- Japan

- /

- Trade Distributors

- /

- TSE:8053

How Investors Are Reacting To Sumitomo (TSE:8053) Entering India’s Biogas Market With TruAlt Joint Venture

Reviewed by Sasha Jovanovic

- TruAlt Bioenergy announced it has signed a joint venture and share purchase agreement with Sumitomo Corporation to accelerate the development and scaling of compressed biogas (CBG) plants in India, starting with four initial facilities and potential expansion outlined in the pact.

- This partnership merges TruAlt's bioenergy expertise with Sumitomo's global industrial experience, aiming to advance India's clean energy transition and build a future-ready sustainable fuel infrastructure in support of national renewable energy policies.

- We'll examine how Sumitomo's move into the Indian CBG market with TruAlt could refresh the company's investment narrative on renewable energy growth.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Sumitomo's Investment Narrative?

For shareholders, the opportunity in Sumitomo rests on belief in the group's ability to drive consistent earnings from diversified global operations while finding fresh sources of growth. The recent joint venture with TruAlt Bioenergy marks a clear push into India's fast-growing clean energy sector, tying Sumitomo to the country's government-backed push for biofuels and circular economy solutions. This could reshape short-term catalysts: successful execution may boost sentiment and open new revenue streams more quickly than previously expected, especially since most prior analysis did not price in exposure to India's compressed biogas market. On the flip side, the move could tuck new risks under the surface, such as accelerated capital allocation needs or exposure to Indian regulatory delays. Otherwise, the company maintains good value on traditional measures, but the importance of this venture in shifting both risk and reward is worth watching closely. On the other hand, execution risks in India could become much more relevant.

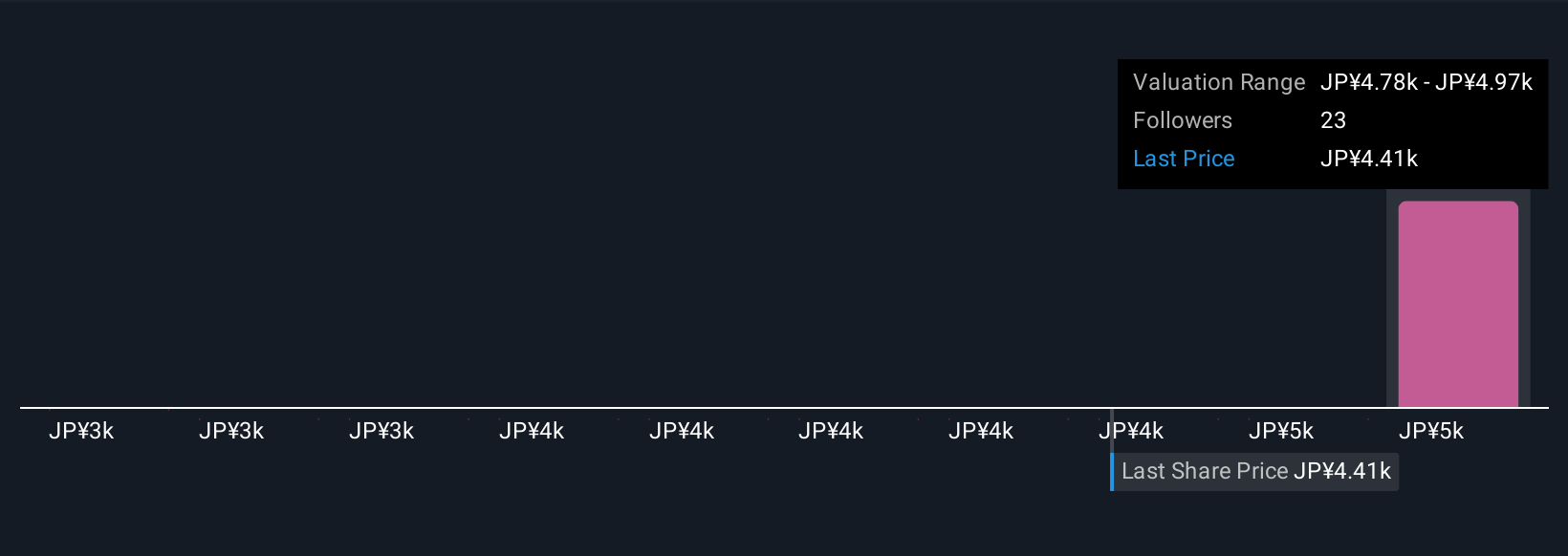

Despite retreating, Sumitomo's shares might still be trading 11% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Sumitomo - why the stock might be worth as much as 12% more than the current price!

Build Your Own Sumitomo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sumitomo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sumitomo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sumitomo's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8053

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives