- Taiwan

- /

- Electrical

- /

- TWSE:6409

Top Asian Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asia's stock markets have not been immune, with notable declines in major indices like Japan's Nikkei 225 and China's CSI 300. Amidst this backdrop, dividend stocks in Asia present a compelling opportunity for investors seeking stability and income potential.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.36% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.67% | ★★★★★★ |

| NCD (TSE:4783) | 4.57% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.71% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.79% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1037 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Seika (TSE:8061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Seika Corporation imports, sells, and exports plants, machinery, and environmental, information communication, and electronic equipment across Asia, Europe, the United States, and internationally with a market cap of ¥84.94 billion.

Operations: Seika Corporation's revenue is primarily derived from its Energy Business at ¥37.34 billion, Product Business at ¥34.33 billion, and Industrial Machinery Business at ¥31.32 billion.

Dividend Yield: 3.1%

Seika Corporation recently announced an interim dividend increase to JPY 110.00 per share, up from JPY 90.00 the previous year, payable on December 5, 2025. Despite a volatile dividend history and a lower-than-top-tier yield of 3.12%, Seika's dividends are well-covered by earnings and cash flows with payout ratios of 48.8% and 70.4%, respectively. The company remains committed to stable dividends while balancing business growth needs and maintaining a target total return ratio of 45%.

- Take a closer look at Seika's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Seika is priced higher than what may be justified by its financials.

Winmate (TWSE:3416)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Winmate Inc. specializes in the R&D, manufacturing, and sales of rugged display equipment and mobile computers globally, with a market cap of NT$12.40 billion.

Operations: Winmate Inc.'s revenue primarily comes from its Liquid Crystal Display Application Equipment and Embedded System Modules segment, generating NT$3.47 billion.

Dividend Yield: 3.5%

Winmate has demonstrated consistent dividend growth over the past decade, with stable payments. However, its current dividend yield of 3.54% is below the top quartile in Taiwan's market, and high cash payout ratios indicate dividends are not well covered by free cash flows. Recent earnings showed solid revenue growth to TWD 1 billion for Q3 2025, but net income coverage remains tight. Analysts predict a potential stock price increase of over 20%.

- Click here to discover the nuances of Winmate with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Winmate is trading beyond its estimated value.

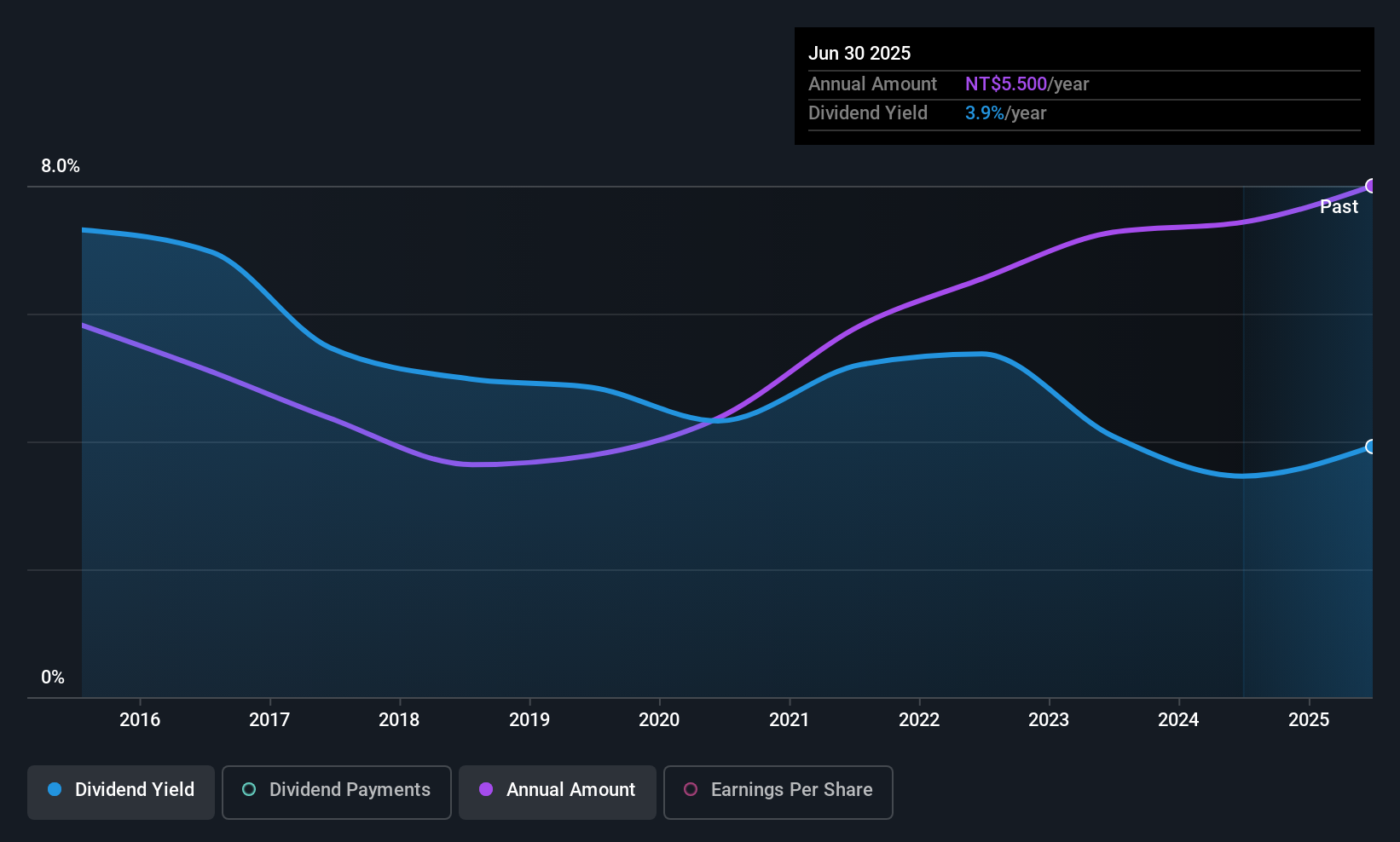

Voltronic Power Technology (TWSE:6409)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Voltronic Power Technology Corp., along with its subsidiaries, manufactures and sells uninterruptible power systems (UPS) in Taiwan and China, with a market cap of NT$101.31 billion.

Operations: Voltronic Power Technology Corp. generates revenue of NT$20.89 billion from its manufacturing and trading of uninterruptible power systems and inverters.

Dividend Yield: 3.2%

Voltronic Power Technology has maintained stable and reliable dividend payments over the past decade, with dividends growing consistently. Despite a current yield of 3.25%, which is below Taiwan's top quartile, the payout ratio of 78.9% suggests earnings coverage, though high cash payout ratios indicate inadequate free cash flow coverage. Recent Q3 2025 results showed decreased revenue (TWD 5.18 billion) and net income (TWD 640.66 million), highlighting potential pressure on future dividend sustainability amidst declining earnings performance.

- Click here and access our complete dividend analysis report to understand the dynamics of Voltronic Power Technology.

- According our valuation report, there's an indication that Voltronic Power Technology's share price might be on the expensive side.

Seize The Opportunity

- Dive into all 1037 of the Top Asian Dividend Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6409

Voltronic Power Technology

Manufactures and sells uninterruptible power systems (UPS) in Taiwan and China.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success