- Japan

- /

- Electrical

- /

- TSE:6925

Ushio (TSE:6925) Releases New Earnings Guidance: What Does It Mean for Valuation?

Reviewed by Simply Wall St

Ushio (TSE:6925) just released consolidated earnings guidance for the fiscal year ending March 2026, outlining expectations for net sales, operating profit, and profit attributable to owners. Investors often track these updates closely because they signal management’s outlook and strategic priorities.

See our latest analysis for Ushio.

After Ushio’s updated earnings guidance, the momentum around the stock has cooled a bit, with a 4.56% dip in the 7-day share price return and a slight pullback over the past month. Even so, the longer-term picture remains compelling. Ushio has delivered a 14.42% total shareholder return in the last year and a nearly doubled 98.1% return over five years, suggesting that optimism about future growth still outweighs recent volatility.

If you’re interested in finding other stocks with strong growth and solid insider commitment, now is a great time to discover fast growing stocks with high insider ownership

The question now is whether Ushio’s current share price reflects the company’s strong long-term growth or if there is still room for upside. Could this be a buying opportunity, or is future growth already priced in?

Price-to-Earnings of 40x: Is it justified?

Ushio is trading at a price-to-earnings (P/E) ratio of 40x, which signals that the market is willing to pay a steep premium based on recent profits. At the last close of ¥2,292.5, investors are paying far above both the industry average and Ushio's own historical benchmark.

The price-to-earnings ratio reflects what investors are paying today for a single yen of Ushio's trailing earnings. In capital goods sectors, a higher P/E can sometimes indicate optimism for accelerated growth or exceptional earnings power. However, the number must be justified by future performance.

Currently, the P/E stands at 40x, versus an industry average of 13.2x and a peer average of 16.9x. This is also well above the estimated fair P/E of 28.4x. This suggests that Ushio is not only more expensive than industry peers, but also priced well beyond what would be considered reasonable by regression-based fair value models. If market sentiment cools, the P/E could revert towards the fair level.

Explore the SWS fair ratio for Ushio

Result: Price-to-Earnings of 40x (OVERVALUED)

However, slower revenue growth or a reversion in earnings momentum could prompt a valuation reset and quickly shift market sentiment against Ushio.

Find out about the key risks to this Ushio narrative.

Another View: DCF Paints a Different Picture

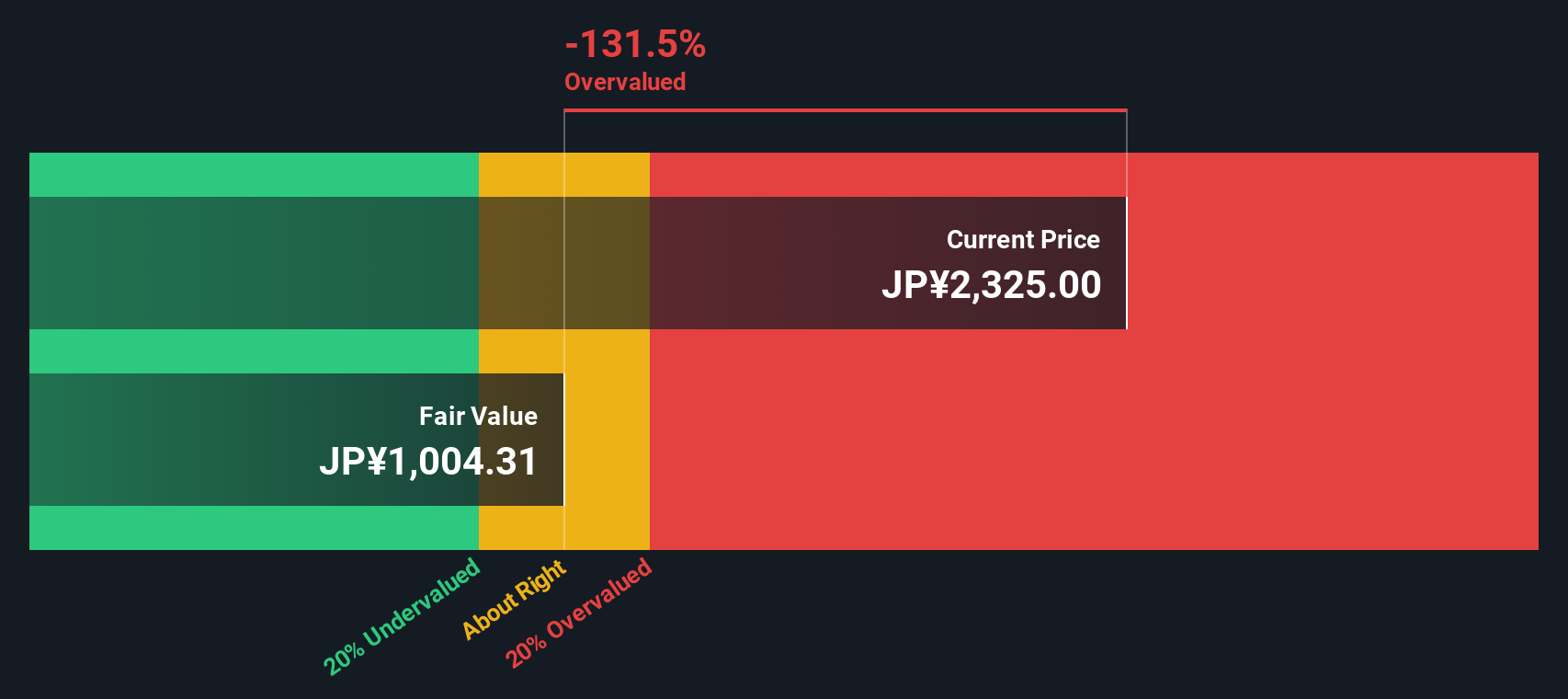

While Ushio’s earnings multiple points to overvaluation, our DCF model suggests an even starker valuation gap. Based on projected future cash flows, the SWS DCF model puts Ushio’s fair value at ¥995.43, which is well below the current price. Are investors betting on factors the model cannot see?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ushio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ushio Narrative

If you want to dig deeper or have your own view on Ushio’s valuation, you can examine the data and shape your own assessment in just a few minutes. Do it your way

A great starting point for your Ushio research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. The Simply Wall Street Screener makes it easy to uncover standout stocks and see what drives tomorrow’s market leaders.

- Catch income opportunities by checking out these 18 dividend stocks with yields > 3% offering yields above 3% and consistent payout histories.

- Tap into the future of medicine with these 31 healthcare AI stocks, where groundbreaking advancements in AI are transforming healthcare outcomes and business models.

- Spot deep value plays with these 900 undervalued stocks based on cash flows that the market may be overlooking, based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6925

Ushio

Engages in the production and sale of light application products, industrial equipment, and other products in Japan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives