- Japan

- /

- Trade Distributors

- /

- TSE:8058

Did Lower Earnings and a US Entertainment Push Just Shift Mitsubishi's (TSE:8058) Investment Narrative?

Reviewed by Sasha Jovanovic

- Mitsubishi Corporation recently reported half-year earnings through September 2025, revealing sales of ¥8.64 trillion and net income of ¥355.80 billion, both lower than the previous year.

- Meanwhile, Mitsubishi's entertainment subsidiary is partnering with TOMY and SEGA to launch a limited-time pop-up arcade experience in Santa Monica, bringing Japanese prize-winning games and exclusive collectibles to a US audience.

- We'll explore how the recent earnings decline and international entertainment initiative may influence Mitsubishi's investment outlook and risk profile.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Mitsubishi Investment Narrative Recap

To be a Mitsubishi shareholder, you need to believe in the company’s ability to balance its broad exposure to global commodities with its strategic moves toward new growth areas such as international consumer entertainment. The recent half-year earnings decline highlights continued profit challenges, especially as resource markets remain crucial; however, the U.S. pop-up arcade initiative is unlikely to materially shift the short-term outlook or offset the biggest risk, its ongoing vulnerability to commodity price volatility.

Among recent announcements, the new "Gacha & Catch" collaboration in Santa Monica offers a glimpse into Mitsubishi’s efforts to diversify beyond traditional sectors. While intriguing, these consumer-focused ventures play a much smaller role compared to capital-intensive investments like the Hudbay Minerals copper project, which has more immediate relevance for Mitsubishi’s earnings catalysts and risk exposure.

By contrast, investors should factor in just how sensitive Mitsubishi remains to resource price swings, especially since...

Read the full narrative on Mitsubishi (it's free!)

Mitsubishi's narrative projects ¥19,785.2 billion in revenue and ¥915.4 billion in earnings by 2028. This requires 2.9% yearly revenue growth and a ¥115.9 billion earnings increase from the current earnings of ¥799.5 billion.

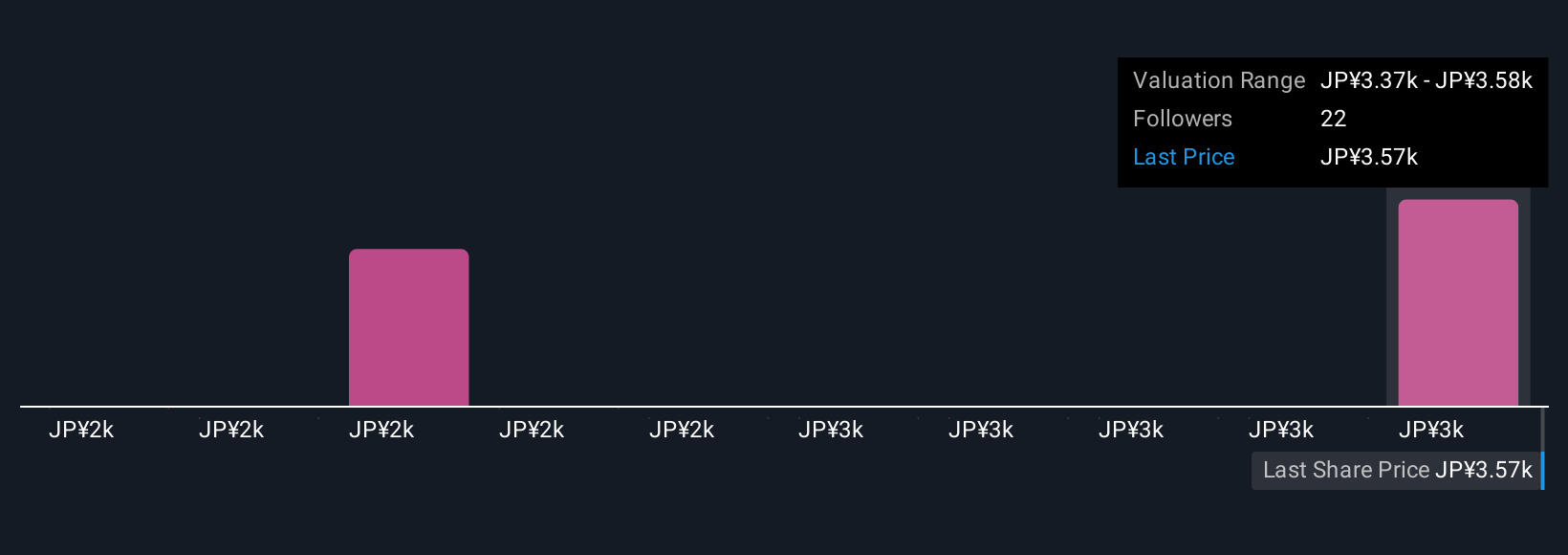

Uncover how Mitsubishi's forecasts yield a ¥3405 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Four retail investor perspectives from the Simply Wall St Community value Mitsubishi between ¥1,520 and ¥3,405 per share. Earnings volatility tied to commodity cycles remains central to how the market could interpret the company's future resilience, so compare these diverse views to gain a fuller picture.

Explore 4 other fair value estimates on Mitsubishi - why the stock might be worth less than half the current price!

Build Your Own Mitsubishi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Mitsubishi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8058

Mitsubishi

Engages in the global environment and energy, material solutions, metal resources, social infrastructure, mobility, food industry, SLC, and power solutions businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives