- Japan

- /

- Trade Distributors

- /

- TSE:9934

Inaba Denki Sangyo (TSE:9934) Margin Expansion Reinforces Bullish Case Despite Dividend Concerns

Reviewed by Simply Wall St

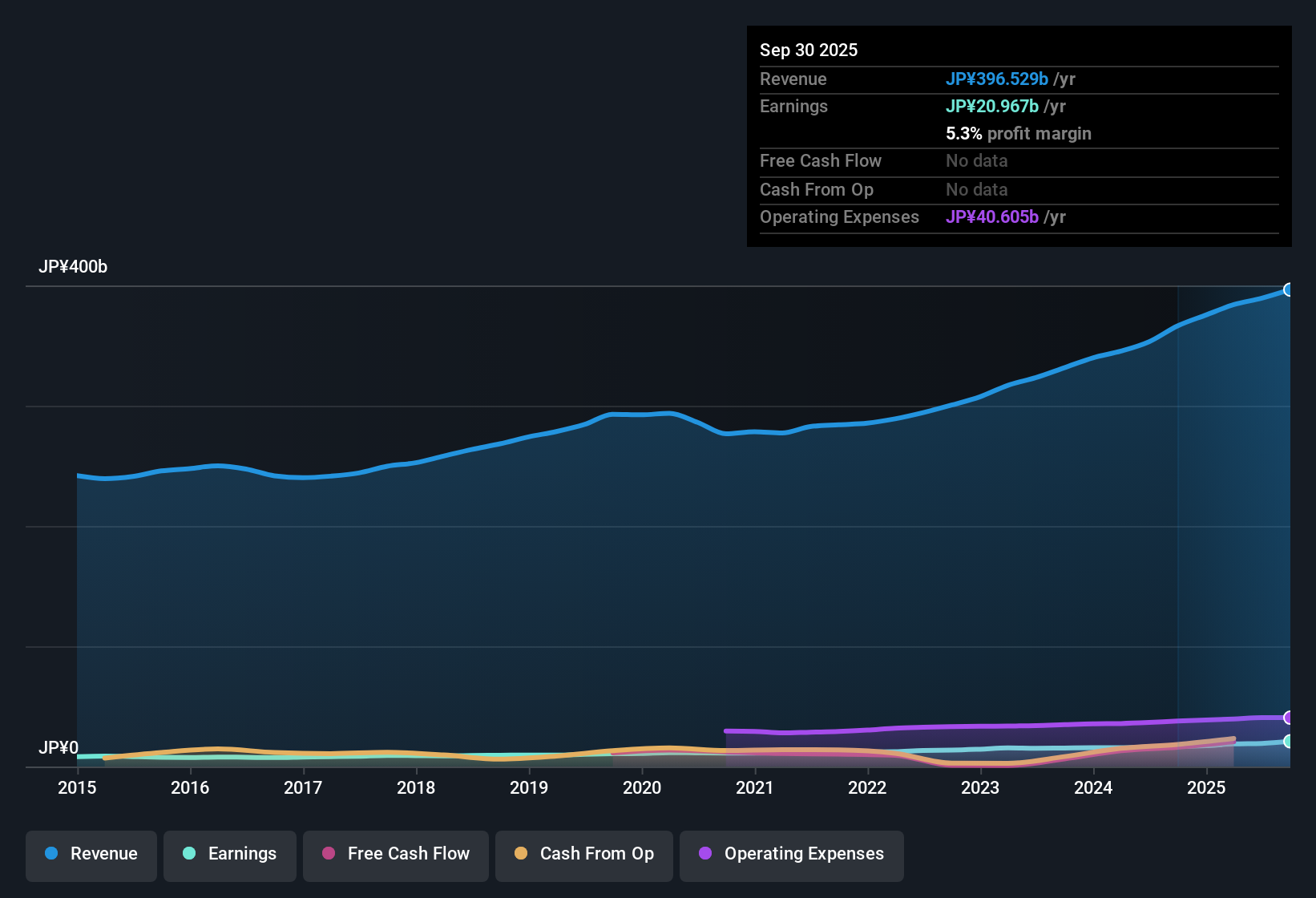

Inaba Denki Sangyo Ltd. (TSE:9934) posted net profit margins of 5.3%, up from 4.5% last year, with earnings climbing 26.5% this period. Looking back, the company has averaged 12.2% annual earnings growth over the last five years, and ongoing profit momentum has outpaced historical trends. Investors will note that profit and revenue growth remain strong drivers this season, though the mixed valuation and a flagged risk on dividend sustainability add nuance to the overall picture.

See our full analysis for Inaba Denki SangyoLtd.With the headline figures set, we now turn to how these results compare to widely followed narratives in the market. Some expectations will likely be confirmed, while others may be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Strengthen Amid High-Quality Profits

- Net profit margins climbed to 5.3% from 4.5% last year, outpacing typical profitability for the company.

- The ongoing ability to sustain and even improve margins heavily supports the view that Inaba Denki Sangyo’s earnings quality stands out among Japanese industrial distributors.

- Bulls often argue that the company’s track record of 12.2% average annual earnings growth over five years not only shows resilience, but sets it up to weather sector volatility.

- What is surprising, given the usually modest profile of sector peers, is that Inaba Denki Sangyo achieved a 26.5% surge in recent profit growth. This exceeds its historic average and reinforces optimism about management’s operational efficiency.

Dividend Sustainability Under the Microscope

- While profit growth and margin levels are robust, the reliability of future dividends has been flagged as a risk for income-focused investors.

- Critics highlight that, despite this period’s strong bottom-line performance, there is no confirmation from the filing that dividend levels are being raised in tandem with profits.

- This tension challenges the view that recent earnings strength will immediately benefit shareholder payouts, especially if profit retention becomes a management priority.

- As a defensive play, the company typically attracts for its dividend history, making any signals of uncertainty or unsustainable distributions especially noteworthy for conservative investors.

Valuation: Premium Versus Industry, Discount to DCF

- The share price of ¥4,543 trades below the DCF fair value of ¥7,612.63, yet the price-to-earnings ratio of 12.2x is above both the industry average of 10.1x and peer average of 8.5x.

- Despite strong profitability metrics, prevailing analysis points out a mixed picture for new investors weighing up current entry points.

- The valuation premium against industry norms can be justified by ongoing profit momentum, but the discount to DCF fair value might appeal most to those with a longer-term mindset.

- Sector context matters too. While margin and profit expansion distinguish the company, higher-than-average multiples could limit near-term upside unless growth continues to surprise.

For a more detailed breakdown of how analysts view these valuation factors and industry comparisons, check out the full consensus narrative for the inside scoop. 📊 Read the full Inaba Denki SangyoLtd Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Inaba Denki SangyoLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Dividend sustainability remains a risk, since the company’s strong profits have not been matched by clear evidence that shareholder payouts will keep pace.

If income reliability matters to you, check out these 1993 dividend stocks with yields > 3% to discover companies with a stronger track record of stable, rewarding dividends that can weather uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9934

Inaba Denki SangyoLtd

Sells electrical equipment and materials, industrial automation, and proprietary products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives