As global markets edge toward record highs, buoyed by strong performances in U.S. stock indexes and hopes for easing trade tensions, investors are keeping a close eye on inflation data that could influence future interest rate decisions. Amid this backdrop of economic uncertainty and market optimism, dividend stocks offer a compelling option for those seeking steady income streams; these stocks can provide stability and potential growth even as inflationary pressures loom large.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.96% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

BNK Financial Group (KOSE:A138930)

Simply Wall St Dividend Rating: ★★★★☆☆

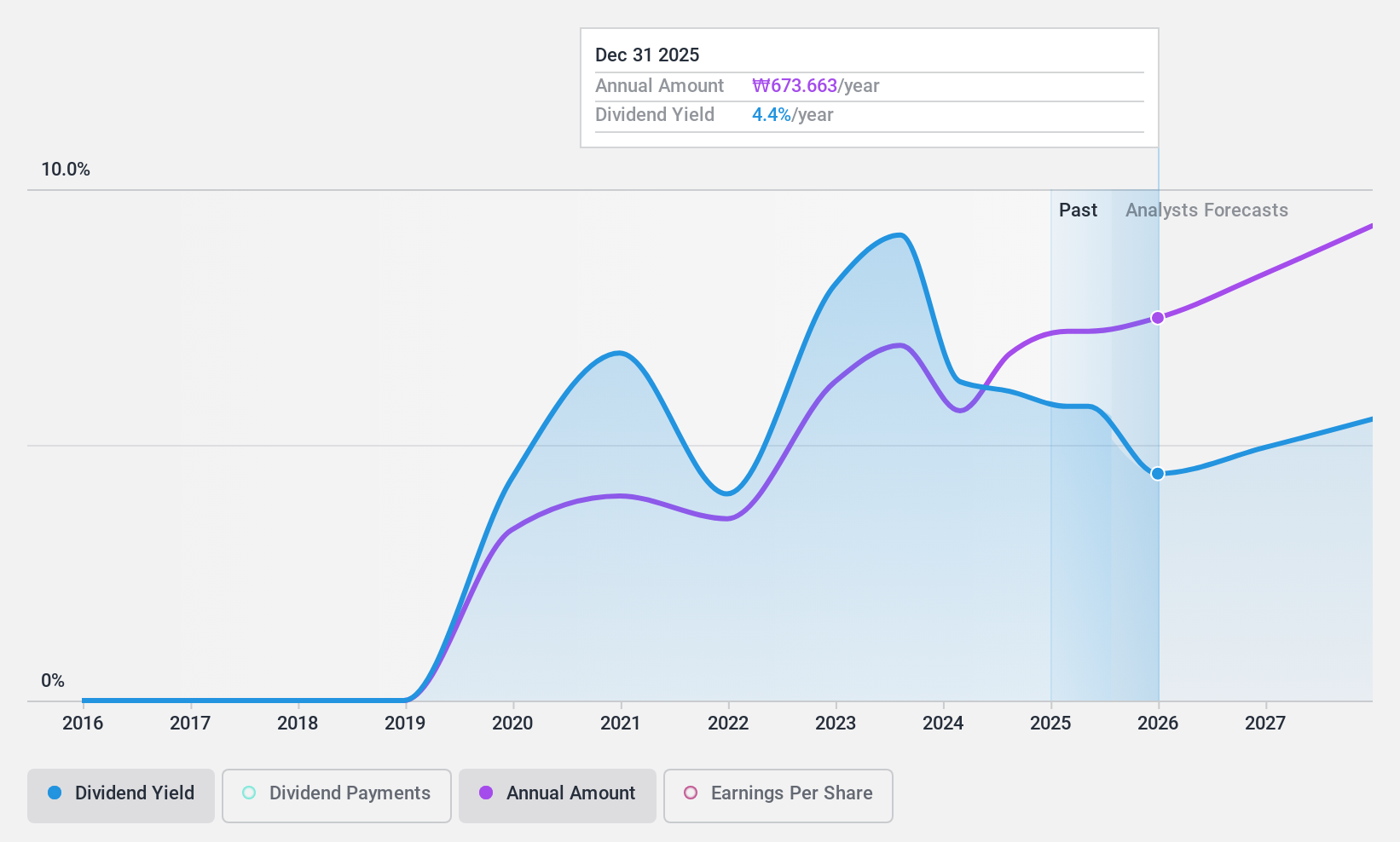

Overview: BNK Financial Group Inc., along with its subsidiaries, offers a range of financial products and services in South Korea and internationally, with a market cap of ₩3.69 trillion.

Operations: BNK Financial Group Inc. operates through various revenue segments, providing diverse financial services both domestically and internationally.

Dividend Yield: 5.6%

BNK Financial Group's dividend is well-covered by earnings with a low payout ratio of 25.8%, indicating sustainability. However, its dividend history is unstable and unreliable, having been paid for only five years with volatility in payments. The dividend yield stands at 5.57%, placing it among the top 25% in the Korean market. Recent buyback announcements aim to enhance shareholder value, with KRW 40 billion allocated for repurchases until August 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of BNK Financial Group.

- According our valuation report, there's an indication that BNK Financial Group's share price might be on the cheaper side.

Vanguard International Semiconductor (TPEX:5347)

Simply Wall St Dividend Rating: ★★★★☆☆

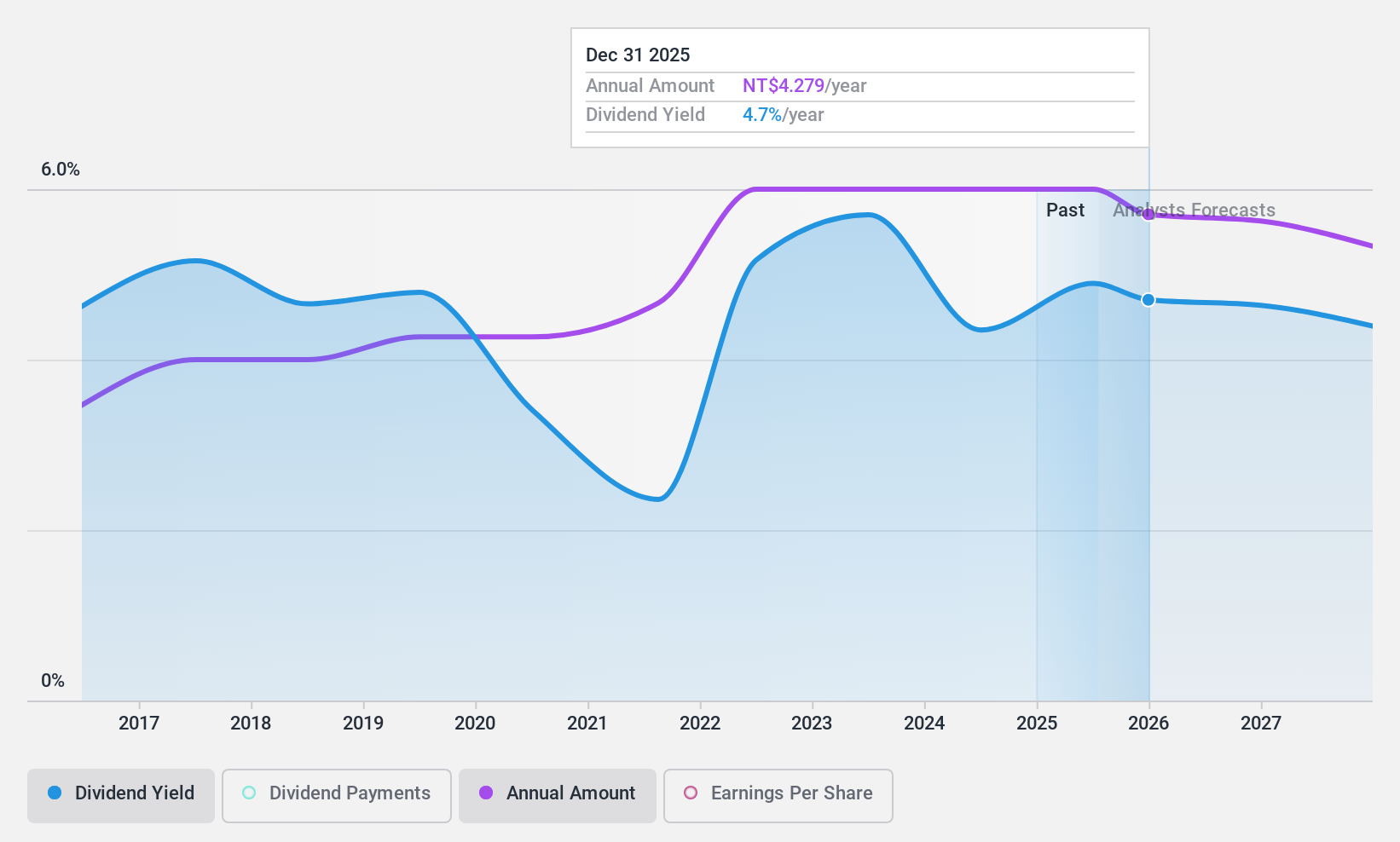

Overview: Vanguard International Semiconductor Corporation, along with its subsidiaries, is involved in the manufacturing, selling, packaging, testing, and computer-aided design of integrated circuits and other semiconductor devices both in Taiwan and internationally; it has a market cap of approximately NT$163.52 billion.

Operations: Vanguard International Semiconductor's revenue primarily comes from its Wafer Manufacturing Conformity segment, which generated NT$42.18 billion.

Dividend Yield: 5.1%

Vanguard International Semiconductor offers a dividend yield of 5.07%, placing it in the top 25% of Taiwan's market, but its dividends are not well covered by earnings or cash flows, with payout ratios of 97.2% and a cash payout ratio of 178.6%. Despite this, dividends have been reliably growing over the past decade with little volatility. The stock's price-to-earnings ratio is favorable at 21.8x compared to the industry average of 30.6x.

- Click to explore a detailed breakdown of our findings in Vanguard International Semiconductor's dividend report.

- The valuation report we've compiled suggests that Vanguard International Semiconductor's current price could be inflated.

Noritsu Koki (TSE:7744)

Simply Wall St Dividend Rating: ★★★★★☆

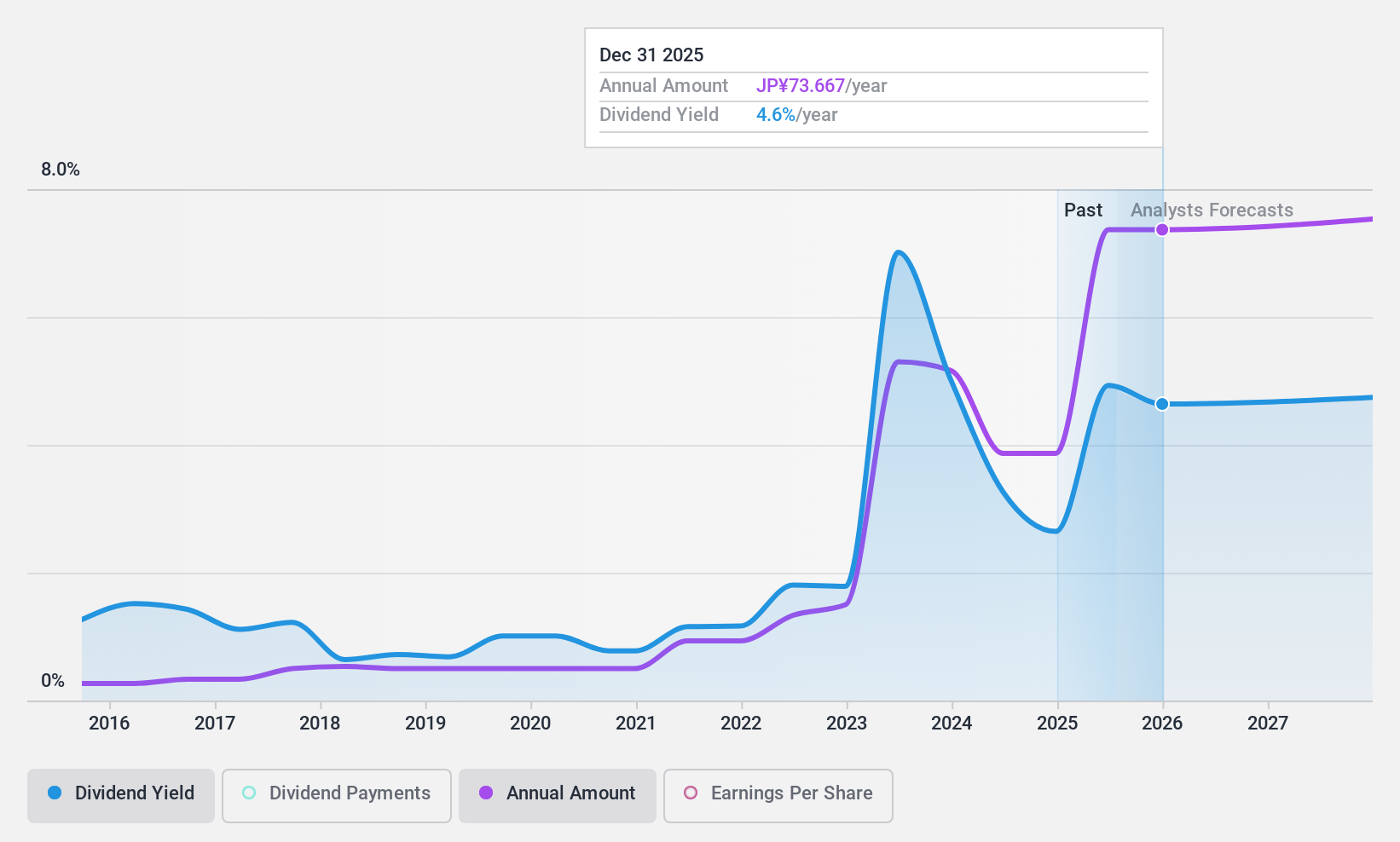

Overview: Noritsu Koki Co., Ltd. is a company that manufactures and sells audio equipment and peripheral products across various regions including Japan, China, the United States, Europe, Central and South America, the Middle East, Africa, and internationally with a market capitalization of approximately ¥168.86 billion.

Operations: Noritsu Koki Co., Ltd. generates revenue through the production and sale of audio equipment and peripheral products across multiple global markets.

Dividend Yield: 4.6%

Noritsu Koki trades at 55.2% below its estimated fair value, offering a dividend yield of 4.6%, which ranks in the top 25% of Japan's market. Despite a volatile and unstable dividend history over the past decade, current dividends are well covered by earnings (45.4% payout ratio) and cash flows (25.5% cash payout ratio). Earnings grew by 39.5% last year, supporting dividend sustainability despite past inconsistencies in payments.

- Get an in-depth perspective on Noritsu Koki's performance by reading our dividend report here.

- Our valuation report unveils the possibility Noritsu Koki's shares may be trading at a discount.

Summing It All Up

- Dive into all 1985 of the Top Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noritsu Koki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7744

Noritsu Koki

Manufactures and sells audio equipment and peripheral products in Japan, China, the United States, Europe, Central and South America, the Middle East, Africa, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives