- Japan

- /

- Trade Distributors

- /

- TSE:8020

Kanematsu (TSE:8020) Valuation in Focus as Carbon Credit Venture with Green Carbon Unfolds

Reviewed by Kshitija Bhandaru

Kanematsu (TSE:8020) is teaming up with Green Carbon to verify methane reduction in rice paddies in the Philippines. This partnership aims to create and sell carbon credits by 2026. The initiative could open new possibilities for ESG-focused investors.

See our latest analysis for Kanematsu.

Kanematsu’s recent collaboration on carbon credits comes as momentum builds in its stock performance. The 90-day share price return of 8.5% and a strong 34.4% total shareholder return over the past year highlight growing market confidence. Its five-year total return climbed 185.6% as the company pushes into sustainability-focused opportunities.

If this ESG move has you thinking bigger, now’s the perfect time to broaden your investing lens and discover fast growing stocks with high insider ownership

Given its recent rally, some may wonder if Kanematsu’s future growth from carbon credits and sustainability is already fully reflected in the stock price, or if there is still a buying opportunity for forward-looking investors.

Price-to-Earnings of 9.2x: Is it justified?

Kanematsu shares are trading on a price-to-earnings (P/E) ratio of 9.2x, which appears inexpensive compared to both the peer group and the broader Japanese market.

The price-to-earnings ratio measures how much investors are willing to pay for each ¥1 of the company's earnings. For a diversified trading business like Kanematsu, the P/E helps anchor expectations for current profitability relative to sector peers and market benchmarks.

This level suggests the market may be undervaluing Kanematsu’s earning power, despite its improving profit margins and ongoing growth. Its P/E offers better value than both the Japanese market average of 14.4x and the industry average of 10.1x. It is also below an estimated fair P/E of 14.9x, which is the level the market could move toward if positive trends persist.

Explore the SWS fair ratio for Kanematsu

Result: Price-to-Earnings of 9.2x (UNDERVALUED)

However, uncertainty around future profitability and reliance on unrealized gains remain potential risks that could limit Kanematsu’s current value appeal.

Find out about the key risks to this Kanematsu narrative.

Another View: Discounted Cash Flow Tells a Different Story

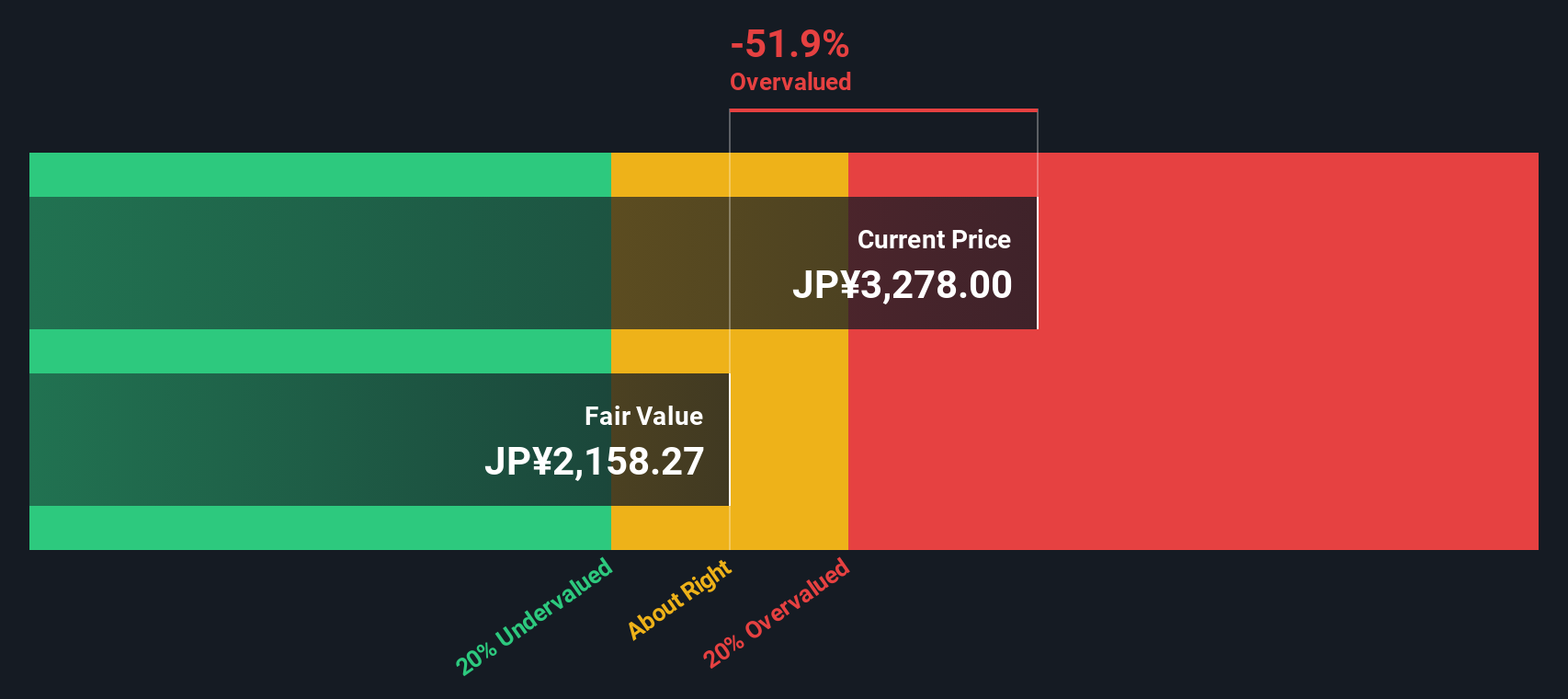

While Kanematsu’s price-to-earnings ratio suggests good value, our DCF model estimates a much lower fair value of ¥2,118.84. This means shares are currently trading above what the cash flow outlook justifies. Could the market be overestimating the company’s future cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kanematsu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kanematsu Narrative

If you think the story should read differently or want to dive into the numbers yourself, you can craft your own insights in just a few minutes, and Do it your way.

A great starting point for your Kanematsu research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock the smartest opportunities around you. Don’t settle for a single success story when there are so many ways to get ahead in the market.

- Start building wealth with reliable payouts by scanning for top-yield earners among these 20 dividend stocks with yields > 3%.

- Position yourself for tomorrow’s breakthroughs by uncovering innovation leaders among these 24 AI penny stocks, now transforming industries worldwide.

- Tap into growth potential others overlook with these 868 undervalued stocks based on cash flows, highlighting stocks priced below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kanematsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8020

Established dividend payer with proven track record.

Market Insights

Community Narratives