Microwave Chemical (TSE:9227) Seems To Use Debt Quite Sensibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Microwave Chemical Co., Ltd. (TSE:9227) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Microwave Chemical's Debt?

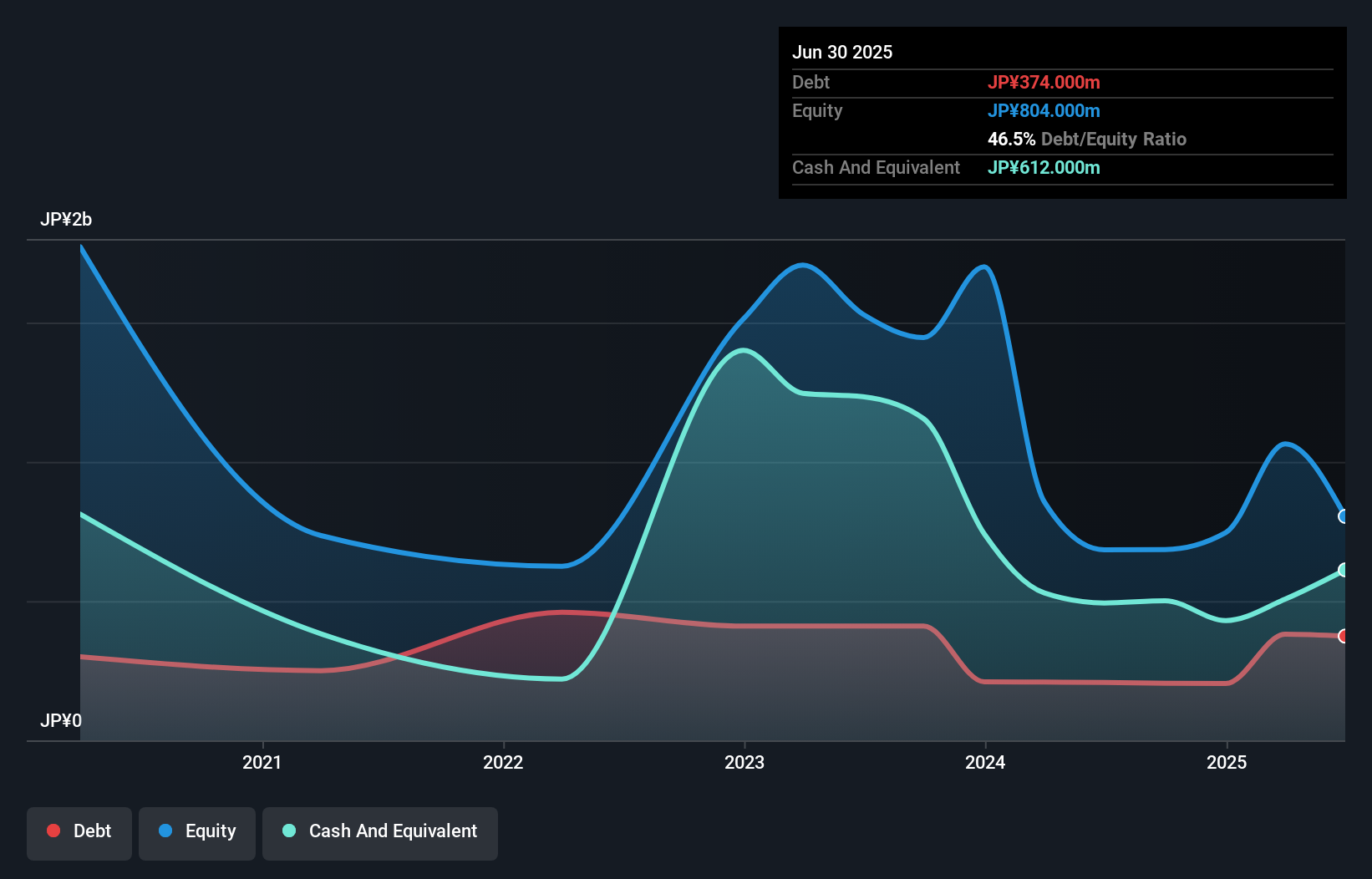

You can click the graphic below for the historical numbers, but it shows that as of June 2025 Microwave Chemical had JP¥374.0m of debt, an increase on JP¥208.0m, over one year. However, its balance sheet shows it holds JP¥612.0m in cash, so it actually has JP¥238.0m net cash.

How Strong Is Microwave Chemical's Balance Sheet?

The latest balance sheet data shows that Microwave Chemical had liabilities of JP¥338.0m due within a year, and liabilities of JP¥622.0m falling due after that. Offsetting this, it had JP¥612.0m in cash and JP¥60.0m in receivables that were due within 12 months. So it has liabilities totalling JP¥288.0m more than its cash and near-term receivables, combined.

Since publicly traded Microwave Chemical shares are worth a total of JP¥12.0b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Microwave Chemical boasts net cash, so it's fair to say it does not have a heavy debt load!

View our latest analysis for Microwave Chemical

Also good is that Microwave Chemical grew its EBIT at 15% over the last year, further increasing its ability to manage debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Microwave Chemical will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Microwave Chemical may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last two years, Microwave Chemical burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

We could understand if investors are concerned about Microwave Chemical's liabilities, but we can be reassured by the fact it has has net cash of JP¥238.0m. On top of that, it increased its EBIT by 15% in the last twelve months. So we don't have any problem with Microwave Chemical's use of debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Microwave Chemical (of which 1 can't be ignored!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9227

Microwave Chemical

Researches, develops, engineers, and licenses microwave chemical process in Japan.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives