Kawasaki Heavy Industries, Ltd.'s (TSE:7012) P/E Is Still On The Mark Following 26% Share Price Bounce

Kawasaki Heavy Industries, Ltd. (TSE:7012) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 85%.

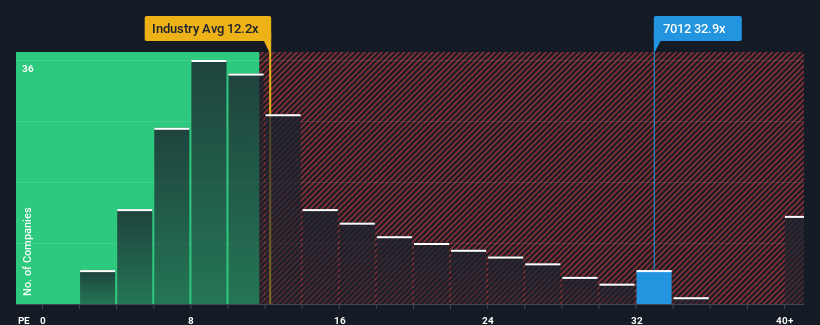

Following the firm bounce in price, Kawasaki Heavy Industries' price-to-earnings (or "P/E") ratio of 32.9x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Kawasaki Heavy Industries could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Kawasaki Heavy Industries

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Kawasaki Heavy Industries' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 44% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 1,268% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 51% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 9.6% per annum, which is noticeably less attractive.

With this information, we can see why Kawasaki Heavy Industries is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Kawasaki Heavy Industries' P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Kawasaki Heavy Industries' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Kawasaki Heavy Industries (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Kawasaki Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7012

Kawasaki Heavy Industries

Engages in aerospace systems, energy solution and marine engineering, precision machinery and robot, rolling stock, and motorcycle and engine businesses in Japan and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives