores a commitment to shareholder rewards. This action is aligned with ongoing efforts to enhance returns, but the biggest near-term catalyst is still the growth of the Career SBU, particularly the AI Strategy Division's push to boost efficiency and placement rates, which is essential for offsetting cost pressures and maintaining profitability.

By contrast, investors should pay close attention to the risk that higher marketing and personnel expenses in a competitive labor market could...

Read the full narrative on Persol HoldingsLtd (it's free!)

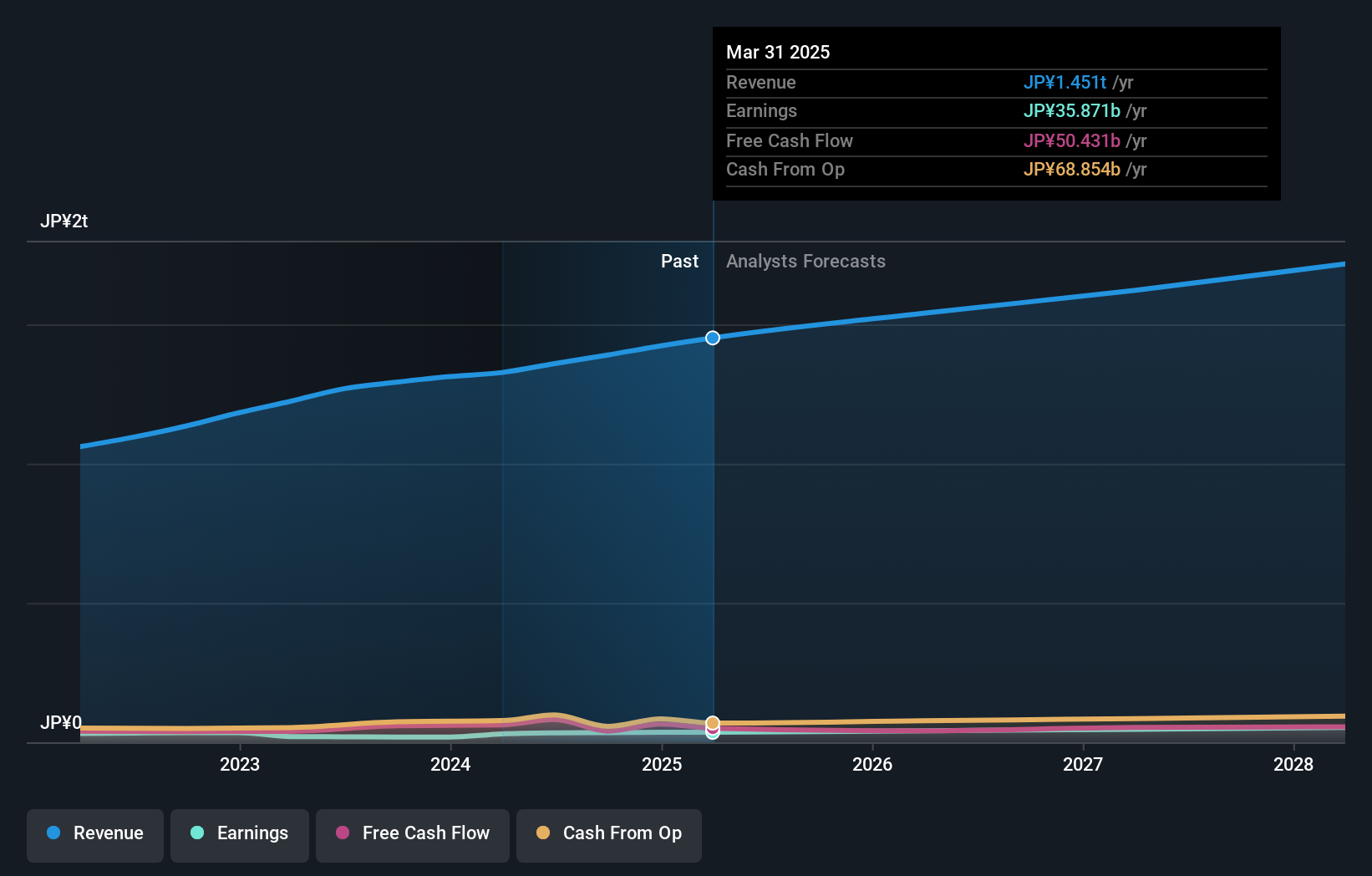

Persol HoldingsLtd's narrative projects ¥1,723.1 billion revenue and ¥54.2 billion earnings by 2028. This requires 5.6% yearly revenue growth and a ¥20.6 billion earnings increase from ¥33.6 billion currently.

Uncover how Persol HoldingsLtd's forecasts yield a ¥329 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place Persol Holdings’ fair value between ¥233 and ¥329, reflecting two quite different outlooks on growth potential. Many recognize the potential impact of the Career SBU's AI-driven initiatives, but investors' opinions differ widely, review several perspectives to better understand possible outcomes for the company's performance.

Explore 2 other fair value estimates on Persol HoldingsLtd - why the stock might be worth 16% less than the current price!

Build Your Own Persol HoldingsLtd Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Persol HoldingsLtd research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Persol HoldingsLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Persol HoldingsLtd's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2181

Persol HoldingsLtd

Provides human resource services under the PERSOL brand worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives