- Japan

- /

- Commercial Services

- /

- TSE:5695

Know This Before Buying Powdertech Co., Ltd. (TYO:5695) For Its Dividend

Today we'll take a closer look at Powdertech Co., Ltd. (TYO:5695) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

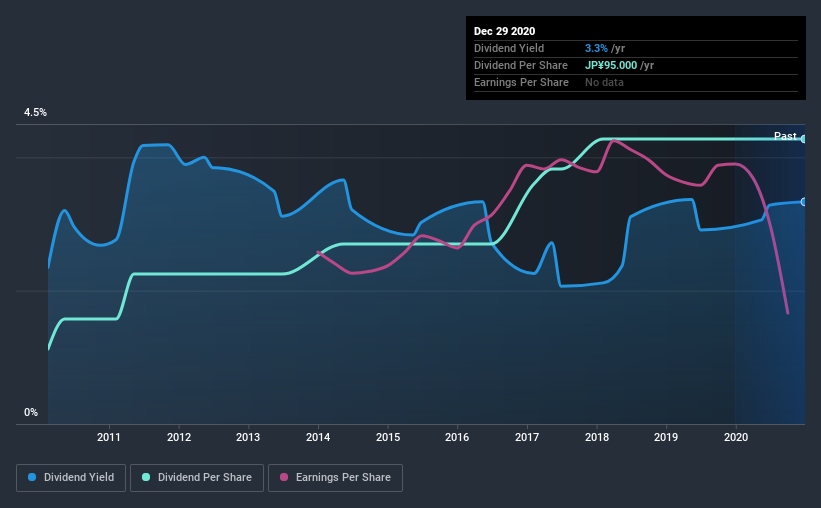

With Powdertech yielding 3.3% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. We'd guess that plenty of investors have purchased it for the income. Some simple analysis can reduce the risk of holding Powdertech for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Powdertech!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 57% of Powdertech's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Powdertech paid out 125% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. Powdertech paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough free cash flow to cover the dividend. Were it to repeatedly pay dividends that were not well covered by cash flow, this could be a risk to Powdertech's ability to maintain its dividend.

With a strong net cash balance, Powdertech investors may not have much to worry about in the near term from a dividend perspective.

We update our data on Powdertech every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of Powdertech's dividend payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was JP¥25.0 in 2010, compared to JP¥95.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 14% a year over that time.

With rapid dividend growth and no notable cuts to the dividend over a lengthy period of time, we think this company has a lot going for it.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. In the last five years, Powdertech's earnings per share have shrunk at approximately 9.5% per annum. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Powdertech gets a pass on its dividend payout ratio, but it paid out virtually all of its cash flow as dividends. This may just be a one-off, but we'd keep an eye on this. Moreover, earnings have been shrinking. While the dividends have been fairly steady, we'd wonder for how much longer this will be sustainable if earnings continue to decline. With this information in mind, we think Powdertech may not be an ideal dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for Powdertech that investors should know about before committing capital to this stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade Powdertech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:5695

Powdertech

Manufactures and sells carriers for electrophotography in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives