Dongfang Electric And 2 Other Reliable Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, investors have witnessed major indices like the Nasdaq Composite and S&P 500 experience volatility, with growth stocks lagging behind value shares. Amidst these fluctuations, dividend stocks stand out as potential anchors of stability by providing consistent income streams even when market conditions are unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Innotech (TSE:9880) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.18% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.36% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 2022 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

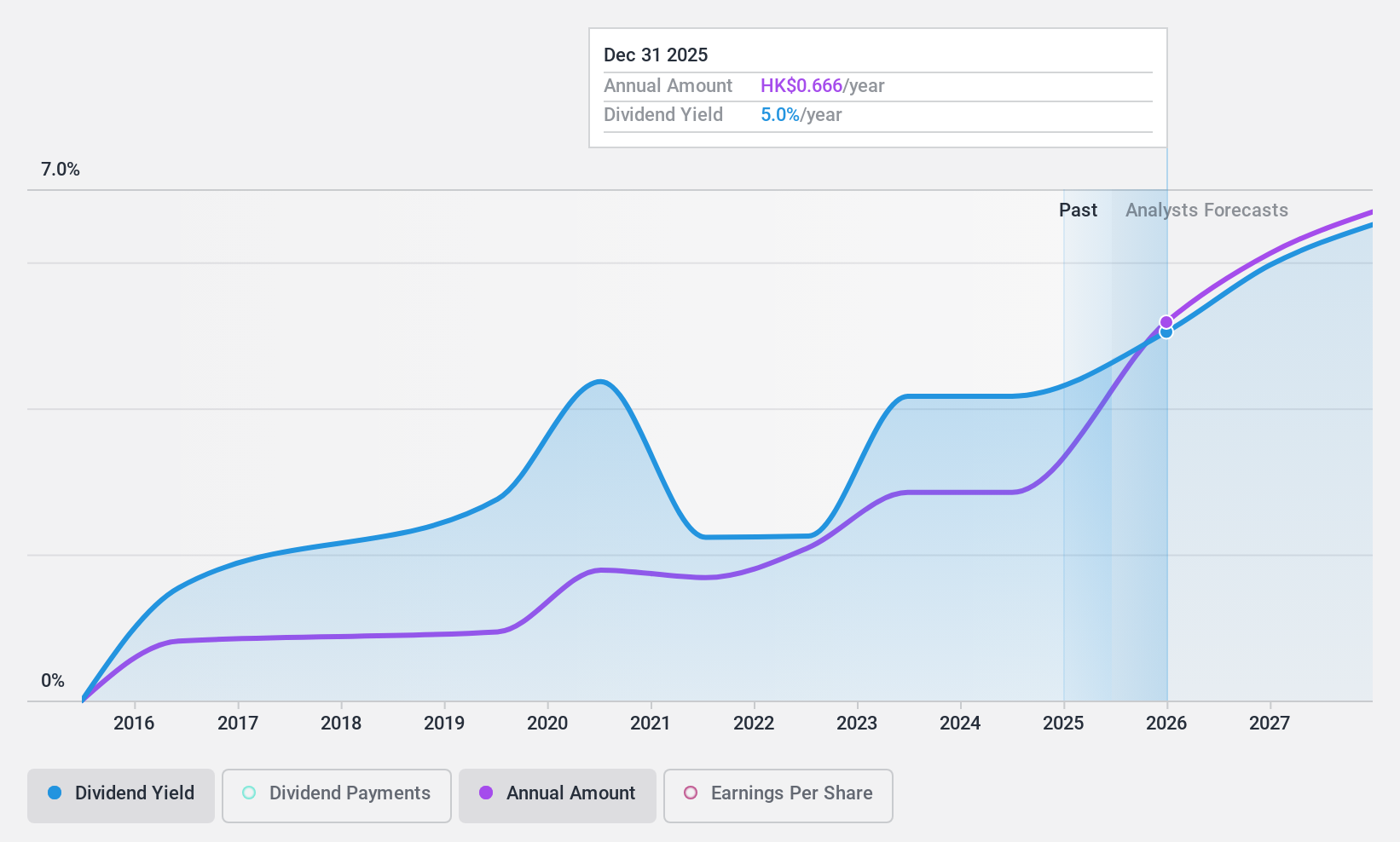

Dongfang Electric (SEHK:1072)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dongfang Electric Corporation Limited designs, develops, manufactures, and sells power generation equipment in China and internationally, with a market cap of HK$52.48 billion.

Operations: Dongfang Electric Corporation Limited's revenue segments include thermal power equipment (CN¥13.45 billion), hydro power equipment (CN¥5.62 billion), wind power equipment (CN¥3.24 billion), engineering and services (CN¥4.89 billion), and environmental protection equipment (CN¥1.15 billion).

Dividend Yield: 4.8%

Dongfang Electric's dividends are well-covered by earnings and cash flows, with a payout ratio of 45.3% and a cash payout ratio of 33.9%. Despite trading at a good value with a P/E ratio of 9.4x, its dividend reliability is questionable due to volatility over the past decade. Recent earnings showed improved sales but decreased net income, highlighting potential challenges in sustaining dividend growth despite an increase in payments over the last ten years.

- Click here to discover the nuances of Dongfang Electric with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Dongfang Electric is priced lower than what may be justified by its financials.

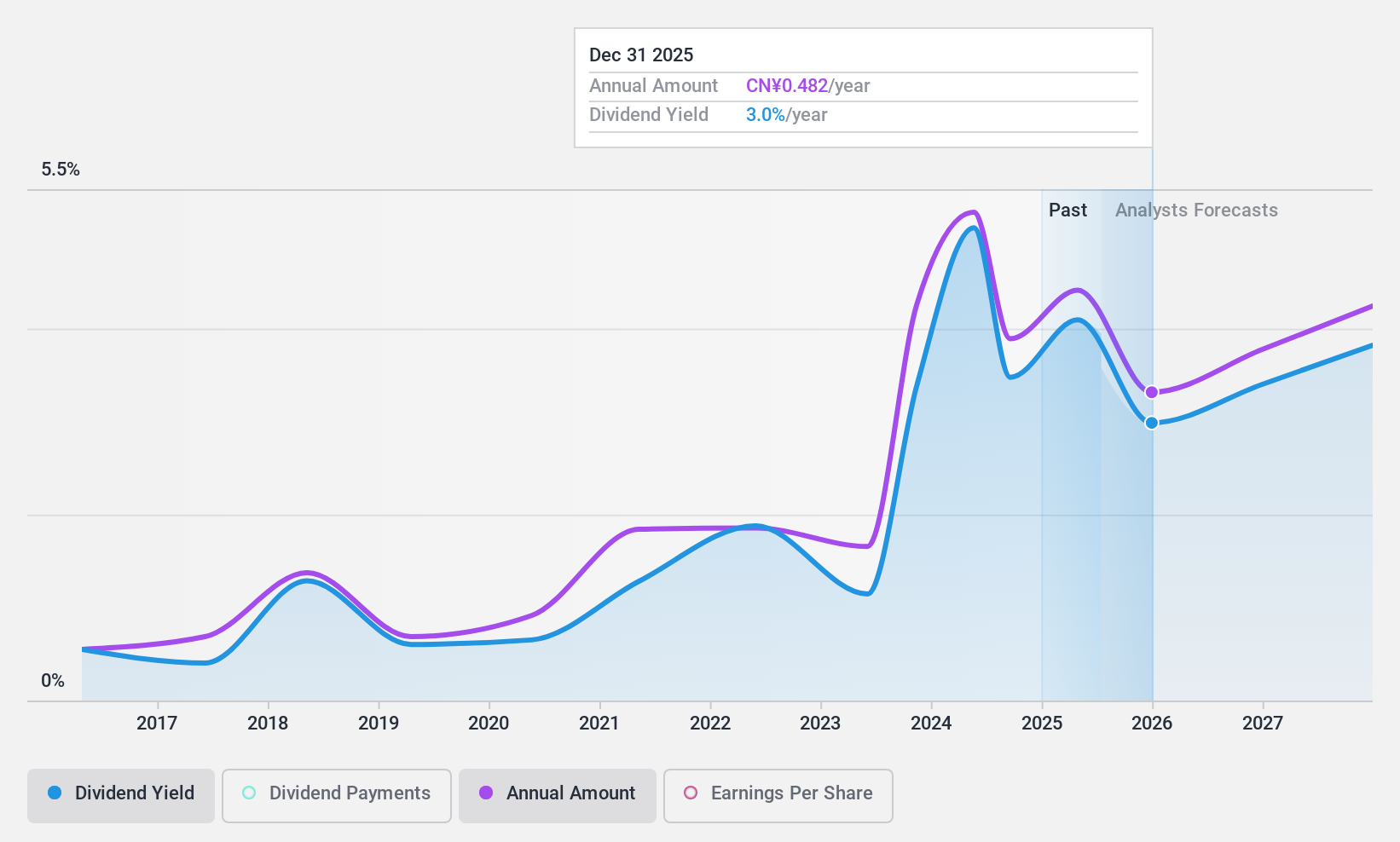

Zhejiang Dahua Technology (SZSE:002236)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Dahua Technology Co., Ltd. operates globally in the intelligent Internet of Things industry and has a market cap of CN¥56.58 billion.

Operations: Zhejiang Dahua Technology Co., Ltd. generates revenue primarily from the R&D, production, and sales of video IoT products, amounting to CN¥32.39 billion.

Dividend Yield: 3.3%

Zhejiang Dahua Technology's dividend yield of 3.27% is among the top in the CN market, yet its sustainability is questionable due to a high cash payout ratio of 93.5%. Despite a low earnings payout ratio of 25.3%, dividends are not well covered by free cash flows. Recent earnings showed stable sales but slightly reduced net income, which may affect future payouts given the historically volatile and unreliable nature of their dividends over ten years.

- Click to explore a detailed breakdown of our findings in Zhejiang Dahua Technology's dividend report.

- Our valuation report unveils the possibility Zhejiang Dahua Technology's shares may be trading at a discount.

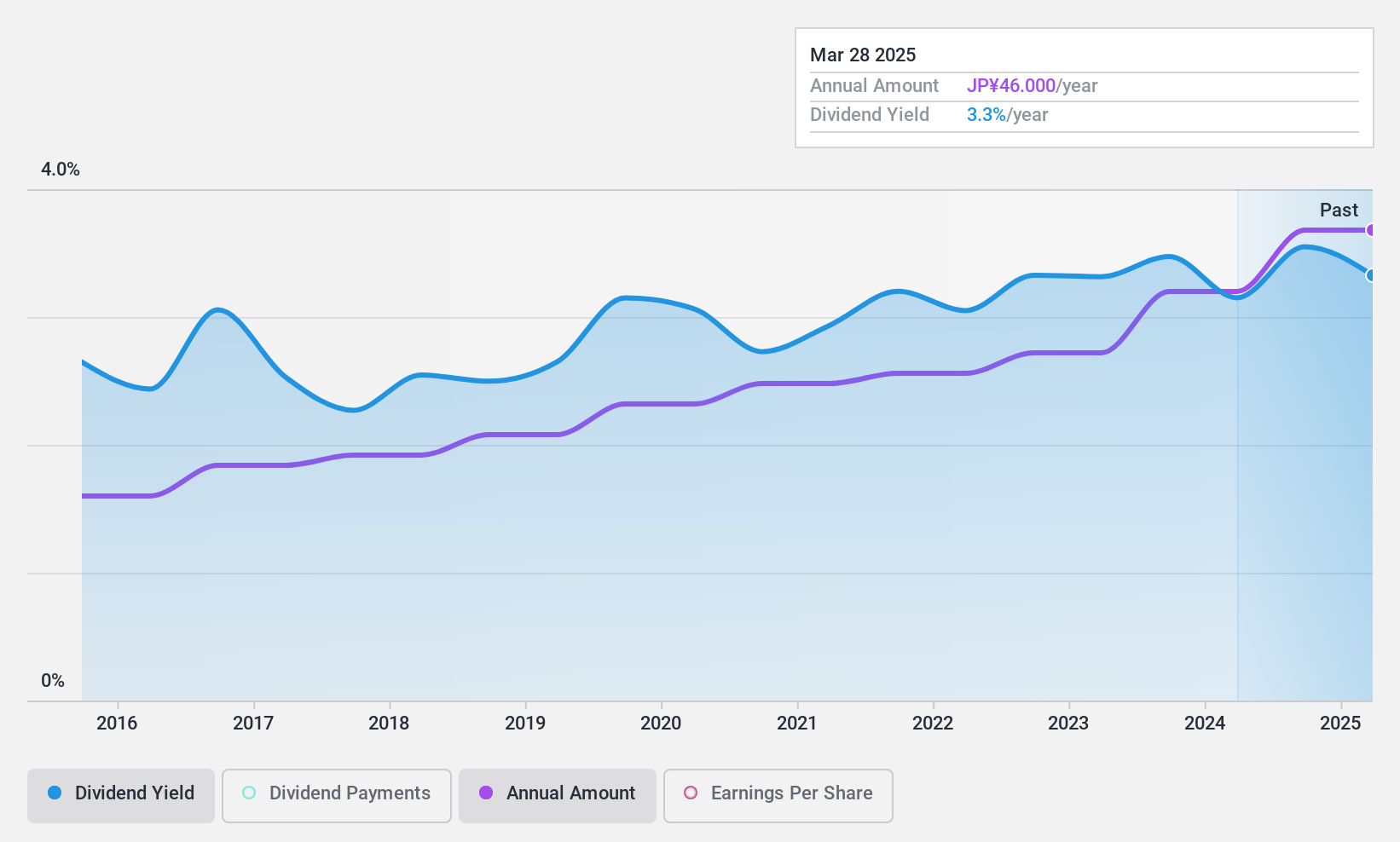

Kondotec (TSE:7438)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kondotec Inc. operates in the manufacture, procurement, import, sale, wholesale, and export of industrial materials mainly within the retail hardware sector both in Japan and internationally, with a market capitalization of ¥34.04 billion.

Operations: Kondotec Inc.'s revenue segments include Industrial Materials at ¥37.61 billion, Scaffolding Construction at ¥8.63 billion, Steel Structure Materials at ¥21.24 billion, and Electrical Equipment Materials at ¥10.70 billion.

Dividend Yield: 3.5%

Kondotec offers a stable dividend yield of 3.45%, supported by consistent growth over the past decade and a low payout ratio of 31.8%, indicating strong earnings coverage. The cash payout ratio at 57.5% further ensures dividends are well covered by cash flows, though the yield is below the top quartile in Japan's market (3.82%). Trading at 25.5% below estimated fair value, it presents potential for long-term dividend sustainability amidst reliable financial performance.

- Dive into the specifics of Kondotec here with our thorough dividend report.

- The valuation report we've compiled suggests that Kondotec's current price could be quite moderate.

Next Steps

- Click through to start exploring the rest of the 2019 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kondotec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7438

Kondotec

Engages in the manufacture, procurement, import, sale, wholesale, and export of industrial materials primarily in the retail hardware business in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.