- China

- /

- Electronic Equipment and Components

- /

- SZSE:300880

Exploring Undiscovered Gems on None in December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in major indexes and mixed performances across sectors, small-cap stocks represented by the Russell 2000 Index have recently underperformed their larger peers. In this environment, where growth shares are outpacing value stocks significantly, identifying promising opportunities among lesser-known companies becomes crucial for investors seeking potential hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| CHT Security | NA | 11.75% | 35.75% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Kinpo Electronics | 126.70% | 5.77% | 32.85% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Boji Medical TechnologyLtd (SZSE:300404)

Simply Wall St Value Rating: ★★★★★☆

Overview: Boji Medical Technology Co., Ltd. offers contract research services for the R&D and production of drugs and medical devices to pharmaceutical companies both in China and internationally, with a market cap of CN¥3.64 billion.

Operations: Boji Medical Technology generates revenue primarily from providing contract research services for the R&D and production of drugs and medical devices. The company's market cap is CN¥3.64 billion, reflecting its scale in the industry.

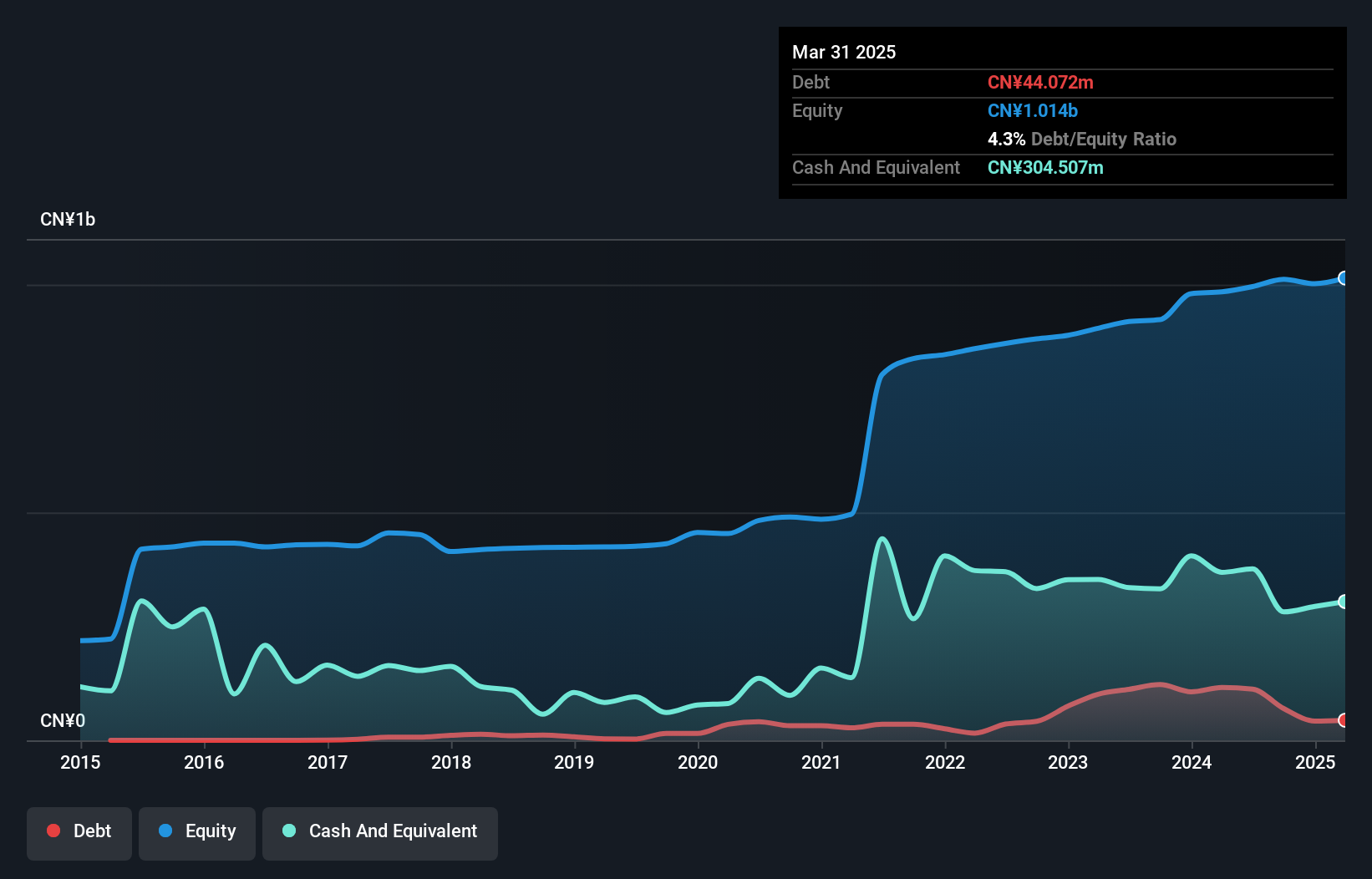

Boji Medical Technology, a smaller player in the industry, has shown impressive earnings growth of 52.3% over the past year, outpacing the Life Sciences sector's -14.4%. The company reported sales of CN¥556.15 million for the first nine months of 2024, up from CN¥358.78 million a year ago, with net income rising to CN¥43.28 million from CN¥23.02 million. Despite a debt-to-equity ratio increase from 3.5% to 6.9% over five years and no positive free cash flow currently, Boji maintains more cash than its total debt and continues to cover interest payments comfortably.

Ningbo Jianan ElectronicsLtd (SZSE:300880)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Jianan Electronics Co., Ltd focuses on the research, development, production, and sale of smart energy meters, data collection systems, and metering infrastructure in China with a market cap of CN¥4.65 billion.

Operations: Ningbo Jianan Electronics Co., Ltd generates revenue primarily from the sale of smart energy meters and related systems. The company's cost structure is influenced by production expenses associated with these products. It has a market capitalization of CN¥4.65 billion, reflecting its position in the Chinese market for metering solutions.

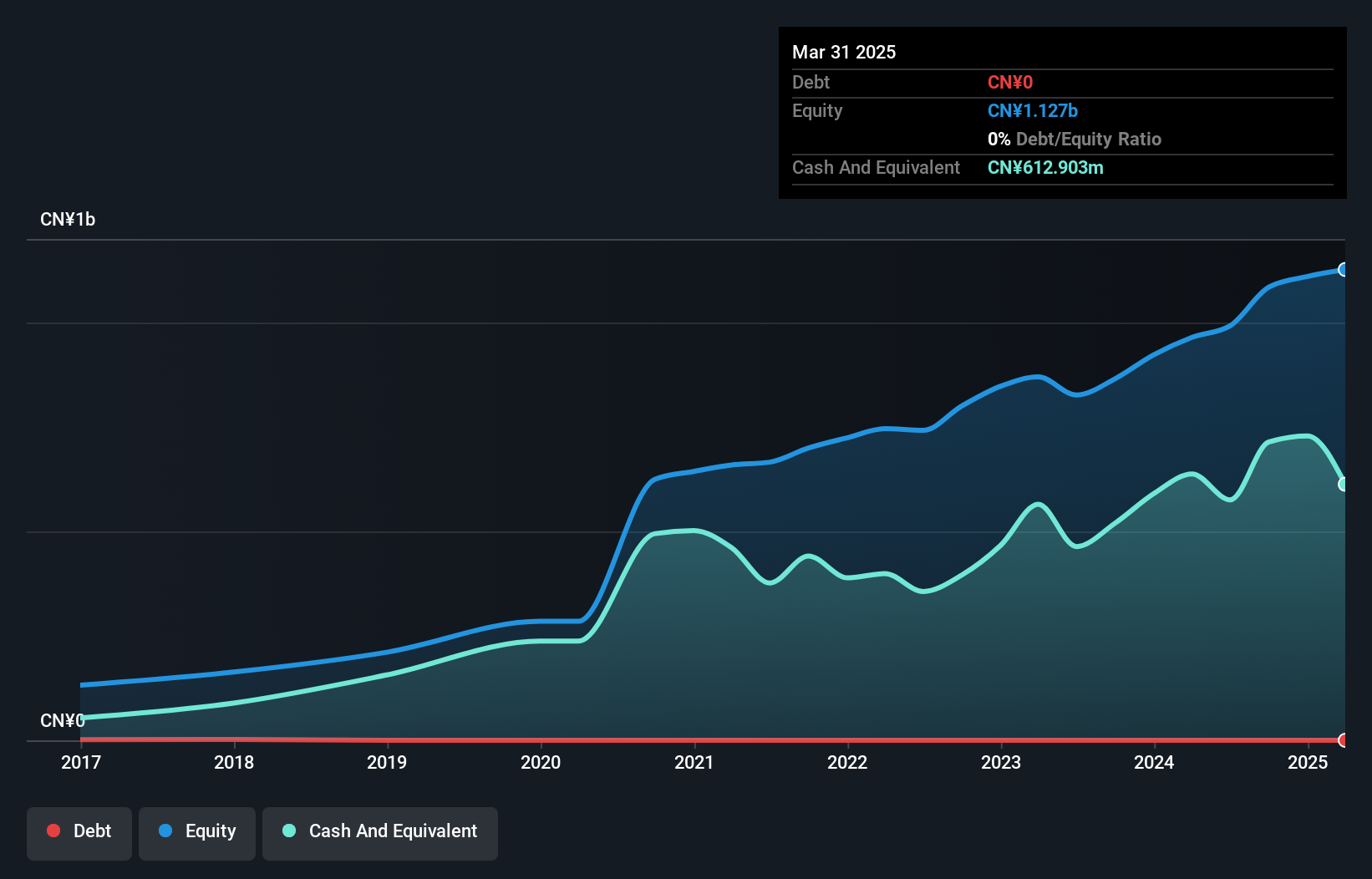

Ningbo Jianan Electronics has shown impressive growth, with earnings surging by 58.6% over the past year, outpacing the electronic industry average of 1.8%. The company is debt-free and boasts high-quality earnings, ensuring a solid financial footing. Recent results revealed sales of CNY 783 million for nine months ending September 2024, up from CNY 605 million last year, while net income climbed to CNY 172 million from CNY 106 million. Trading at approximately 7.7% below its estimated fair value suggests potential for investors seeking undervalued opportunities in the electronics sector.

Senshu ElectricLtd (TSE:9824)

Simply Wall St Value Rating: ★★★★★☆

Overview: Senshu Electric Co., Ltd. operates in Japan, focusing on trading various cables, wires, and materials for electrical construction work with a market capitalization of ¥91.72 billion.

Operations: Senshu Electric's primary revenue stream is from its Electric Wire and Cable Business, generating ¥131.26 billion. The company's market capitalization stands at ¥91.72 billion.

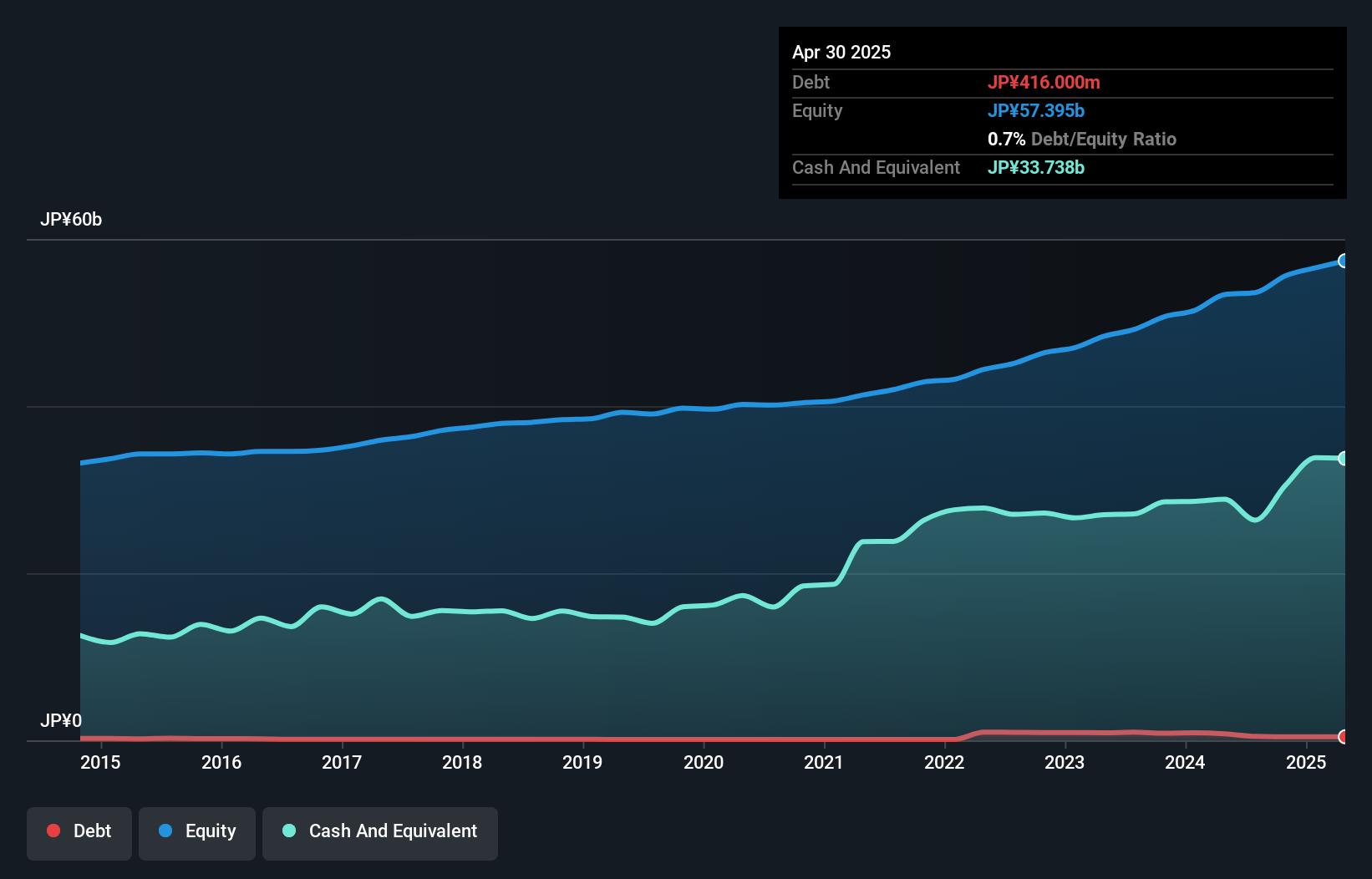

Senshu Electric, a nimble player in the trade distributors space, has been making waves with its robust financial performance. Over the past year, its earnings surged by 13.8%, outpacing the industry average of 0.2%. This growth is backed by high-quality earnings and an appropriate debt level, as it holds more cash than total debt despite a rise in its debt-to-equity ratio from 0.3 to 0.9 over five years. Recently, Senshu announced a share repurchase program worth ¥500 million to enhance shareholder returns and improve capital efficiency amidst evolving business conditions, reflecting strategic agility in capital management.

- Take a closer look at Senshu ElectricLtd's potential here in our health report.

Understand Senshu ElectricLtd's track record by examining our Past report.

Make It Happen

- Gain an insight into the universe of 4631 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Jianan ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300880

Ningbo Jianan ElectronicsLtd

Engages in the research, development, production, and sale of smart energy meters, data collection systems, and metering infrastructure in China.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives