- Japan

- /

- Trade Distributors

- /

- TSE:8031

What Do Mitsui’s 378% Five-Year Surge and Recent Sector Trends Mean for Investors in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Mitsui shares, or maybe considering your first investment? You are definitely not alone, as the market seems to be wrestling with the same question. After staging a massive 378.6% gain over five years, Mitsui’s stock has truly rewarded long-term believers. Even just in the past year, the stock is up 15.7%, and 12.4% year-to-date. Short-term moves, though, are more muted: up just 0.5% in the last week, and actually dipping a modest 0.5% in the past month. Some of that sideways shuffle could easily be tied to shifting market perceptions about global resource demand, as Mitsui’s fortunes are often seen as a gauge for broader industrial activity, especially as global trade patterns keep evolving.

With all that in mind, how does Mitsui stack up on valuation? Here is where it gets interesting: by the numbers, Mitsui scores a 1 out of 6 on undervaluation checks. That suggests the company currently passes just one of the common tests analysts look at to spot an undervalued opportunity. But is the story really that simple? In the next section, let’s break down how these valuation methods work, and why they may (or may not) tell the whole story when it comes to Mitsui. Stick around to discover an even better lens for understanding whether Mitsui is still a smart buy.

Mitsui scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mitsui Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting them back to today’s value. For Mitsui, this involves looking at the money the company is expected to generate each year and adjusting for the risk and time value of money to determine what that future cash is worth in the present.

Mitsui’s current Free Cash Flow is ¥692.3 billion, indicating the company generates significant cash today. Analyst forecasts suggest Free Cash Flow will reach about ¥714 billion by 2030. Projections beyond five years rely on calculated extrapolations, as direct analyst estimates are only available for the next five years.

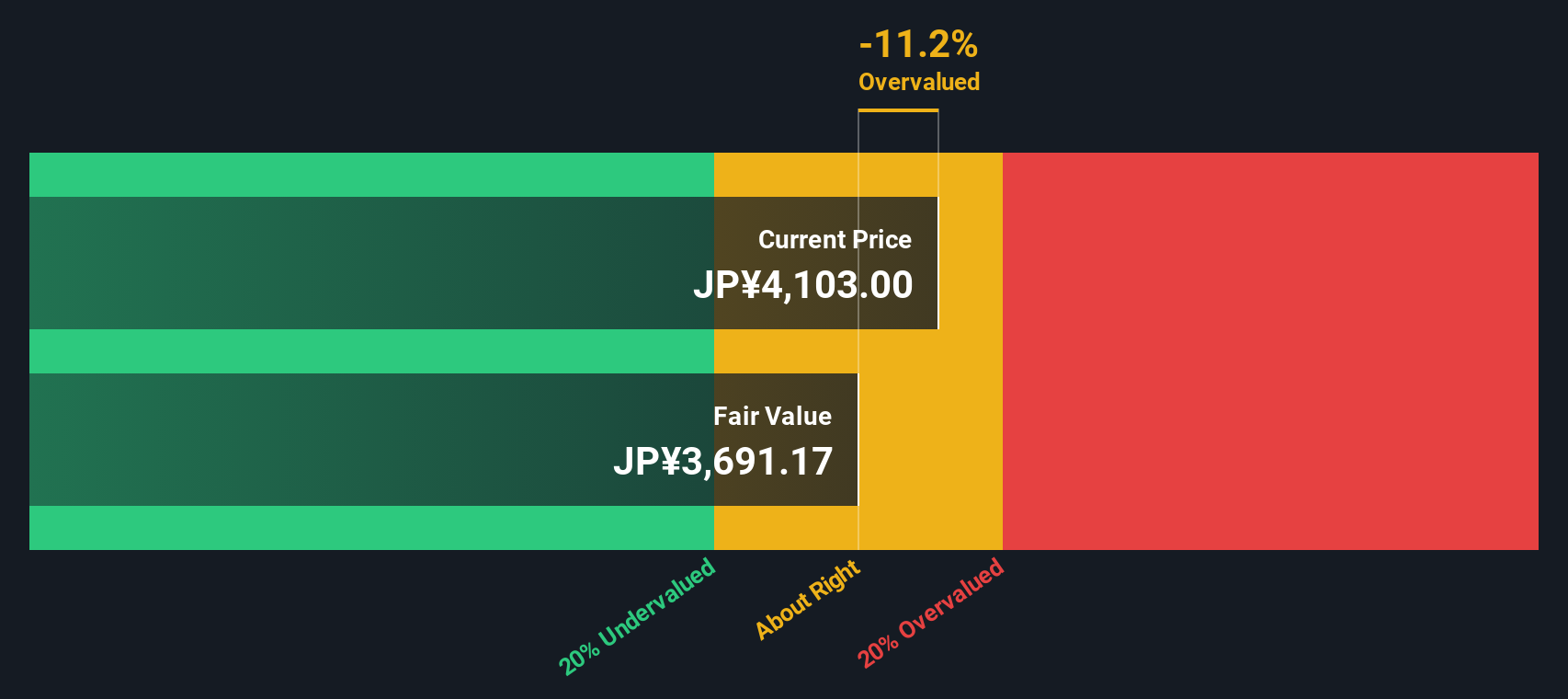

According to this DCF model, Mitsui's estimated intrinsic value is ¥3,271.91 per share. Compared to the current share price, the DCF analysis indicates the stock is trading about 13.0% higher than its estimated fair value. This suggests the market price is ahead of what the future cash flow projections indicate is reasonable.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mitsui may be overvalued by 13.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Mitsui Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is one of the most popular tools for valuing companies that are consistently profitable, like Mitsui. By comparing a company’s current share price to its earnings per share, investors can get a quick sense of how much the market is willing to pay today for each yen of earnings. The logic is simple: a lower PE can mean a stock is undervalued, while higher PE ratios might signal overvaluation or high growth expectations.

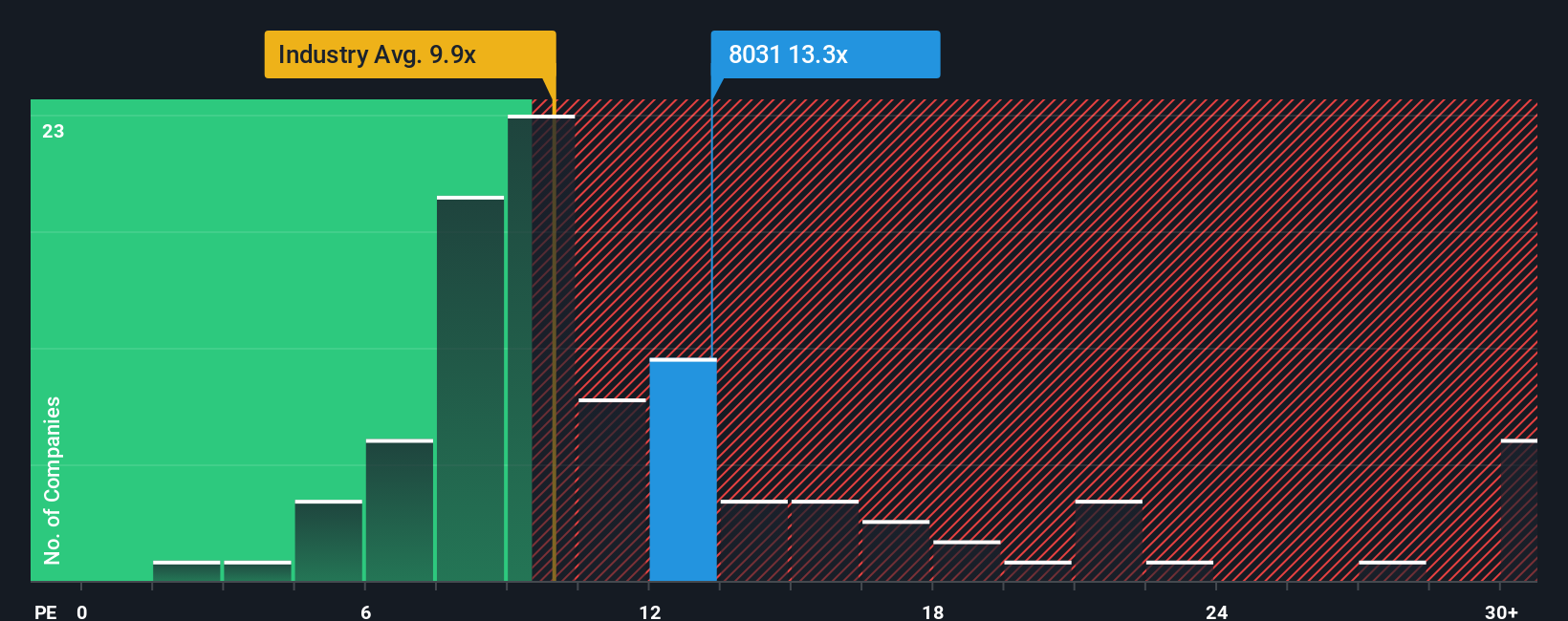

However, what’s considered a “normal” or “fair” PE ratio is influenced by expected earnings growth, perceived business risks, and how Mitsui stacks up against its industry. Mitsui currently trades at a PE of 13.0x. That is above the Trade Distributors industry average PE of 9.9x and even higher than the peer group average of 12.6x. On the surface, this could imply the stock is a bit pricey compared to peers and the broader sector.

But this is where Simply Wall St’s “Fair Ratio” comes in. Instead of just comparing Mitsui to basic averages, the Fair Ratio blends in more nuanced factors like earnings growth, margins, industry type, business risks, and market cap. In Mitsui’s case, the Fair Ratio is calculated as 21.8x. After considering all relevant fundamentals and risk factors, the stock’s current 13.0x PE is actually well below what would be reasonable for a company of its profile. This suggests that Mitsui is trading at a discount relative to its intrinsic quality, and not just on a superficial or short-term basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mitsui Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or thesis about a company, combining your expectations for its future revenue, profit margins, and fair value. Essentially, it's your perspective made actionable. Instead of just relying on analyst numbers or static metrics, Narratives connect the company's business story, your financial forecasts, and what you calculate as a fair price, all in one place.

On Simply Wall St's Community page, used by millions of investors globally, Narratives make this approach easy and accessible. They allow you to see how your view compares with both the latest analyst expectations and the perspectives of other investors. By comparing your Narrative’s fair value to the current market price, you can quickly identify when a stock may be a buy, hold, or sell for you. Since Narratives update in real-time whenever new information emerges, such as earnings releases or important news, you can always keep your investment decisions relevant and informed.

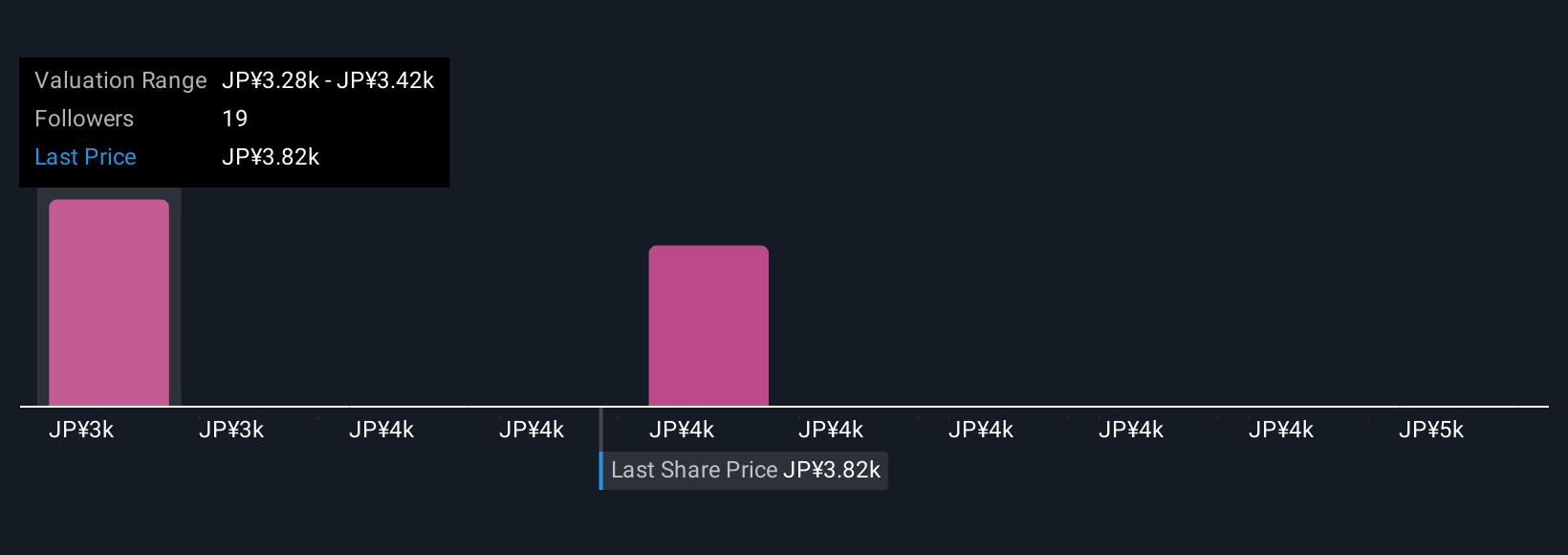

For Mitsui, one investor’s Narrative might highlight the company’s push into clean energy and assign a bullish price target of ¥4,200, while a more cautious outlook, perhaps concerned about commodity price risks, would set fair value closer to ¥2,860.

Do you think there's more to the story for Mitsui? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8031

Mitsui

Operates as trading company in Japan, Singapore, the United States, Australia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives