Why We're Not Concerned Yet About Kawasaki Heavy Industries, Ltd.'s (TSE:7012) 27% Share Price Plunge

Kawasaki Heavy Industries, Ltd. (TSE:7012) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 25% in the last year.

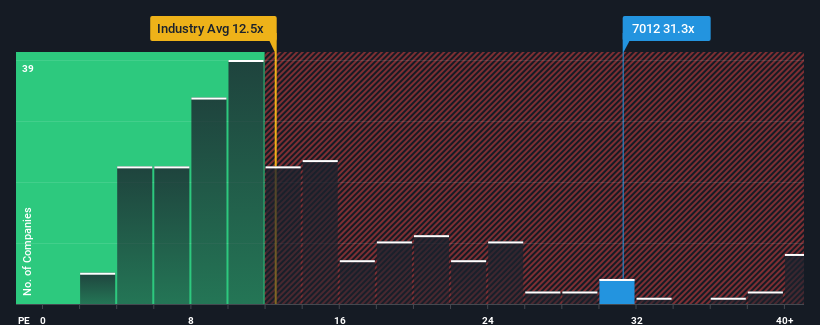

Although its price has dipped substantially, Kawasaki Heavy Industries' price-to-earnings (or "P/E") ratio of 31.3x might still make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Kawasaki Heavy Industries hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Kawasaki Heavy Industries

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Kawasaki Heavy Industries' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 52%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 60% per annum during the coming three years according to the twelve analysts following the company. That's shaping up to be materially higher than the 9.6% per year growth forecast for the broader market.

In light of this, it's understandable that Kawasaki Heavy Industries' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Kawasaki Heavy Industries' P/E

Kawasaki Heavy Industries' shares may have retreated, but its P/E is still flying high. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Kawasaki Heavy Industries' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Kawasaki Heavy Industries (2 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Kawasaki Heavy Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kawasaki Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7012

Kawasaki Heavy Industries

Engages in aerospace systems, energy solution and marine engineering, precision machinery and robot, rolling stock, and motorcycle and engine businesses in Japan and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives