- Japan

- /

- Electrical

- /

- TSE:6653

Seiko Electric (TSE:6653) Margin Gain Challenges Concerns Over Quality of Earnings

Reviewed by Simply Wall St

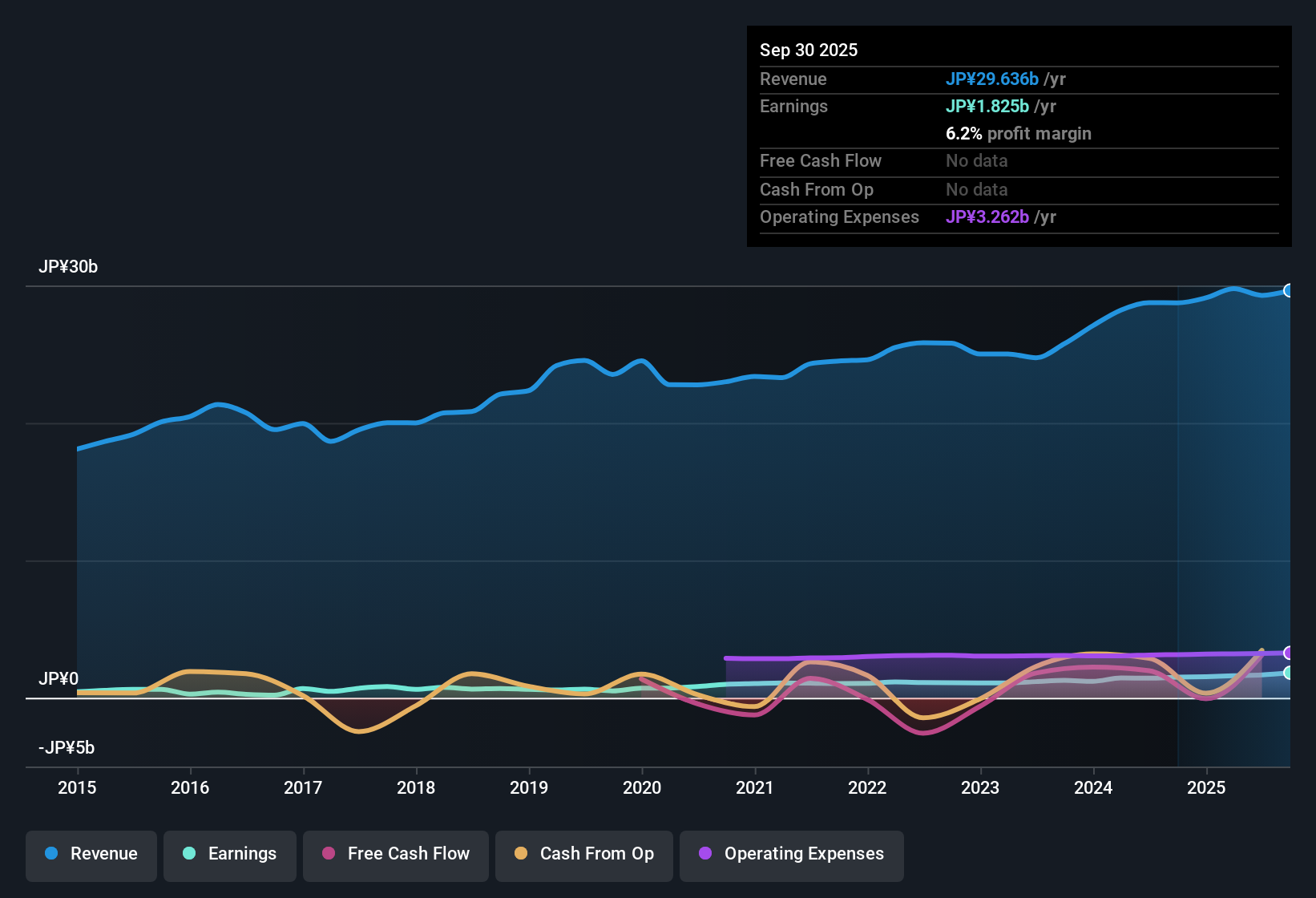

Seiko Electric (TSE:6653) posted an impressive set of results, with revenue projected to grow at 7.2% per year, outpacing the Japanese market average, and EPS expected to rise 8.1% annually. Profit margins expanded to 6.2% from last year’s 5.2%, and recent earnings growth reached 21.6%, well ahead of the company’s strong five-year average. With this combination of accelerating profitability and an active track record, investors are weighing the growth momentum and improved margins against current share price dynamics and some questions around quality of earnings.

See our full analysis for Seiko Electric.The next step is to see how these headline numbers compare with the widely discussed narratives investors and analysts are tracking, and where the numbers might surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Lift Above Last Year

- Profit margins expanded to 6.2% from 5.2% a year ago, showing the company is capturing more earnings from every yen of sales.

- Strong margin progression suggests Seiko Electric is increasingly efficient and challenges the idea that only sector leaders are able to maintain profitability momentum.

- Recent earnings growth of 21.6% not only tops the company’s own five-year trend but also comes alongside the margin gain, providing double support to the upside scenario.

- With net profit margin now outpacing last year and sector averages, there is clear operational progress backing up optimism about ongoing competitiveness.

One-Off Gain Clouds Comparability

- A ¥487 million one-off gain in the period distorts bottom-line growth, making it harder to judge underlying performance based solely on net income figures.

- Prevailing analysis notes that while growth rates look strong on headline numbers, investors are urged to focus on sustainable profit drivers rather than temporary windfalls.

- Critics highlight that adjusting for this non-recurring item is essential to understanding whether Seiko Electric’s impressive acceleration can continue after the gain drops out.

- This lens shifts attention back to core revenue and margin trends, emphasizing soundness over short-term earnings spikes.

Premium Valuation Despite Fair Value Discount

- Seiko Electric’s P/E of 15.3x stands above both the Japanese electrical industry average (13.4x) and peer average (14.7x). However, the stock trades at a notable discount to its DCF fair value of ¥3407.56 versus a current share price of ¥2071.

- Market commentary points out this tension. While a lower share price compared to DCF fair value bolsters the case for upside, the fact that the valuation is above peer and industry multiples gives some investors pause about overpaying for recent momentum.

- The mixed valuation picture means bulls can point to the discount to DCF fair value as an opportunity, while skeptics counter with the relatively high P/E ratio that suggests limited margin for error.

- Both camps will be watching to see if earnings quality and margins stay strong enough to justify the current premium versus peers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Seiko Electric's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Seiko Electric posts headline growth and margin improvements, the reliance on a one-off gain and a relatively high P/E highlight uncertainty regarding the sustainability of its earnings quality and valuation.

If you want more predictable value and lower valuation risk, check out these 867 undervalued stocks based on cash flows for companies trading well below what their fundamentals suggest they’re worth today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6653

Seiko Electric

Operates in the field of power system, and environmental energy and control system in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives