- Japan

- /

- Trade Distributors

- /

- TSE:8002

A Look at Marubeni (TSE:8002) Valuation Following Upgraded Earnings Guidance and Dividend Boost

Reviewed by Simply Wall St

Marubeni (TSE:8002) just rolled out updated earnings guidance for next year along with an increased second-quarter dividend. Both moves highlight the company’s outlook on future growth and commitment to rewarding shareholders. Investors are already taking notice.

See our latest analysis for Marubeni.

Marubeni’s momentum has really picked up in 2024, with investor enthusiasm around its stronger earnings outlook and raised dividend helping drive a 68% year-to-date share price return. Factoring in dividends, the 1-year total shareholder return stands at an impressive 73%, building on spectacular multi-year gains and suggesting sentiment is firmly on the rise.

If Marubeni’s surge makes you wonder what else might be gathering pace, now is a great time to discover fast growing stocks with high insider ownership

With shares hitting new highs and expectations running strong, is Marubeni still trading below its true worth, or is the market now fully pricing in all the anticipated growth? Is there still a buying opportunity here?

Price-to-Earnings of 11.5x: Is it justified?

Marubeni’s latest closing price puts its shares at a price-to-earnings (P/E) multiple of 11.5x, making it look slightly expensive compared to its industry peers. Despite impressive recent growth, this premium raises the question of whether the market is too optimistic about future earnings.

The P/E ratio measures how much investors are willing to pay today for a yen of Marubeni’s earnings. It is especially relevant in sectors like trading and distribution, where earnings can be cyclical and sensitive to wider economic trends.

While strong profit growth in the past year has helped buoy Marubeni's valuation, the premium to the Trade Distributors industry average (10.1x) hints at high expectations already built into the price. However, compared to the estimated Fair Price-to-Earnings Ratio of 20.8x, there is still room for the market to move higher if growth persists.

Explore the SWS fair ratio for Marubeni

Result: Price-to-Earnings of 11.5x (ABOUT RIGHT)

However, slowing annual revenue and net income growth remain risks. These factors could quickly temper optimism if momentum fails to carry through in future quarters.

Find out about the key risks to this Marubeni narrative.

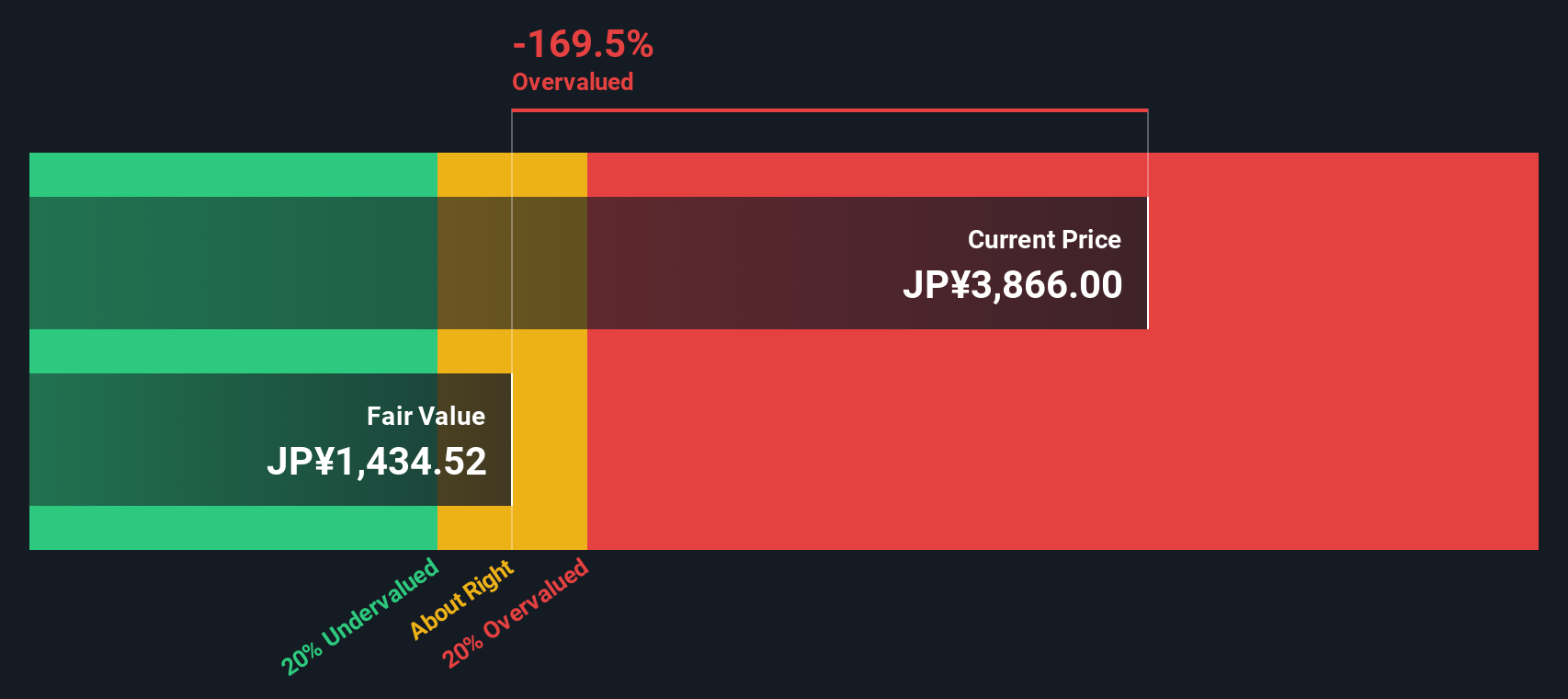

Another View: Discounted Cash Flow Paints a Different Picture

Looking from a different angle, the SWS DCF model suggests Marubeni’s current share price of ¥3,994 sits well above our estimate of fair value at ¥1,603. This implies the market may be getting ahead of itself, with potential downside if lofty expectations do not materialize. Could the risk of overvaluation be emerging?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marubeni for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marubeni Narrative

If you see things differently or want to draw your own conclusions, you can easily explore the numbers and develop your own view in just a few minutes. Do it your way

A great starting point for your Marubeni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your portfolio further with a fresh approach. Don’t let the next big opportunity slip through your fingers. See which standout stocks are catching smart investors’ attention now.

- Unlock the potential of companies reshaping medicine with AI by checking out these 32 healthcare AI stocks.

- Capture income while aiming for steady growth by reviewing these 14 dividend stocks with yields > 3% offering attractive yields and strong fundamentals.

- Ride the next tech wave and stay ahead with these 27 quantum computing stocks leading advancements in computing and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8002

Marubeni

Marubeni Corporation purchases, distributes, and markets industrial and consumer goods.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives