- Japan

- /

- Gas Utilities

- /

- TSE:1663

Undiscovered Gems To Explore In November 2024

Reviewed by Simply Wall St

In the midst of global market fluctuations, driven by uncertainties surrounding the incoming Trump administration and its potential policy impacts, small-cap stocks have shown a mixed performance. With key indices like the Russell 2000 experiencing notable shifts, investors are keenly observing how these dynamics might uncover lesser-known opportunities in various sectors. In this context, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that can navigate such volatile environments effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Spright Agro | 0.24% | 85.62% | 88.80% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Banking Group Limited is an investment holding company offering banking, financial, and related services in Hong Kong, Macau, and the People’s Republic of China with a market cap of approximately HK$10.23 billion.

Operations: The primary revenue streams for Dah Sing Banking Group Limited include Personal Banking, generating HK$2.68 billion, and Treasury and Global Markets, contributing HK$1.34 billion. Corporate Banking adds HK$853.60 million to the revenue mix, while Mainland China and Macau Banking accounts for HK$176.27 million.

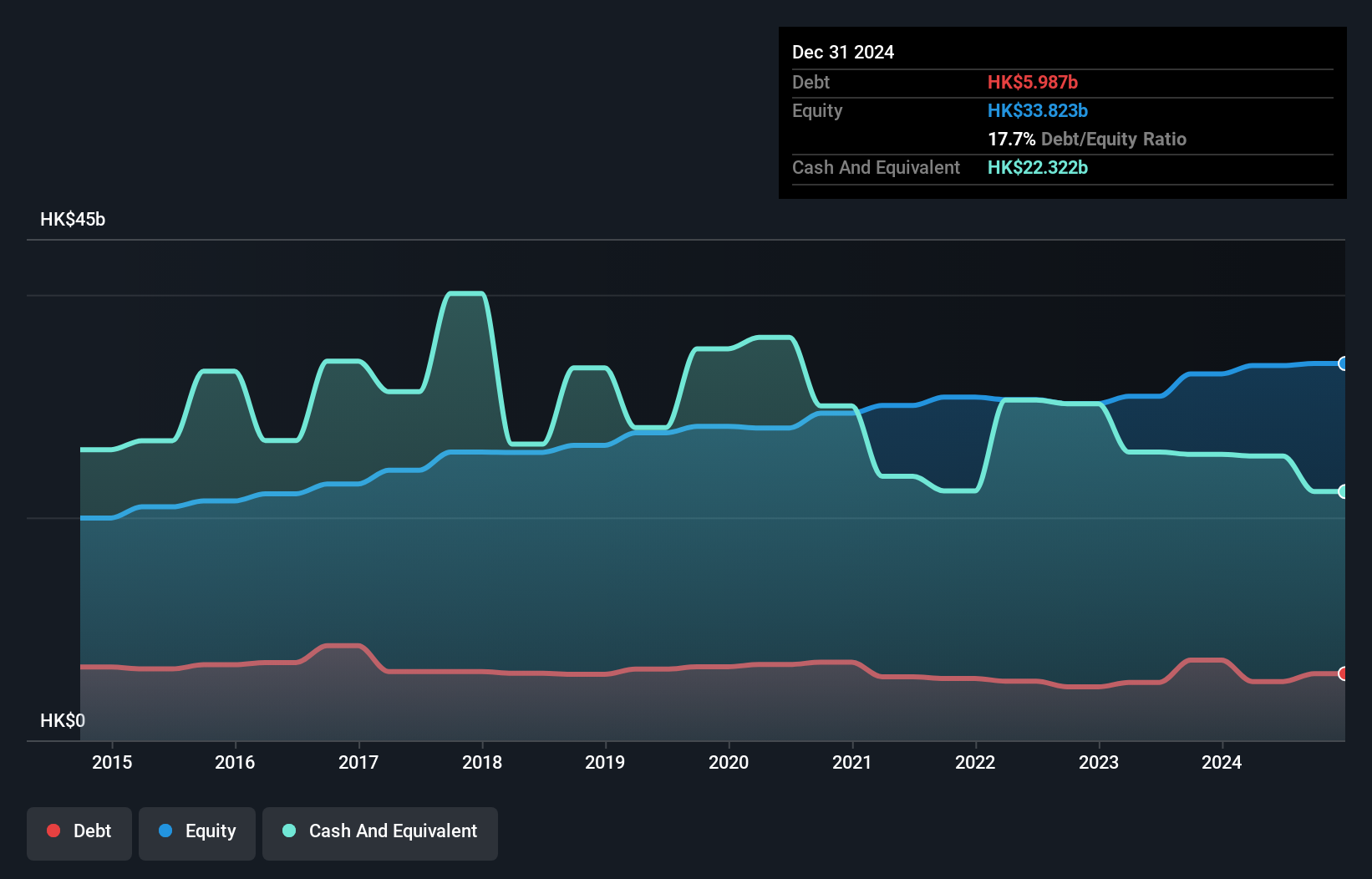

Dah Sing Banking Group, a smaller financial entity, is making waves with its impressive earnings growth of 32.3% over the past year, outpacing the industry average of 1.6%. The company boasts total assets of HK$262.4 billion and equity at HK$33.6 billion, indicating solid financial footing. However, it faces challenges with a low allowance for bad loans at 43%, yet maintains an appropriate level of non-performing loans at 1.9%. Trading significantly below its estimated fair value by 42.5%, Dah Sing seems undervalued while offering a dividend increase to HKD 0.27 per share recently announced in August 2024.

- Dive into the specifics of Dah Sing Banking Group here with our thorough health report.

Evaluate Dah Sing Banking Group's historical performance by accessing our past performance report.

HeNan Splendor Science & Technology (SZSE:002296)

Simply Wall St Value Rating: ★★★★★★

Overview: HeNan Splendor Science & Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.47 billion.

Operations: HeNan Splendor Science & Technology generates revenue primarily through its technology-related operations. The company's financial performance is characterized by a net profit margin trend that has shown variability over recent periods.

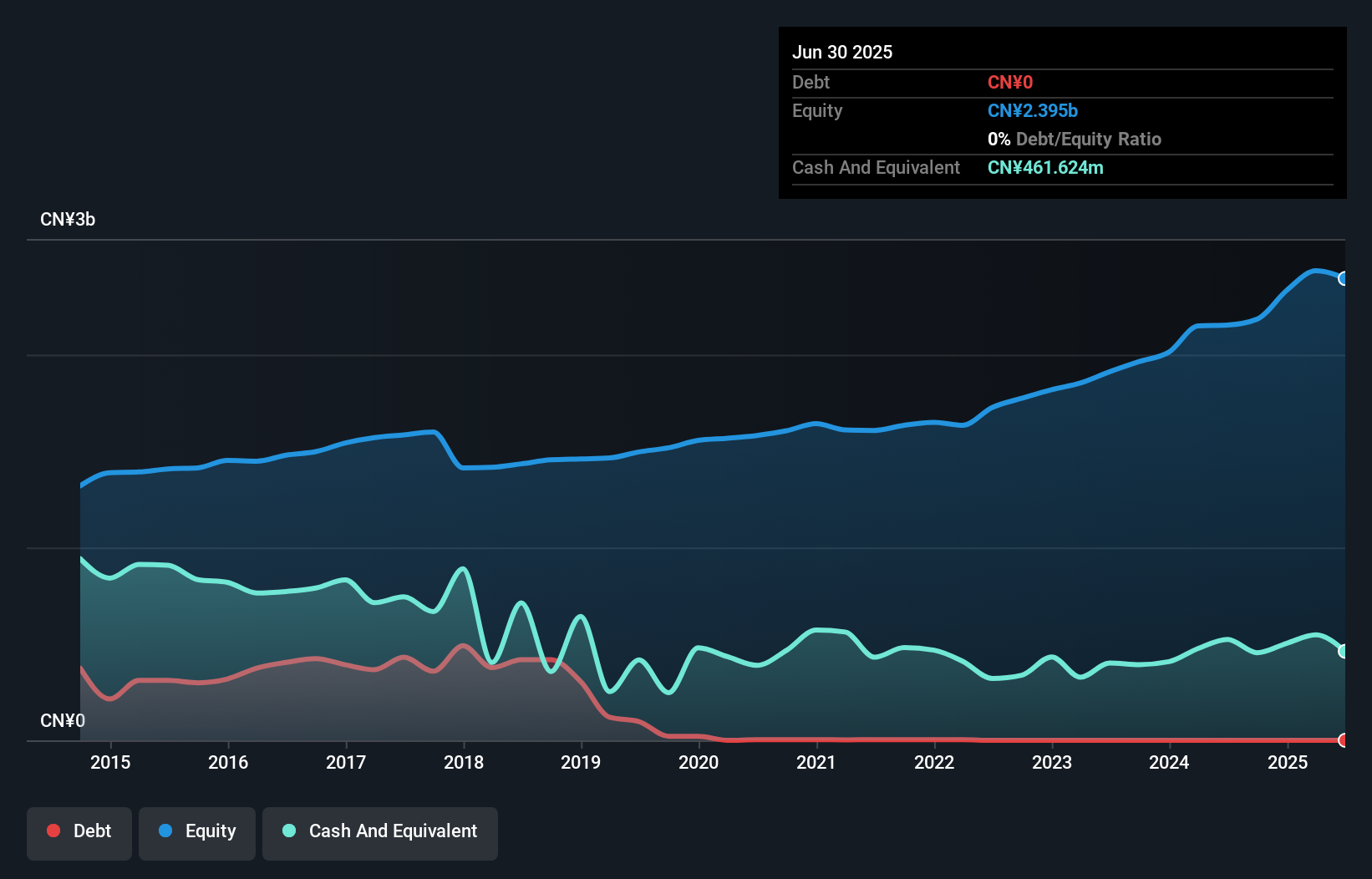

HeNan Splendor Science & Technology is making waves with its recent earnings report, showing sales of CNY 474.43 million and net income reaching CNY 134.4 million for the nine months ending September 2024, compared to last year's figures of CNY 448.3 million and CNY 110.85 million respectively. Despite shareholder dilution in the past year, this company boasts impressive earnings growth of 65.2%, outpacing the Communications industry by a significant margin. With a price-to-earnings ratio at an attractive 20.3x against the broader CN market's 35.3x, it seems well-positioned in terms of valuation and profitability without any debt concerns looming overhead.

K&O Energy Group (TSE:1663)

Simply Wall St Value Rating: ★★★★★★

Overview: K&O Energy Group Inc. is involved in the development, production, supply, and sale of natural gas and iodine in Japan with a market cap of ¥78.94 billion.

Operations: K&O Energy Group generates revenue primarily from the sale of natural gas and iodine. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

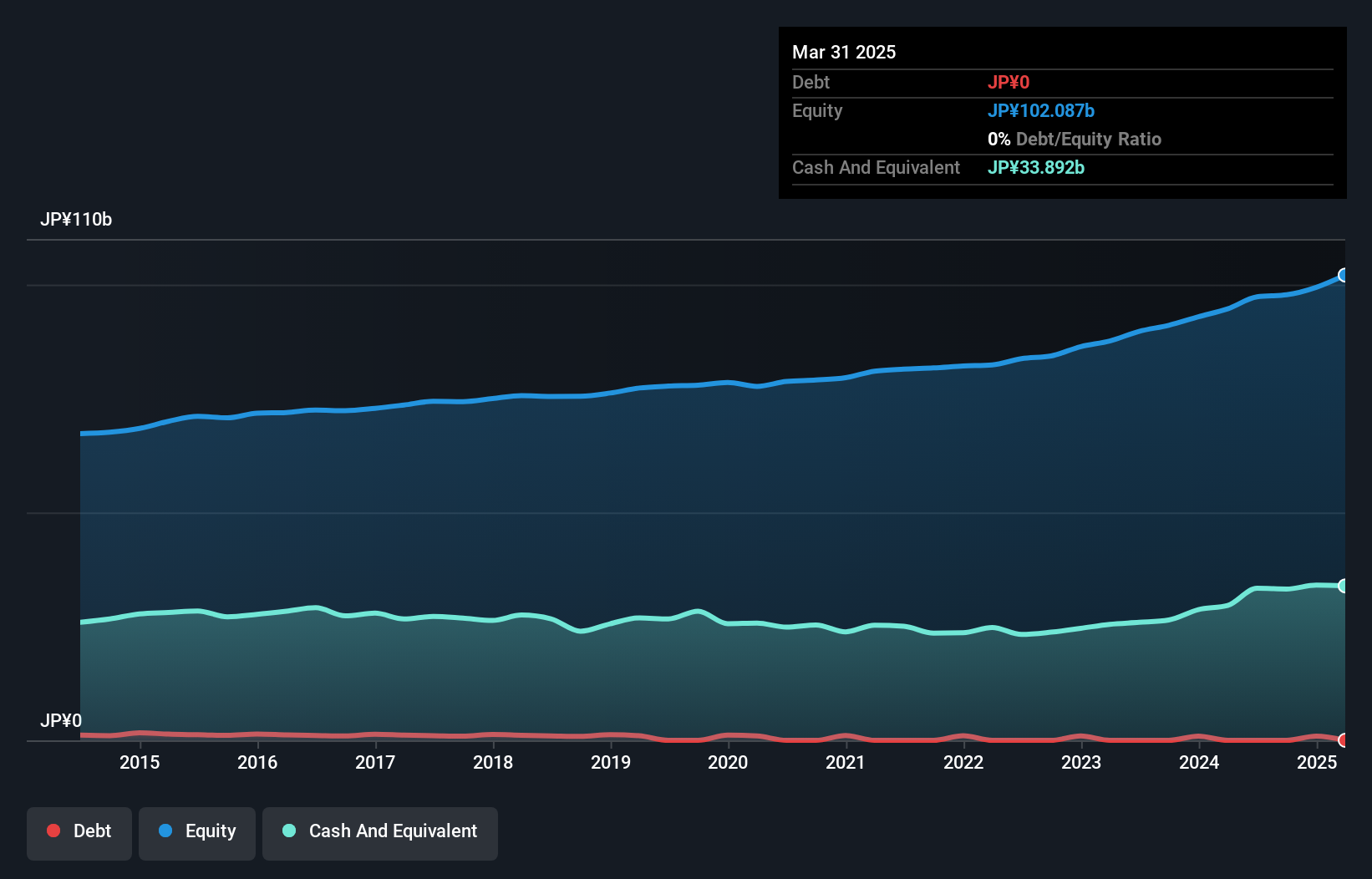

K&O Energy Group, a smaller player in the energy sector, shows promise with its recent earnings growth of 12.1%, outpacing the broader gas utilities industry by a wide margin. Trading at 62.1% below its estimated fair value, it offers potential upside for investors seeking undervalued opportunities. The company operates debt-free and has maintained this status for over five years, which likely contributes to its strong financial foundation and high-quality earnings. However, looking ahead, earnings are projected to decline by an average of 15.9% annually over the next three years, indicating potential challenges in sustaining current growth levels.

- Unlock comprehensive insights into our analysis of K&O Energy Group stock in this health report.

Gain insights into K&O Energy Group's past trends and performance with our Past report.

Taking Advantage

- Unlock our comprehensive list of 4653 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K&O Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1663

K&O Energy Group

Engages in the development, production, supply, and sale of natural gas and iodine in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives