The board of Nippon Tungsten Co., Ltd. (TSE:6998) has announced that it will pay a dividend on the 6th of December, with investors receiving ¥25.00 per share. Based on this payment, the dividend yield on the company's stock will be 3.8%, which is an attractive boost to shareholder returns.

View our latest analysis for Nippon Tungsten

Nippon Tungsten's Earnings Easily Cover The Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Nippon Tungsten's earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Unless the company can turn things around, EPS could fall by 8.7% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 55%, which is definitely feasible to continue.

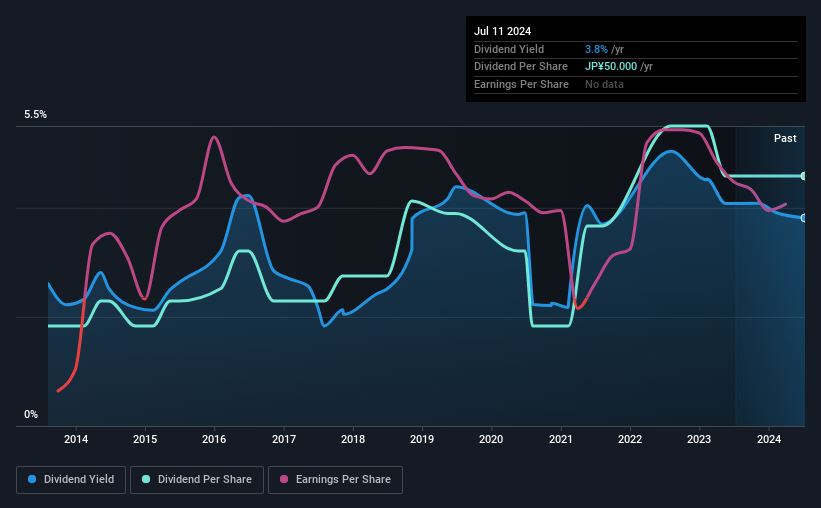

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of ¥20.00 in 2014 to the most recent total annual payment of ¥50.00. This means that it has been growing its distributions at 9.6% per annum over that time. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Dividend Growth May Be Hard To Come By

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. In the last five years, Nippon Tungsten's earnings per share has shrunk at approximately 8.7% per annum. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Nippon Tungsten that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Tungsten might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6998

Nippon Tungsten

Provides rare metal and fine ceramic products primarily composed of tungsten based on powder metallurgical technology.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives