- Taiwan

- /

- Electrical

- /

- TWSE:3501

Top Dividend Stocks To Consider For November 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with mixed earnings reports and fluctuating labor market data, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In this environment, identifying stocks with reliable dividend payouts and strong fundamentals can be especially appealing for those looking to balance growth opportunities with income stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.87% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.92% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.39% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

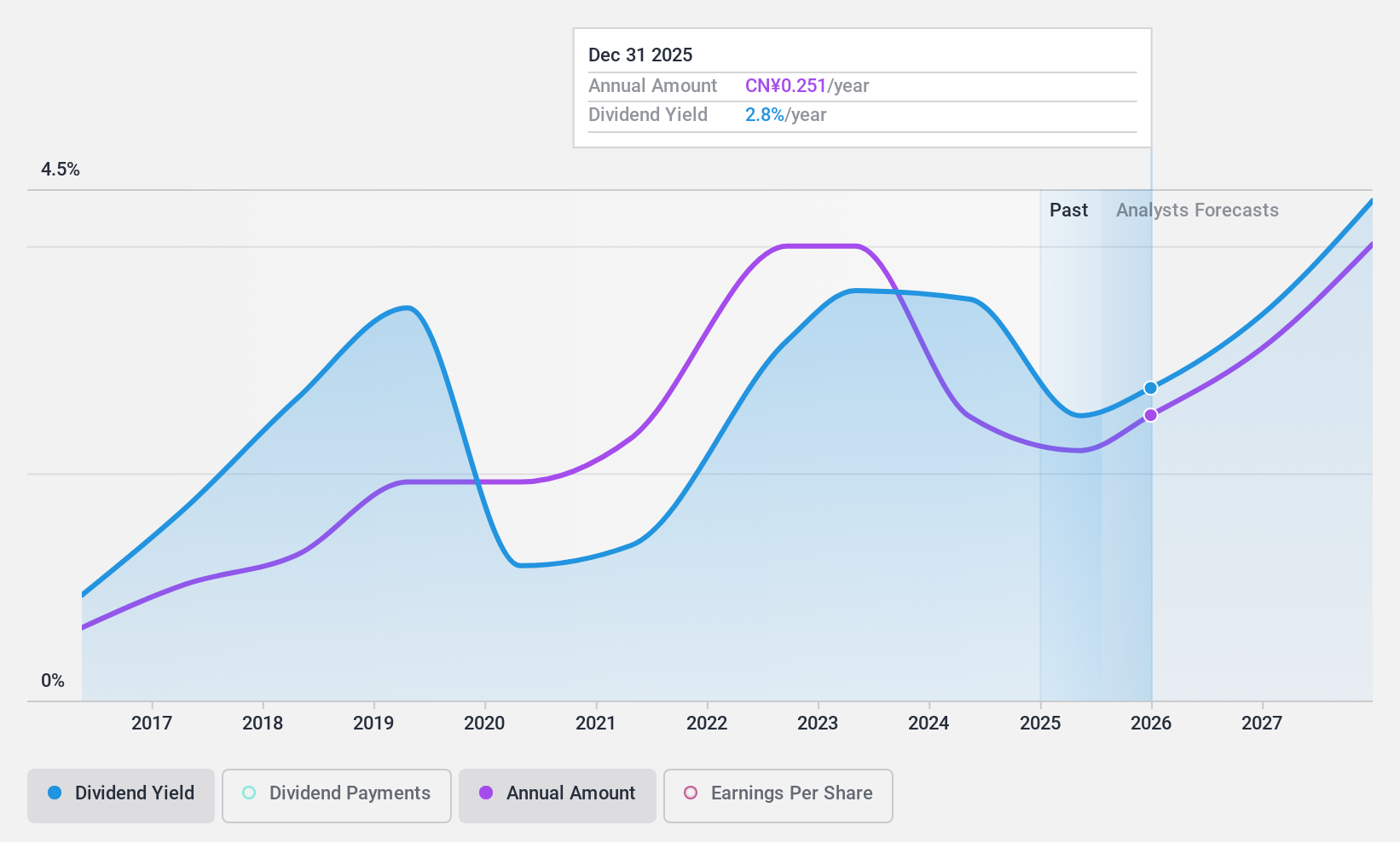

Shanghai Liangxin ElectricalLTD (SZSE:002706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Liangxin Electrical Co., Ltd. is engaged in the research, development, production, and sale of low-voltage electrical apparatus both in China and internationally, with a market capitalization of CN¥7.97 billion.

Operations: Shanghai Liangxin Electrical Co., Ltd. generates its revenue primarily through the research, development, production, and sale of low-voltage electrical apparatus.

Dividend Yield: 3.5%

Shanghai Liangxin Electrical's dividend yield is in the top 25% of the CN market, yet its payments have been unreliable and volatile over the past decade. Despite a reasonable payout ratio of 67.6%, dividends are not well covered by cash flows due to a high cash payout ratio of 93.1%. Recent earnings show declining sales and net income, which could impact future dividend sustainability despite recent share buybacks totaling CNY 111.74 million aimed at maintaining shareholder value.

- Unlock comprehensive insights into our analysis of Shanghai Liangxin ElectricalLTD stock in this dividend report.

- In light of our recent valuation report, it seems possible that Shanghai Liangxin ElectricalLTD is trading behind its estimated value.

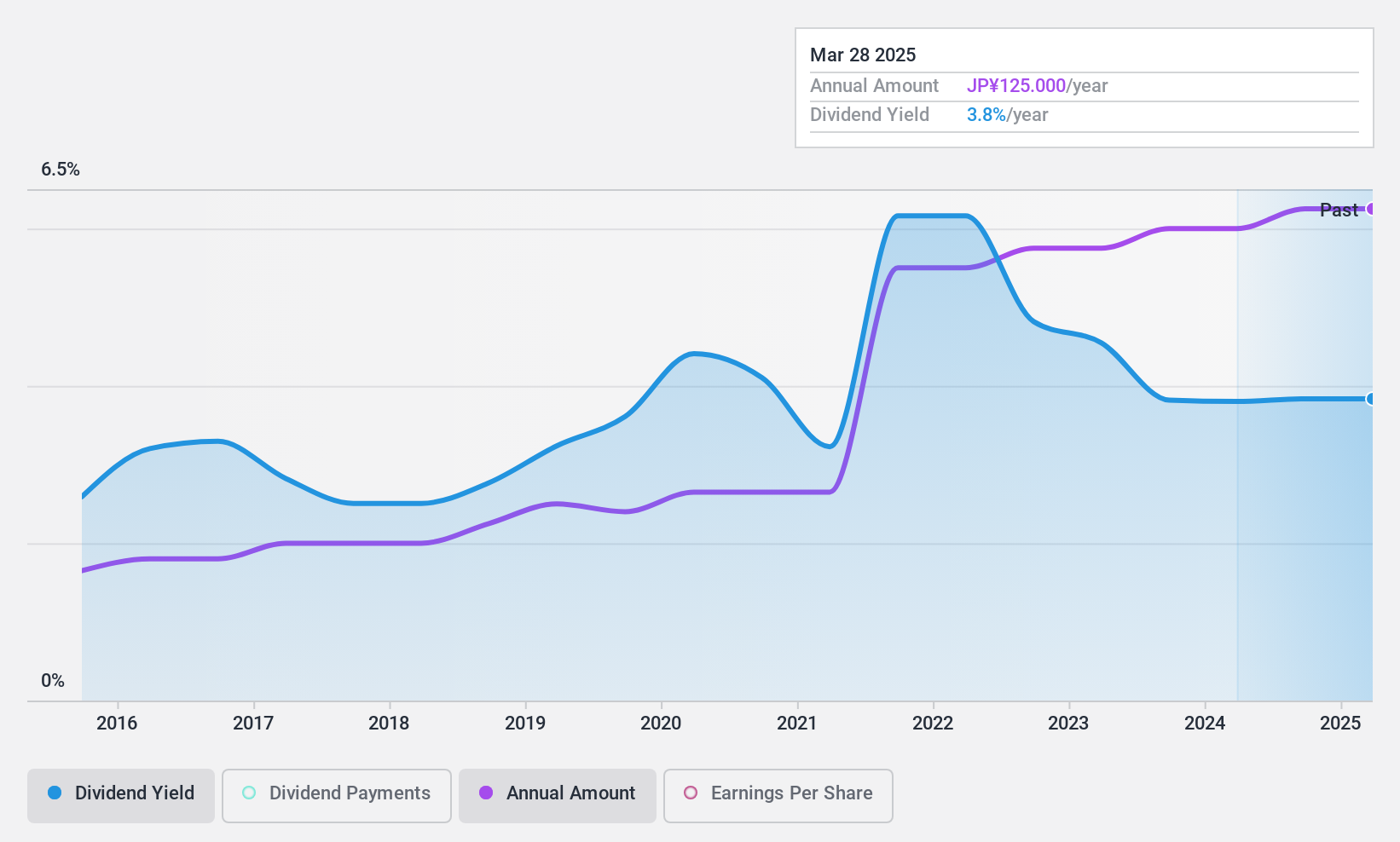

InabataLtd (TSE:8098)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Inabata & Co., Ltd. offers solutions and services across information and electronics, chemicals, life industry, and plastics sectors both in Japan and internationally, with a market cap of ¥187.32 billion.

Operations: Inabata & Co., Ltd.'s revenue is primarily derived from its plastics segment at ¥369.61 billion, followed by information and electronics at ¥256.22 billion, chemicals including dwelling environment at ¥114.23 billion, and life industry at ¥54.81 billion.

Dividend Yield: 3.6%

Inabata Ltd.'s dividend yield of 3.63% is slightly below the top 25% in Japan but remains attractive due to its reliable and stable payments over the past decade. The dividends are well covered by earnings, with a payout ratio of 35.5%, and cash flows, with a cash payout ratio of 26.4%. Additionally, Inabata trades at a significant discount to its estimated fair value, enhancing its appeal as a potential value investment for dividend-focused investors.

- Click to explore a detailed breakdown of our findings in InabataLtd's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of InabataLtd shares in the market.

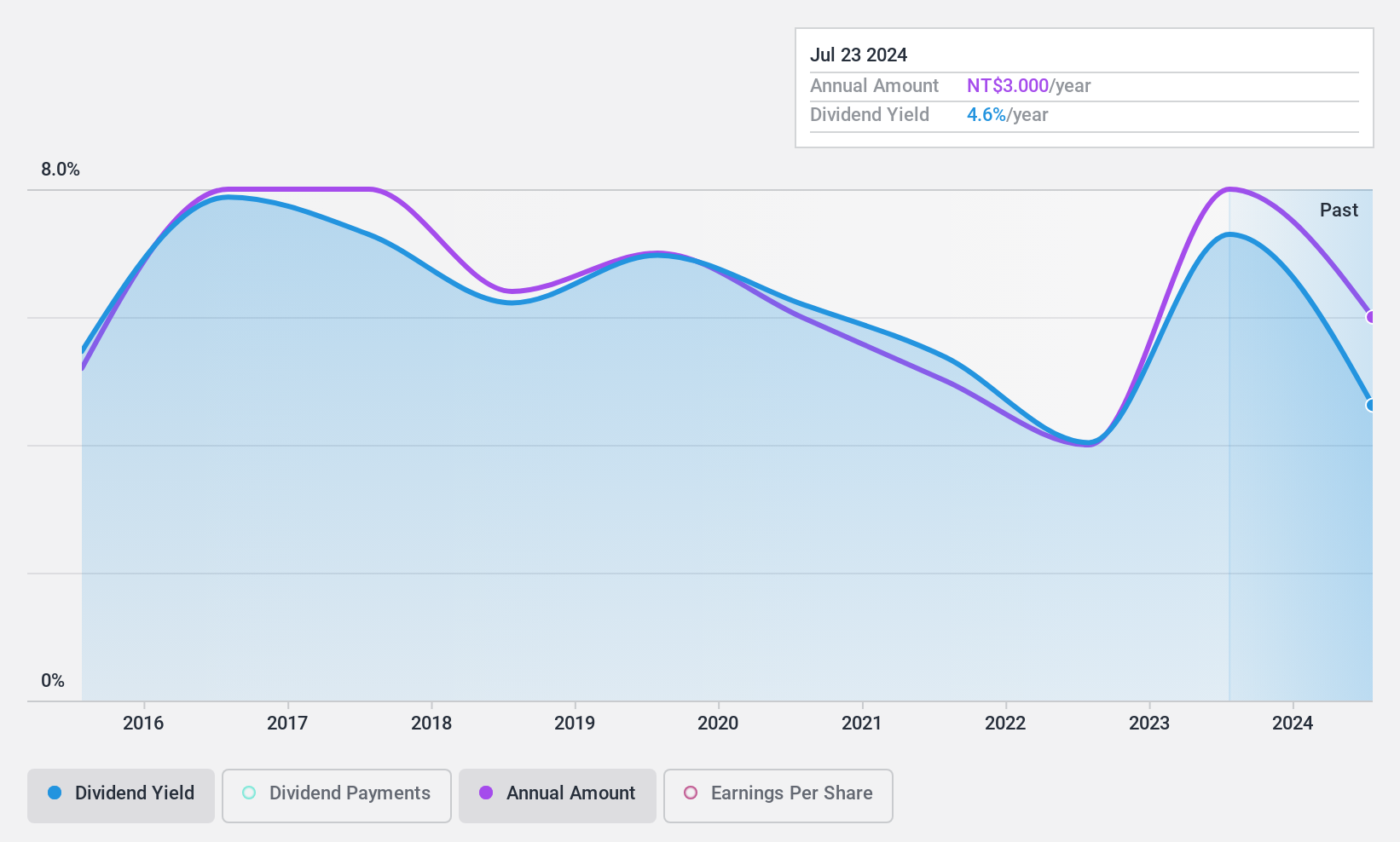

Well Shin Technology (TWSE:3501)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Well Shin Technology Co., Ltd. is involved in the manufacture, wholesale, and retail of wire and cable products, electronic components, and electronic materials across Asia, the United States, Europe, and internationally with a market cap of NT$7.84 billion.

Operations: Well Shin Technology Co., Ltd.'s revenue is primarily derived from the Taiwan Region with NT$4.37 billion, followed by the Southern Region at NT$2.72 billion and the Eastern Region contributing NT$2.67 billion.

Dividend Yield: 4.5%

Well Shin Technology's dividend yield of 4.52% ranks in the top 25% in Taiwan, though its dividend history is marked by volatility and lack of growth over the past decade. The dividends are well-covered by earnings and cash flows, with payout ratios of 55.3% and 61.1%, respectively. Trading at a price-to-earnings ratio of 12.2x, below the market average, it offers good relative value despite an unstable dividend track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Well Shin Technology.

- Our comprehensive valuation report raises the possibility that Well Shin Technology is priced lower than what may be justified by its financials.

Where To Now?

- Access the full spectrum of 1928 Top Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Well Shin Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3501

Well Shin Technology

Engages in the manufacture, wholesale, and retail of wire and cable products, electronic components, and electronic materials in Asia, the United States, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives