- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7732

3 Japanese Exchange Stocks Estimated To Trade At Up To 49.5% Discount

Reviewed by Simply Wall St

Japan's stock markets have recently experienced significant volatility, driven by a rebounding yen and concerns over global economic growth. However, dovish comments from the Bank of Japan have helped stabilize the market, creating potential opportunities for discerning investors. In this context, identifying undervalued stocks can be particularly rewarding. Stocks trading at substantial discounts may offer attractive entry points for those looking to capitalize on market inefficiencies and long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥535.00 | ¥1059.42 | 49.5% |

| Hagiwara Electric Holdings (TSE:7467) | ¥3350.00 | ¥6656.50 | 49.7% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1475.00 | ¥2848.48 | 48.2% |

| Insource (TSE:6200) | ¥838.00 | ¥1617.51 | 48.2% |

| KATITAS (TSE:8919) | ¥1700.00 | ¥3189.94 | 46.7% |

| Micronics Japan (TSE:6871) | ¥4930.00 | ¥9811.20 | 49.8% |

| BayCurrent Consulting (TSE:6532) | ¥4384.00 | ¥8632.81 | 49.2% |

| Premium Group (TSE:7199) | ¥1854.00 | ¥3354.84 | 44.7% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3910.00 | ¥7551.20 | 48.2% |

| TORIDOLL Holdings (TSE:3397) | ¥3820.00 | ¥7233.65 | 47.2% |

Let's explore several standout options from the results in the screener.

Link and Motivation (TSE:2170)

Overview: Link and Motivation Inc. provides consulting and cloud services in Japan with a market cap of ¥56.97 billion.

Operations: The company generates revenue through consulting services amounting to ¥13.45 billion and cloud services totaling ¥7.89 billion in Japan.

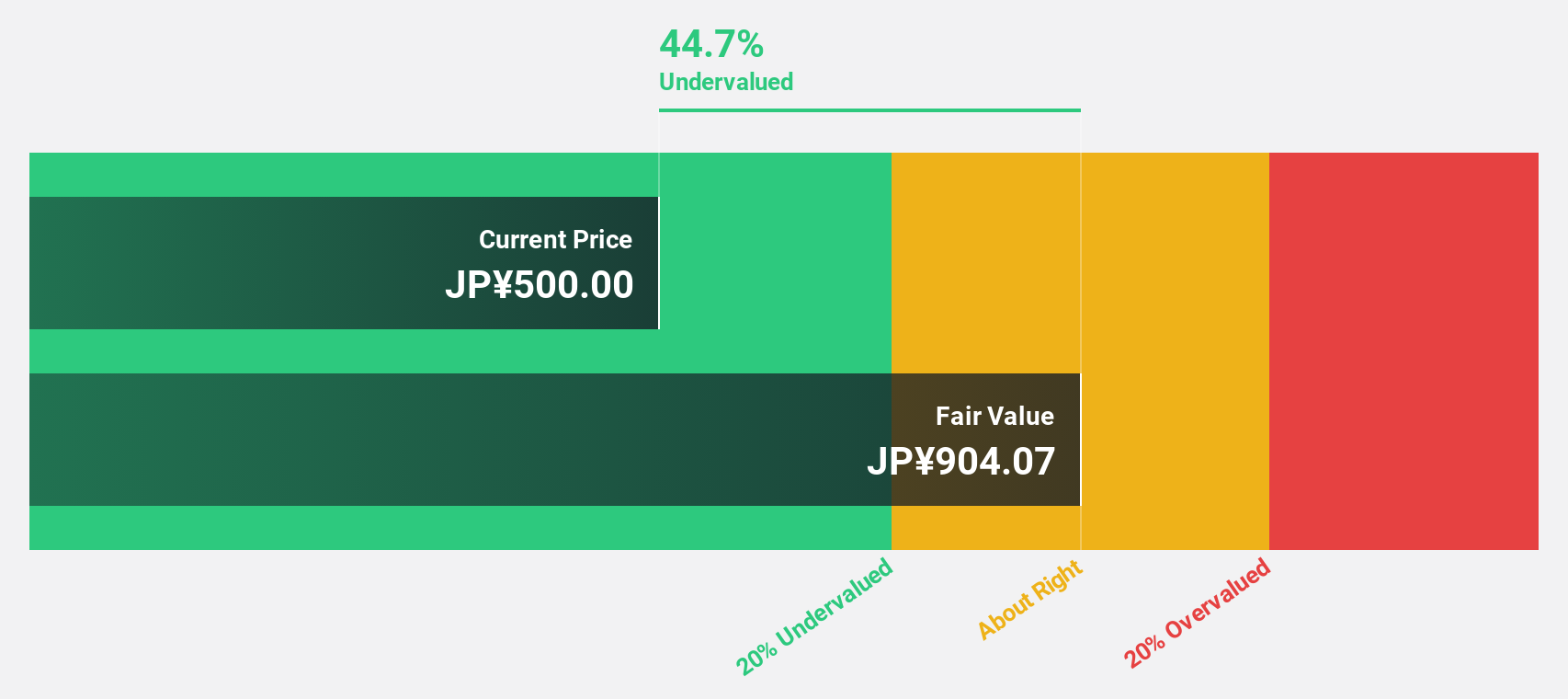

Estimated Discount To Fair Value: 49.5%

Link and Motivation Inc. is trading at ¥535, significantly below its estimated fair value of ¥1059.42, making it highly undervalued based on discounted cash flows. The company has demonstrated strong earnings growth of 44.4% over the past year and is forecasted to grow earnings by 18.38% annually, outpacing the market average. Recent buybacks totaling ¥796.83 million further enhance shareholder value, while a reliable dividend yield of 2.17% adds to its investment appeal.

- Our growth report here indicates Link and Motivation may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Link and Motivation.

BayCurrent Consulting (TSE:6532)

Overview: BayCurrent Consulting, Inc. provides consulting services in Japan and has a market cap of ¥665.15 billion.

Operations: BayCurrent Consulting, Inc. generates revenue from providing consulting services in Japan.

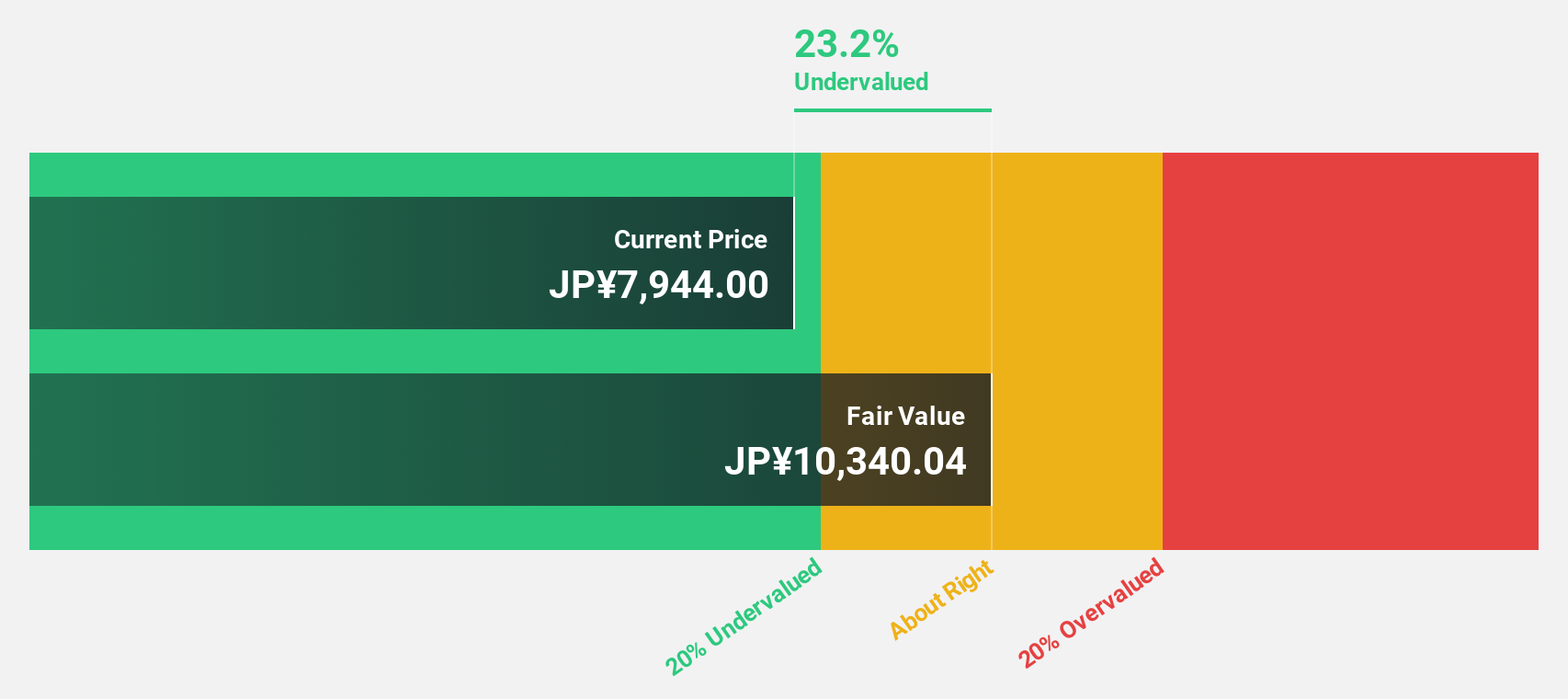

Estimated Discount To Fair Value: 49.2%

BayCurrent Consulting is trading at ¥4384, significantly below its estimated fair value of ¥8632.81, indicating undervaluation based on discounted cash flows. Despite high share price volatility, the company has demonstrated strong earnings growth of 17.4% over the past year and is forecasted to grow earnings by 18.5% annually, outpacing the market average. Recent buybacks totaling ¥3.60 billion further enhance shareholder value ahead of its Q1 2025 results announcement on July 11, 2024.

- Our comprehensive growth report raises the possibility that BayCurrent Consulting is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of BayCurrent Consulting.

Topcon (TSE:7732)

Overview: Topcon Corporation, with a market cap of ¥144.84 billion, develops, manufactures, and sells positioning, eye care, and smart infrastructure products both in Japan and internationally.

Operations: The company's revenue segments include ¥67.89 billion from the Eye Care Business and ¥148.60 billion from the Positioning Business.

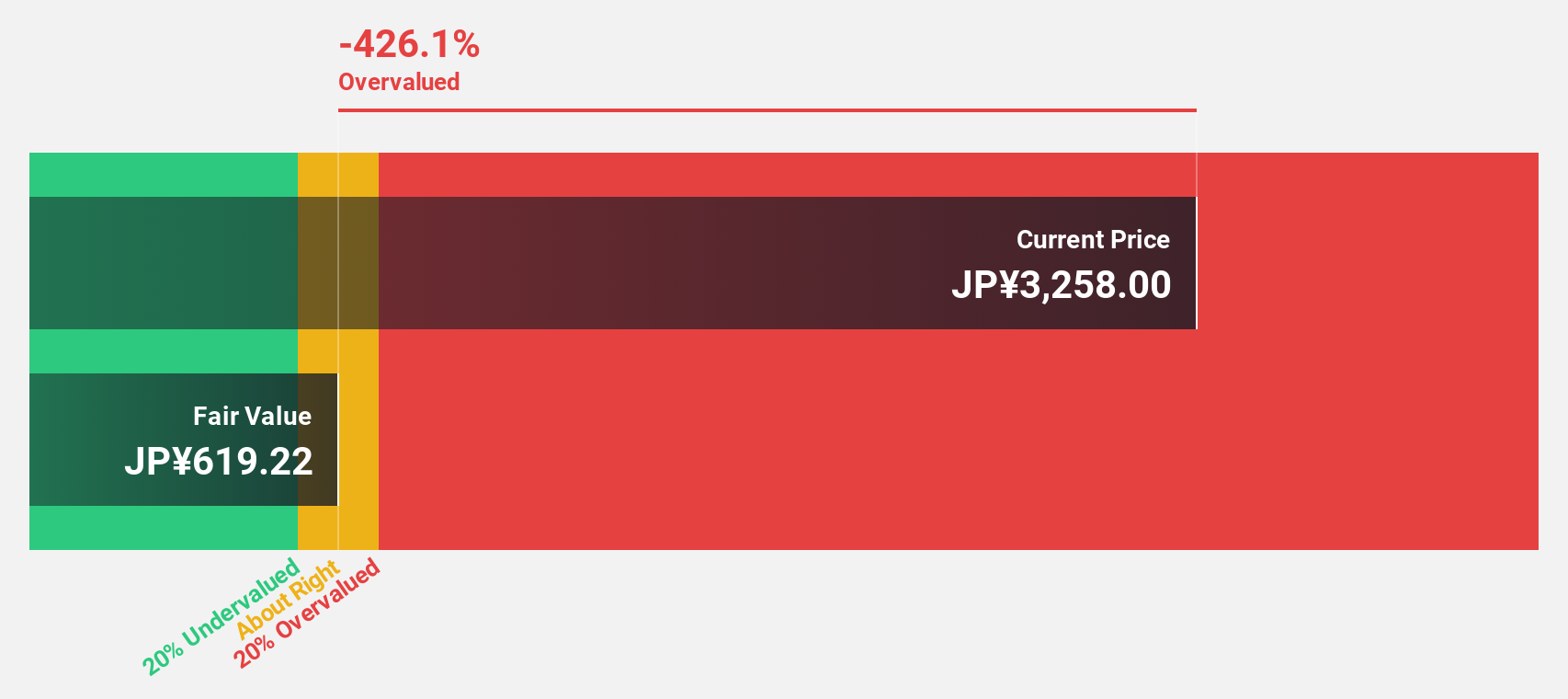

Estimated Discount To Fair Value: 29.1%

Topcon Corporation is currently trading at ¥1374, which is 29.1% below its estimated fair value of ¥1939.26, highlighting significant undervaluation based on discounted cash flows. Despite a forecasted revenue growth of 5.6% per year and earnings growth of 24.1% annually, the company's profit margins have decreased from 4% to 1.9%. Additionally, Topcon's dividend yield of 3.06% is not well covered by earnings or free cash flows, raising sustainability concerns despite recent dividend affirmations and stable guidance for fiscal year ending March 31, 2025.

- The growth report we've compiled suggests that Topcon's future prospects could be on the up.

- Click here to discover the nuances of Topcon with our detailed financial health report.

Seize The Opportunity

- Investigate our full lineup of 73 Undervalued Japanese Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topcon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7732

Topcon

Develops, manufactures, and sells positioning, eye care, and smart infrastructure products in Japan and internationally.

Reasonable growth potential slight.