Is Fanuc’s Share Price Justified After 18.5% Year-to-Date Surge?

Reviewed by Bailey Pemberton

- Ever wondered if Fanuc's current price tag is a bargain or if you're better off waiting on the sidelines? You're not alone. We are about to dig into exactly what matters for value-focused investors.

- Fanuc has seen some notable moves lately, with the stock up 20.5% over the past year and a solid 18.5% gain year-to-date. However, it dipped 6.0% in the past week.

- Recent headlines have zeroed in on shifting investor expectations, as automation industry news points toward global supply chain upgrades and increased robotics demand. These developments have added layers of interest and debate around Fanuc's growth prospects and risk profile.

- As for valuation, Fanuc scores 0 out of 6 on our value checks. This sparks a closer look at traditional metrics and hints at an even better approach to understanding its true worth coming up later in this article.

Fanuc scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Fanuc Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them to today's value. This process allows investors to gauge what a company's shares are really worth based on expected, actual business performance rather than market speculation.

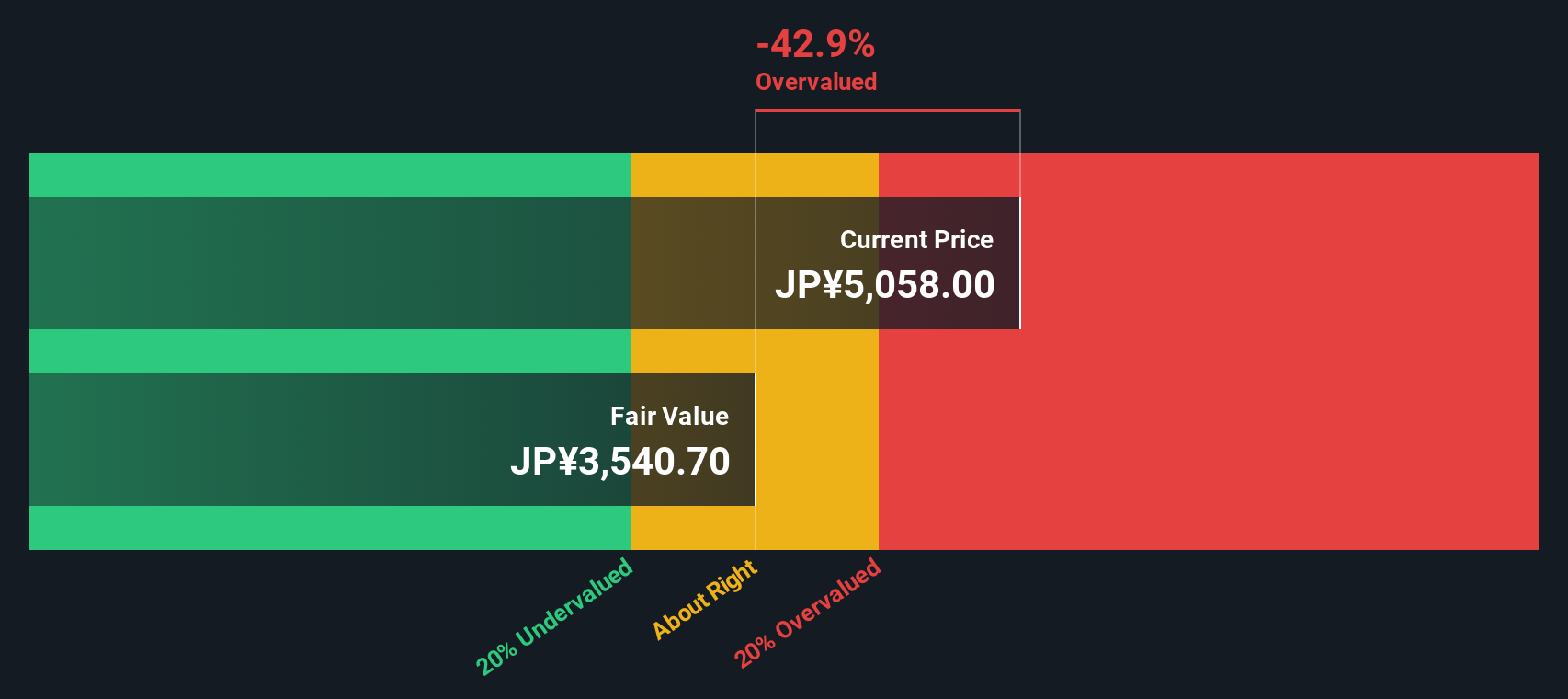

For Fanuc, the latest reported Free Cash Flow (FCF) stands at ¥192.7 billion. Analysts forecast FCF to decrease slightly over the coming years, projecting around ¥188.1 billion by 2030. The DCF model used here is a 2 Stage Free Cash Flow to Equity approach. It incorporates analyst estimates for the next five years and then extrapolates further growth using industry averaging methods.

According to these projections, Fanuc's estimated intrinsic value is ¥3,608 per share. However, with the current share price trading about 34.3% above this level, the DCF model indicates Fanuc stock is meaningfully overvalued compared to its underlying cash flow outlook.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fanuc may be overvalued by 34.3%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fanuc Price vs Earnings

For established, profitable companies like Fanuc, the Price-to-Earnings (PE) ratio is a time-tested valuation tool. It helps investors quickly gauge how much they are paying for each yen of earnings, making it especially useful when profits are consistent and predictable.

The appropriate PE ratio for any company depends on factors like future earnings growth, stability, and the level of risk investors perceive. Companies expected to grow faster or with more stable earnings tend to command higher "normal" or "fair" PE ratios, while riskier or slower-growing firms typically trade at lower multiples.

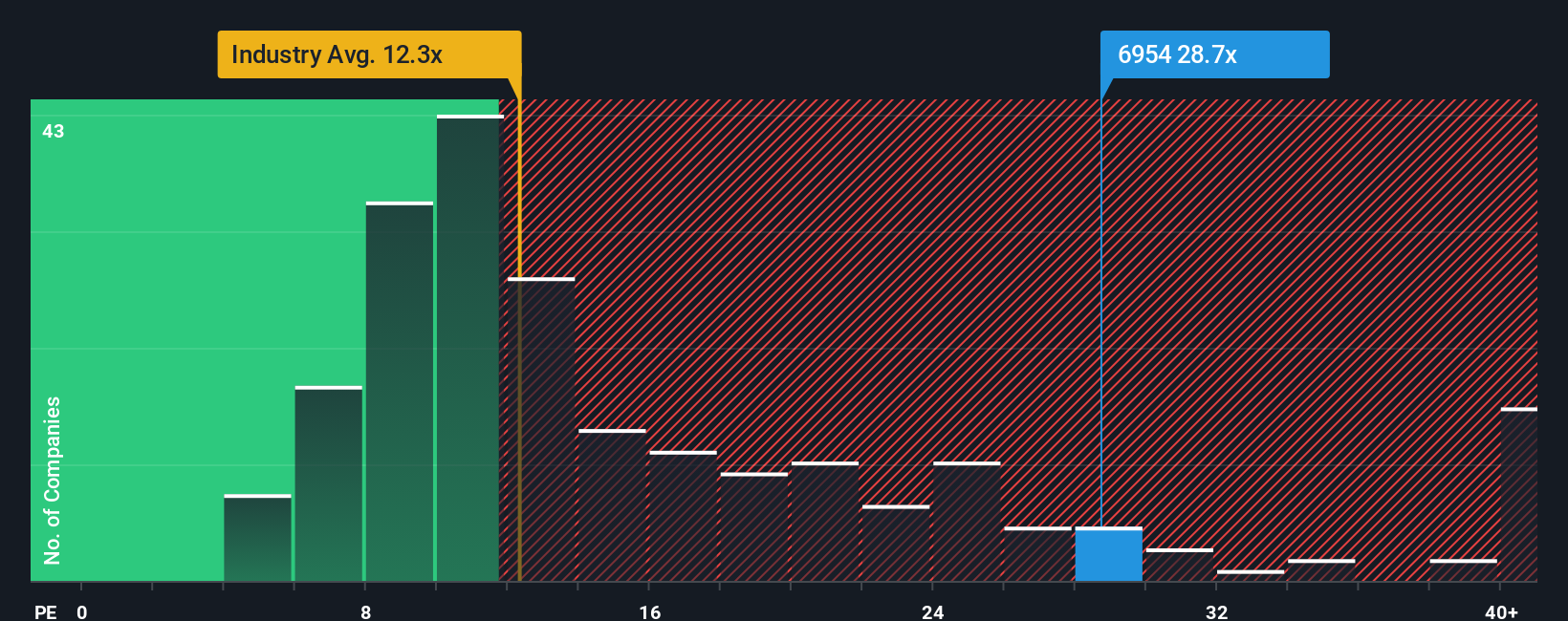

Fanuc’s current PE ratio sits at 28.7x. For context, the industry average for similar Machinery companies is just 12.3x, and the peer group average is 22.8x. At a glance, this suggests Fanuc trades at a premium to both its industry and direct competitors.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio for Fanuc is calculated at 25.1x, factoring in not just industry comparisons but also Fanuc's unique growth prospects, profit margins, risk profile, and company size. Unlike simple peer or industry averages, the Fair Ratio adapts to the company’s actual financial story and outlook. This makes it a more comprehensive benchmark for investors.

Comparing Fanuc’s current PE of 28.7x to its Fair Ratio of 25.1x, the stock is trading above what would typically be justified given its profile. This suggests the market is pricing in a more optimistic scenario than the fundamentals alone support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fanuc Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just a number on a page; it is your perspective on what makes a company like Fanuc valuable, combining your own outlook on its future revenue, earnings, and margins into a single, meaningful story. Narratives connect your investment thesis to a transparent financial forecast and ultimately to a fair value for the stock.

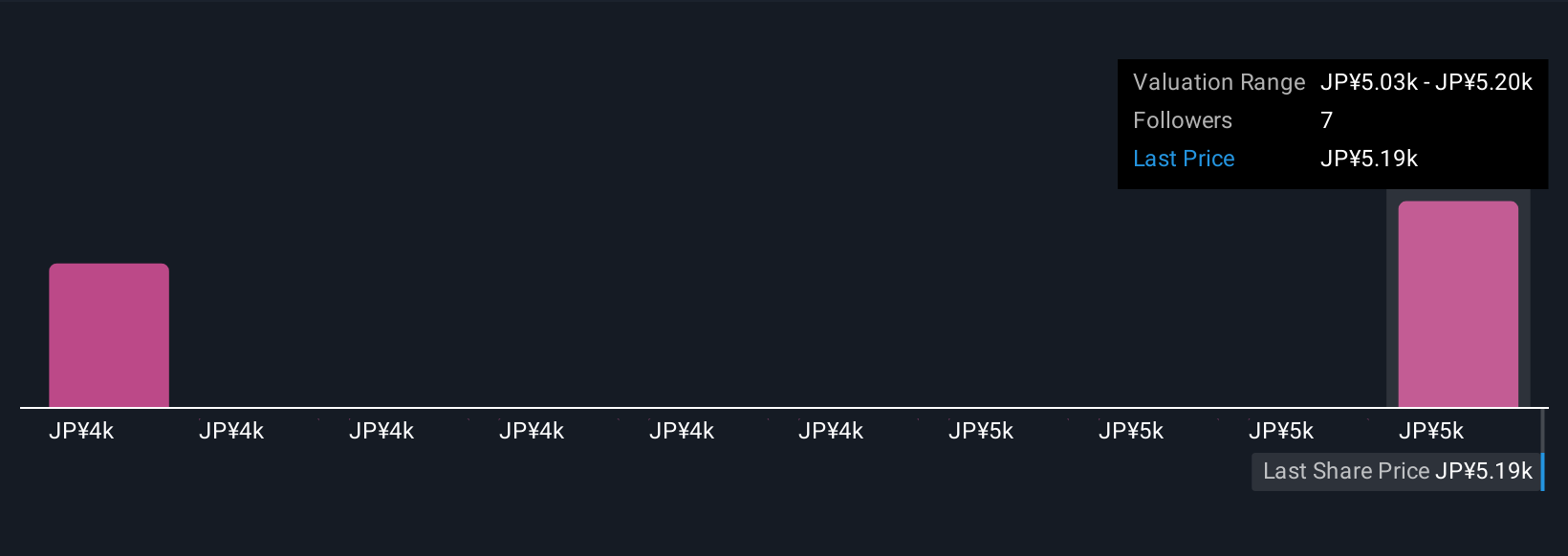

On Simply Wall St’s Community page, Narratives let you easily create and update your own view, or explore millions of other investors’ perspectives. This makes it simple to compare your estimated Fair Value of Fanuc to the current share price and decide whether to buy, hold, or sell based on a story that matches your beliefs about the company.

Narratives automatically adapt to new information, whether it is major news or the latest earnings results. For example, one investor’s Narrative for Fanuc may see a Fair Value as high as ¥4,100 based on aggressive growth, while another may set it at just ¥3,200 due to cautious forecasts.

Do you think there's more to the story for Fanuc? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6954

Fanuc

Engages in the development, manufacture, sale and maintenance services of products used in automated production systems in Japan, the United States, Europe, China, the rest of Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives