Discovering Nihon Parkerizing And Two Other Top Small Cap Gems In Japan

Reviewed by Simply Wall St

Japan's stock markets have recently experienced significant volatility, driven by a rebounding yen and concerns over global growth. Despite these fluctuations, the broader market sentiment has stabilized, thanks in part to reassuring comments from the Bank of Japan. In this environment, identifying strong small-cap stocks requires a focus on companies with robust fundamentals and unique value propositions. Let's explore Nihon Parkerizing and two other top small-cap gems in Japan that stand out in today's market.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Uchida Yoko | 6.26% | 7.83% | 16.58% | ★★★★★★ |

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Imuraya Group | 17.62% | 1.55% | 27.83% | ★★★★★★ |

| Techno Ryowa | 1.77% | 2.06% | 5.32% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Nihon Parkerizing (TSE:4095)

Simply Wall St Value Rating: ★★★★★★

Overview: Nihon Parkerizing Co., Ltd. engages in the manufacture and supply of surface treatment chemicals in Japan and internationally, with a market cap of ¥144.97 billion.

Operations: Nihon Parkerizing generates revenue primarily from the sale of surface treatment chemicals. The company reported a market cap of ¥144.97 billion and operates both domestically in Japan and internationally.

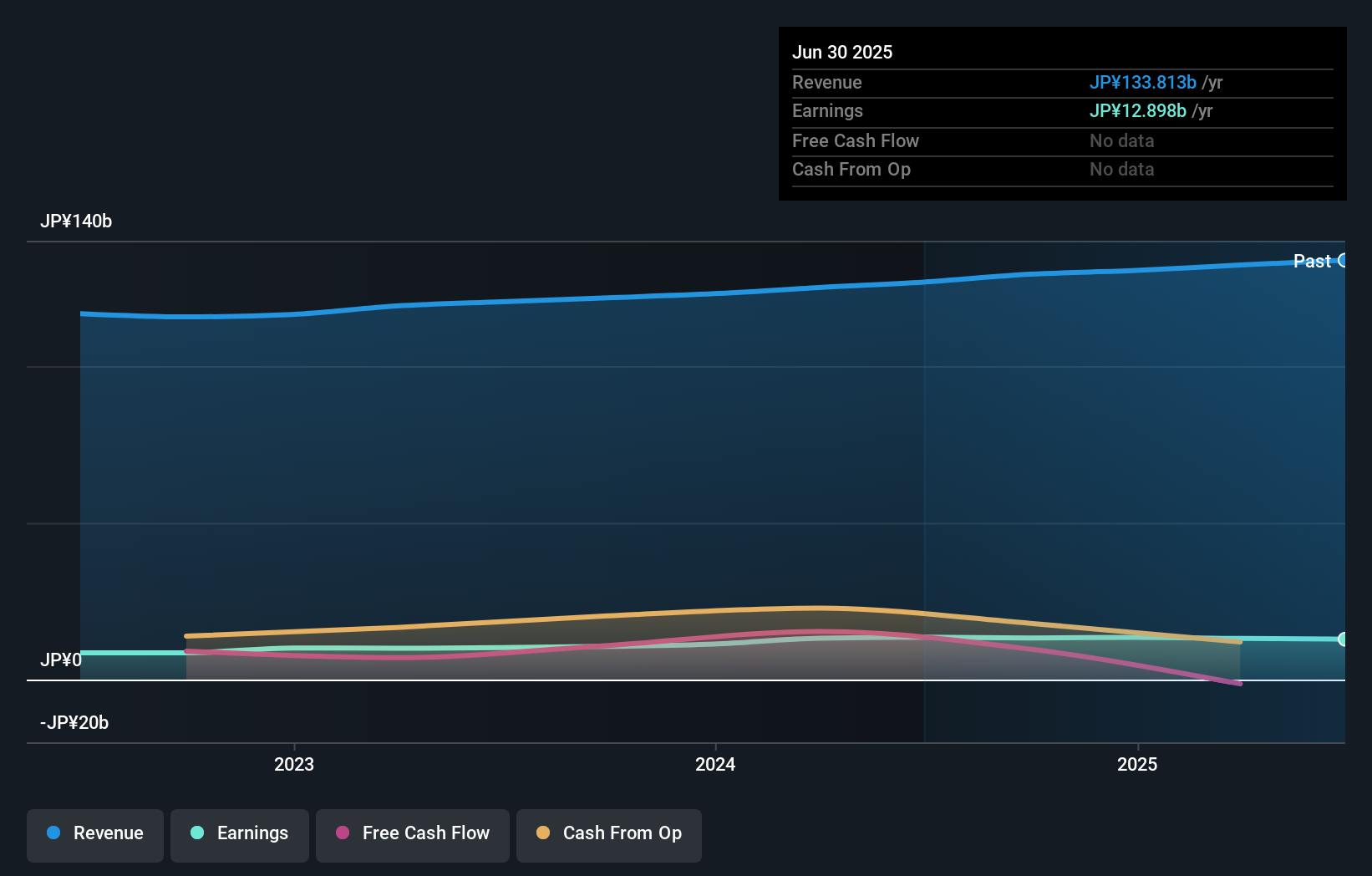

Nihon Parkerizing, a promising player in Japan's chemicals sector, has seen its earnings grow by 32.8% over the past year, outpacing the industry's 10.9%. Trading at 61% below estimated fair value and with a debt-to-equity ratio reduced from 1.1 to 0.3 over five years, it shows strong financial health. The company recently announced a share repurchase program worth ¥15 billion and anticipates net sales of ¥132 billion for FY2025.

Yamabiko (TSE:6250)

Simply Wall St Value Rating: ★★★★★★

Overview: Yamabiko Corporation, along with its subsidiaries, manufactures and sells agricultural machinery in Japan, Europe, the United States, and internationally with a market cap of ¥86.35 billion.

Operations: Yamabiko Corporation generates revenue primarily from the sale of agricultural machinery across various regions, including Japan, Europe, and the United States. The company's net profit margin stands at 5.23%, reflecting its profitability after accounting for all expenses.

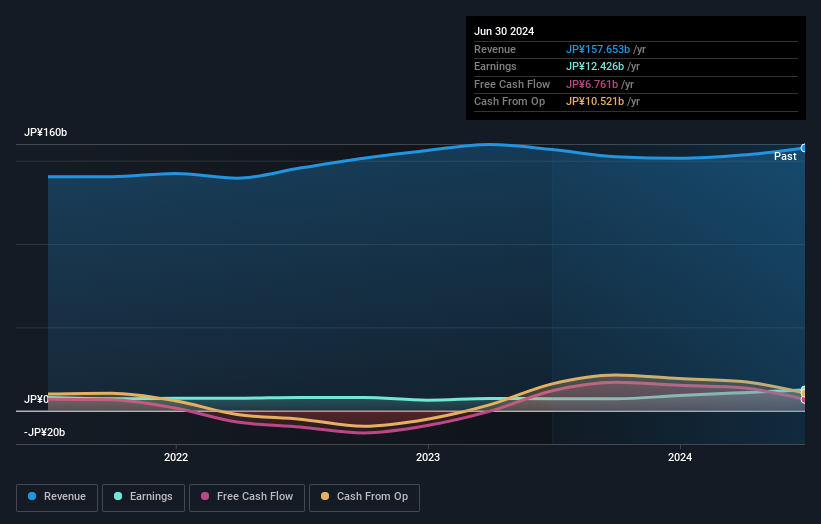

Yamabiko's earnings grew 47.3% over the past year, significantly outpacing the machinery industry's 13.2%. The company's debt to equity ratio has improved from 42% to 21.3% in five years, reflecting strong financial management. Yamabiko announced a Q2 dividend of ¥40 per share, up from ¥26 last year, with an annual forecast of ¥40 per share against ¥29 previously. Net sales for FY2024 are projected at ¥160 billion with operating profit at ¥17.5 billion and EPS at ¥315.50.

- Delve into the full analysis health report here for a deeper understanding of Yamabiko.

Assess Yamabiko's past performance with our detailed historical performance reports.

Konoike TransportLtd (TSE:9025)

Simply Wall St Value Rating: ★★★★★☆

Overview: Konoike Transport Co., Ltd. offers logistics services both domestically in Japan and internationally, with a market cap of ¥125.96 billion.

Operations: Konoike Transport Co., Ltd. generates revenue primarily through its logistics services in Japan and internationally. The company reported a market cap of ¥125.96 billion.

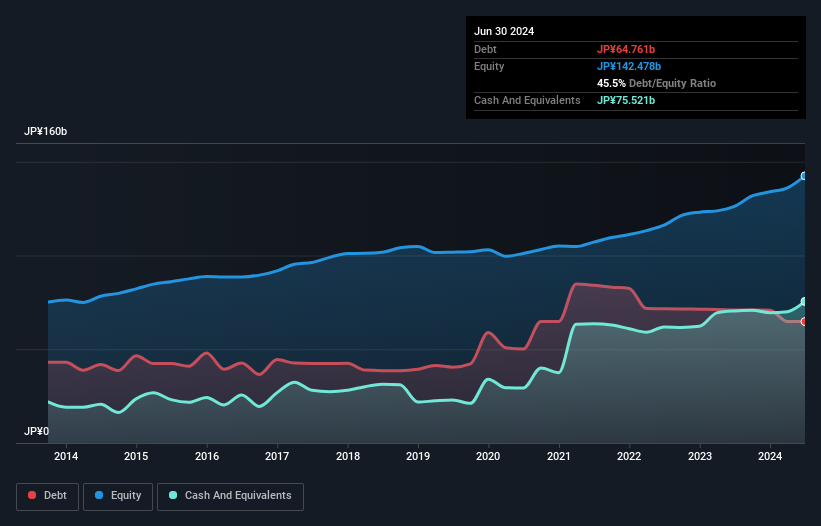

Konoike Transport Co.,Ltd. stands out with a 77% earnings growth over the past year, surpassing the Logistics industry average of -1%. Trading at 45% below its estimated fair value, it offers good relative value compared to peers. The company has forecasted net sales of ¥340 billion and an operating profit of ¥18 billion for the full year ending March 2025. Despite an increased debt-to-equity ratio from 39.7% to 45.5%, it holds more cash than total debt, ensuring financial stability.

Summing It All Up

- Delve into our full catalog of 718 Japanese Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Konoike TransportLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9025

Konoike TransportLtd

Provides logistics services in Japan and internationally.

Undervalued with solid track record and pays a dividend.