- Japan

- /

- Trade Distributors

- /

- TSE:8012

How Investors May Respond To Nagase (TSE:8012) Considering a Share Split and Amended Articles

Reviewed by Sasha Jovanovic

- On October 24, 2025, Nagase & Co., Ltd. held a Board Meeting to consider a share split and to partially amend the Articles of Incorporation in connection with the potential split.

- Such corporate actions can be closely watched by investors, as share splits sometimes signal management’s confidence in improving the company’s liquidity and accessibility to a broader shareholder base.

- Next, we’ll explore how the potential share split consideration shapes Nagase’s investment narrative and market positioning.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Nagase's Investment Narrative?

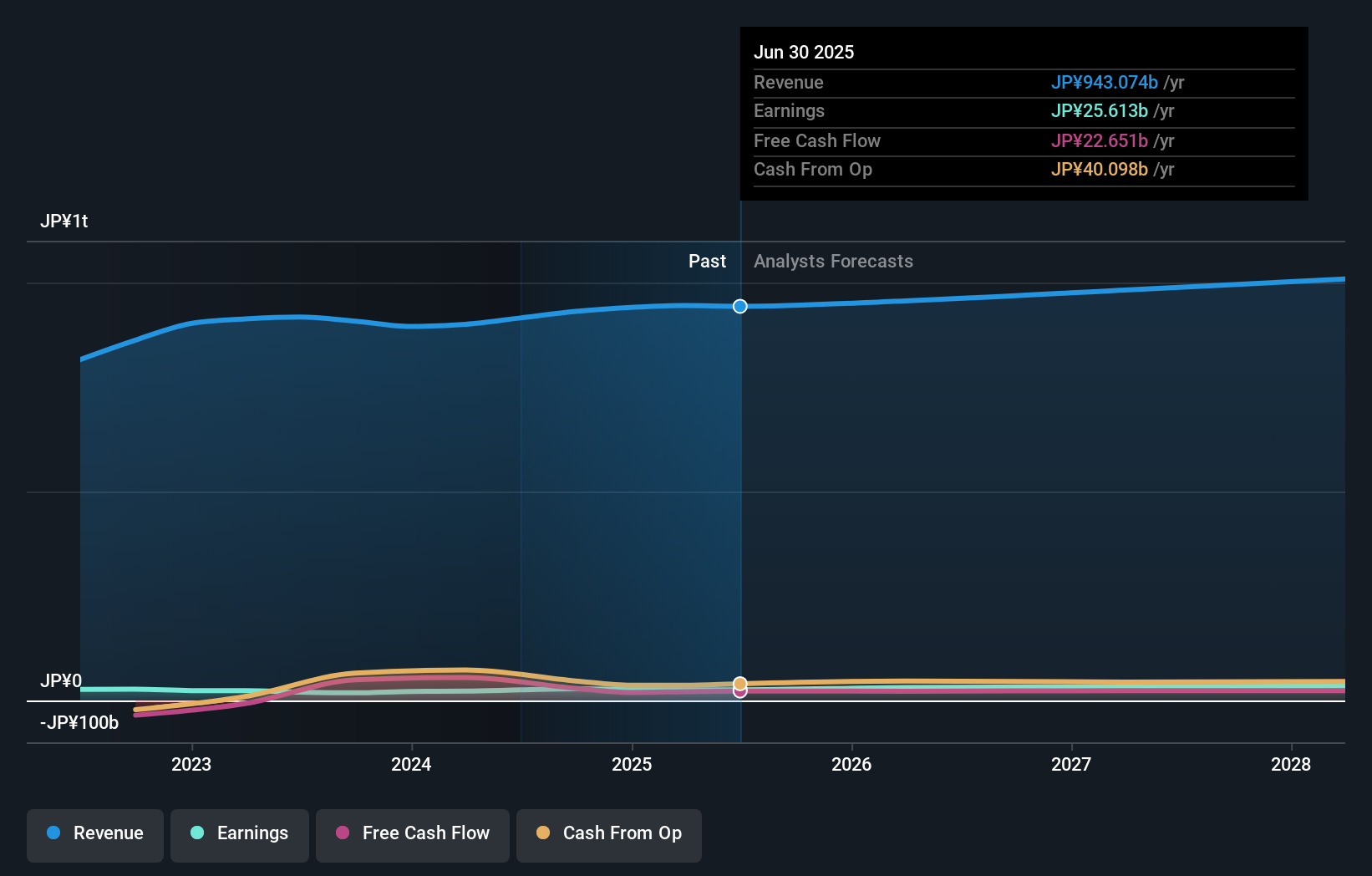

If you’re considering Nagase as an investment, the big picture hinges on the company’s ability to sustain reliable growth and shareholder returns, alongside proven resilience in a competitive but slower-growing trade distributor industry. The recent board discussion about a potential share split is unlikely to alter Nagase’s most important short-term catalysts, such as the highly anticipated Q2 earnings report and rising dividend guidance, though it may improve liquidity and help attract a wider group of retail shareholders. While this move underscores management’s attention to capital structure, it doesn’t directly address fundamental challenges, like below-industry revenue growth, slightly declining profit margins, and relatively low return on equity, which remain key risks to monitor. Still, the company continues to reward shareholders with dividends and maintains a stable outlook, but a more substantial shift in risk profile would only occur if operational or performance metrics start to show sharper improvement or deterioration after this corporate action.

On the other hand, questions around profit margins and industry competition should not be ignored.

Nagase's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Nagase - why the stock might be worth as much as 20% more than the current price!

Build Your Own Nagase Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nagase research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Nagase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nagase's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nagase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8012

Nagase

Manufactures, imports/exports, and sells chemicals, plastics, electronics materials, cosmetics, and health foods worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives