- Japan

- /

- Trade Distributors

- /

- TSE:8031

India’s Semiconductor Breakthrough Could Be a Game Changer for Mitsui (TSE:8031)

Reviewed by Sasha Jovanovic

- On October 15, 2025, Kaynes Semicon Private Limited announced the shipment of 900 domestically assembled Multi-Chip Modules (IPM5) from its OSAT facility in Sanand, marking a significant step for India's semiconductor manufacturing under the India Semiconductor Mission 1.0 and delivering to Alpha & Omega Semiconductor in the US.

- An essential factor in this milestone was Kaynes' collaboration with Mitsui & Co., whose global logistics network and procurement expertise enabled efficient sourcing of crucial raw materials, highlighting Mitsui's expanding influence in critical tech supply chains.

- We'll examine how Mitsui's vital role in developing India's semiconductor capabilities shapes the company's broader investment narrative today.

Find companies with promising cash flow potential yet trading below their fair value.

Mitsui Investment Narrative Recap

To be a Mitsui shareholder, one must believe in the company’s ability to diversify beyond core commodities and capture value from global supply chain shifts, such as expanding into high-growth tech like semiconductors. While the recent Kaynes Semicon milestone showcases Mitsui’s growing tech footprint, its effect on the most pressing near-term catalysts or the primary risk, continued dependence on resource earnings, appears limited at this stage.

The most relevant recent announcement aligning with this news is Mitsui’s investment in the Blue Point low-carbon ammonia project, signaling a continual push toward cleaner energy and diversification. This move addresses the company’s need for portfolio evolution and margin resilience, amidst ongoing headwinds in core resource segments and slower forecasted growth relative to the market.

However, in contrast, investors should be aware that Mitsui’s continued revenue reliance on fossil resources still exposes the business to ...

Read the full narrative on Mitsui (it's free!)

Mitsui's outlook anticipates ¥15,578.0 billion in revenue and ¥878.2 billion in earnings by 2028. This assumes a 3.3% annual revenue growth rate and an earnings increase of ¥62.3 billion from the current ¥815.9 billion.

Uncover how Mitsui's forecasts yield a ¥4010 fair value, a 6% upside to its current price.

Exploring Other Perspectives

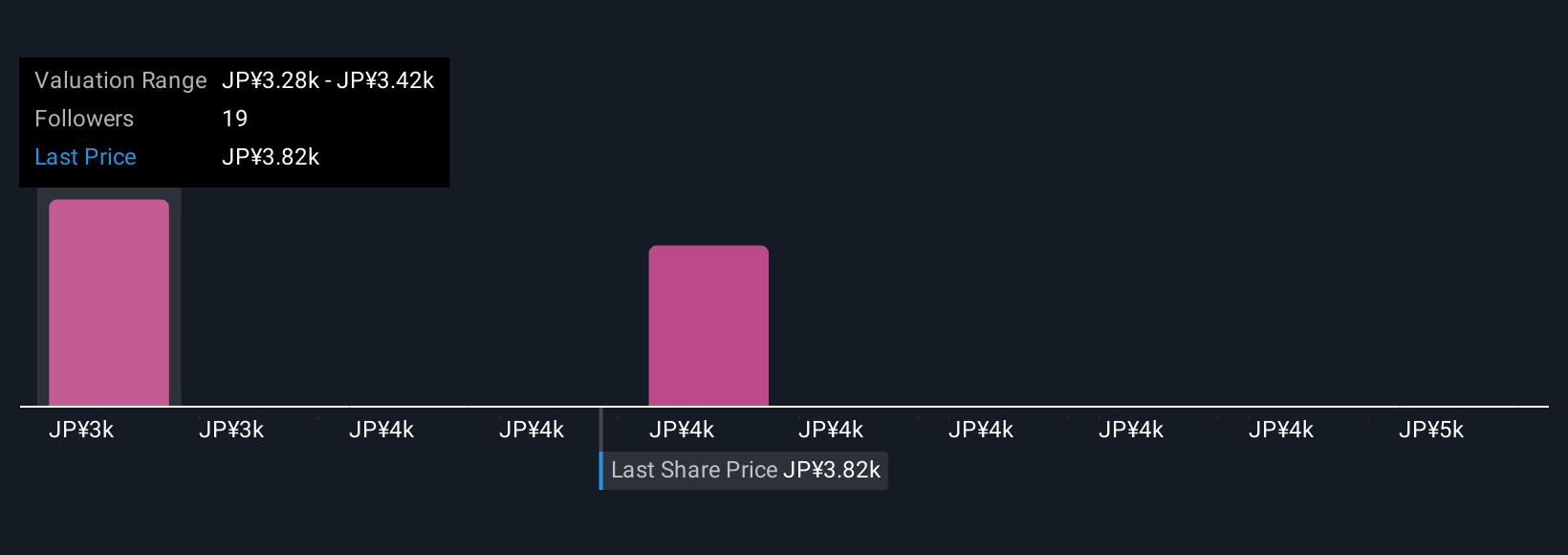

Four Simply Wall St Community fair value estimates for Mitsui range from ¥3,305 to ¥4,700 per share. While some participants see greater upside, catalyst-driven diversification into technology supply chains remains a central debate for future performance.

Explore 4 other fair value estimates on Mitsui - why the stock might be worth as much as 24% more than the current price!

Build Your Own Mitsui Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mitsui research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8031

Mitsui

Operates as trading company in Japan, Singapore, the United States, Australia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives