Why Hino Motors (TSE:7205) Is Up 8.4% After Upgrading Earnings Outlook and Naming a New President

Reviewed by Sasha Jovanovic

- Hino Motors announced on November 4, 2025, an upward revision to its consolidated earnings guidance for the fiscal year ending March 31, 2026, alongside the appointment of Satyakam Arya as the company’s new President, effective April 2026.

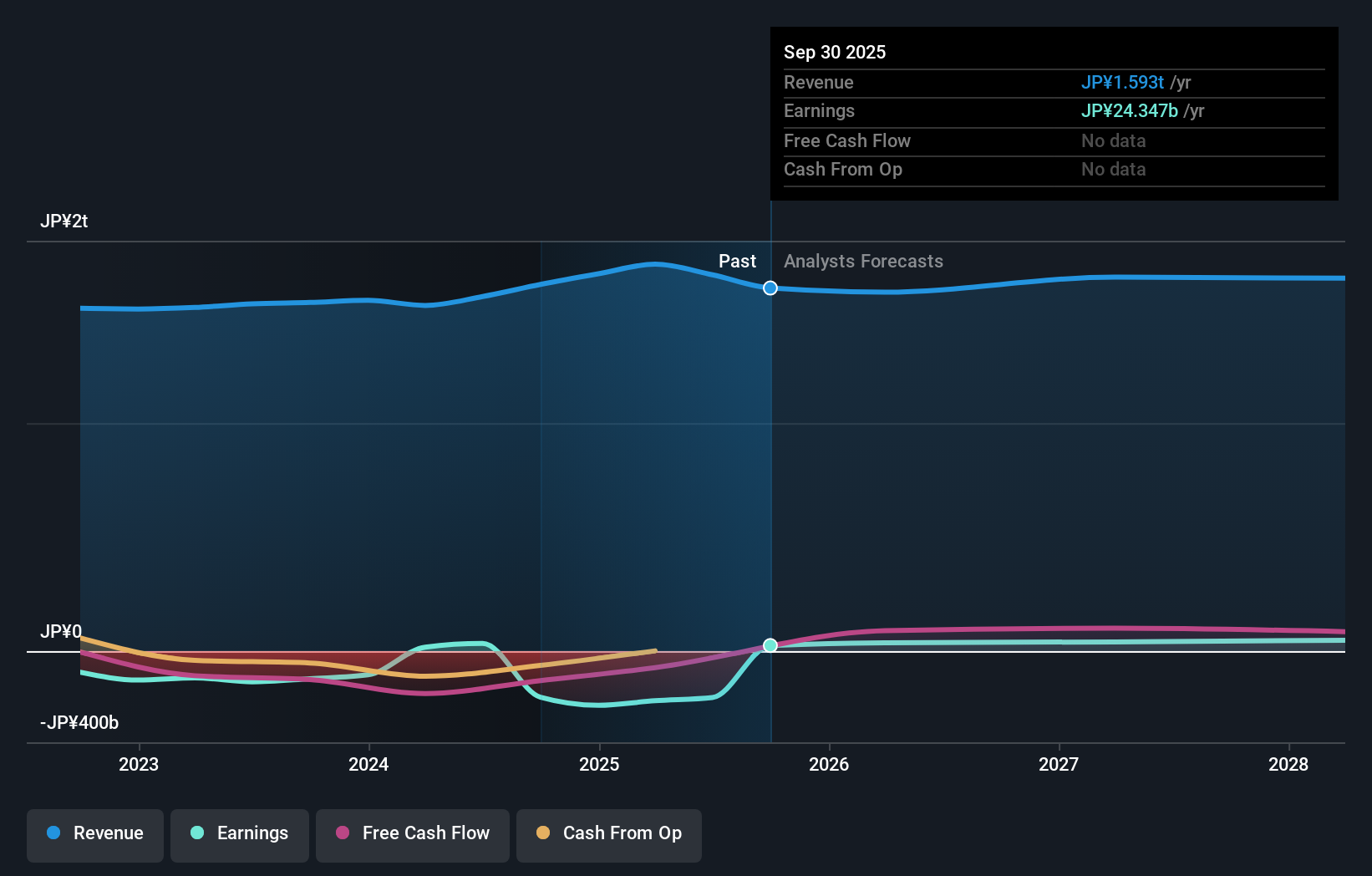

- The improved outlook reflects anticipated increases in operating income and profit, partly driven by shifts in vehicle production for Toyota and evolving truck and bus sales trends.

- We will explore how the enhanced profit forecast, with a focus on higher operating income, influences Hino Motors' broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Hino Motors' Investment Narrative?

For anyone considering Hino Motors, the real story comes down to whether you see the company delivering on its new profit guidance and emerging stronger from recent disruptions. The sudden jump in operating income expectations and a sizable profit upgrade, announced alongside the appointment of Satyakam Arya as incoming President, serve as meaningful near-term catalysts likely to brighten sentiment in the coming quarters. This revised outlook could shift attention away from past legal and compliance hurdles, and instead highlight how integration efforts with Mitsubishi Fuso and Toyota may bring operational upside. However, core risks remain around unresolved lawsuits, past emissions scandals, and relatively subdued revenue growth forecasts compared to peers, not to mention mixed recent share returns. All eyes are now on Hino’s ability to turn improved guidance into sustained performance, especially with new leadership taking the helm in early 2026. On the other hand, legal outcomes from outstanding emissions cases could still surprise the market.

Hino Motors' shares have been on the rise but are still potentially undervalued by 30%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Hino Motors - why the stock might be worth as much as 44% more than the current price!

Build Your Own Hino Motors Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hino Motors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hino Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hino Motors' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hino Motors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7205

Hino Motors

Manufactures and sells commercial vehicles under the Hino brand worldwide.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives