- Japan

- /

- Electrical

- /

- TSE:6594

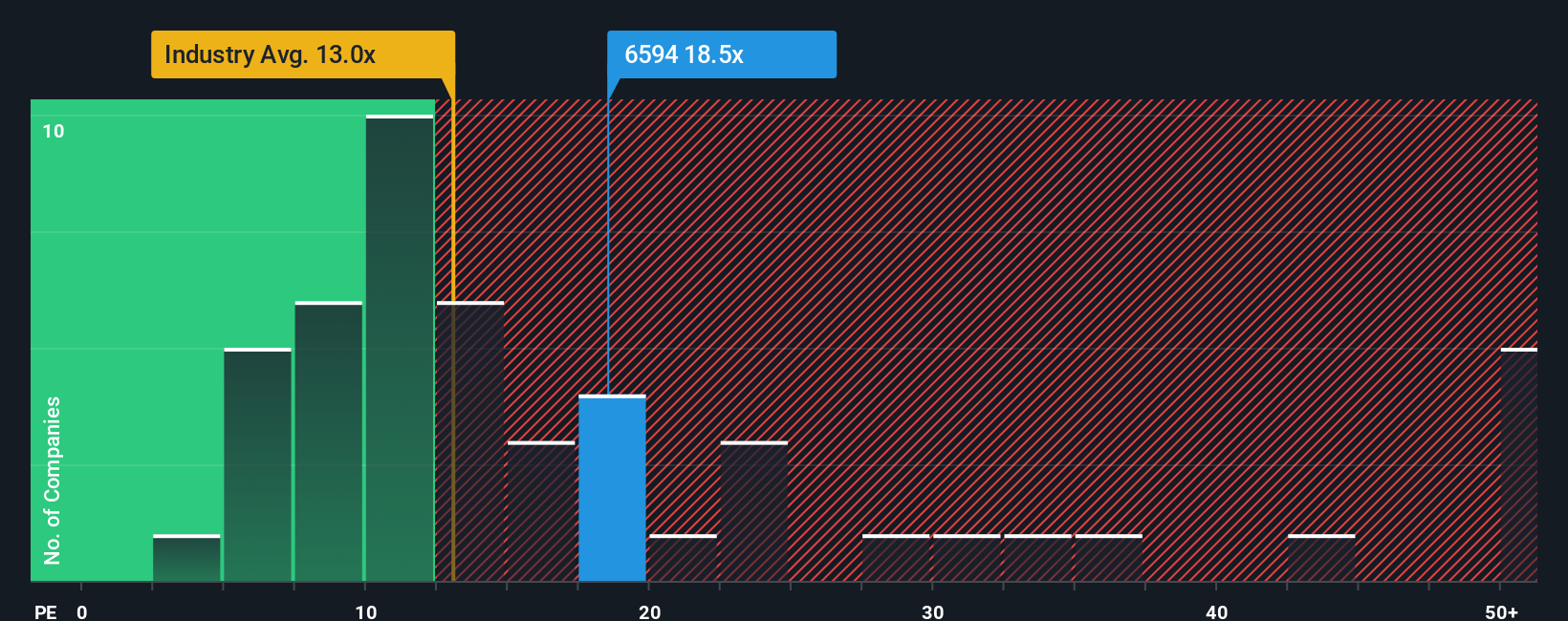

Nidec (TSE:6594) Valuation: Assessing Opportunity After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Nidec.

After a turbulent stretch, Nidec’s latest share price drop follows ongoing market worries regarding its recent earnings and forward guidance. Momentum has faded, with a 1-year total shareholder return of -37%, reflecting deeper challenges after a sustained multi-year decline.

If you're watching shifts among industrial leaders, this could be a great time to broaden your outlook and discover fast growing stocks with high insider ownership

With a sharp drop in recent months but analysts still seeing upside, the key question now is whether Nidec's current valuation reflects its challenges or if this is a window to buy into future growth.

Most Popular Narrative: 45% Undervalued

Nidec's most widely followed narrative assigns a significantly higher fair value compared to the recent closing price. This highlights a wide gap between current sentiment and the long-term outlook. The situation draws added attention to the factors driving analysts' views and the underlying business developments.

Nidec is positioned to capitalize on surging global demand for advanced motor solutions in data centers, particularly with its expanding water cooling module and nearline HDD motor businesses. The company highlighted strong order inquiry trends from major data center markets (U.S., China, Japan) and expects portfolio expansion and market penetration to further accelerate, supporting sustained revenue growth and margin expansion as the AI and cloud infrastructure cycle evolves.

Curious how this bold valuation comes together? The narrative is built on surprisingly robust growth expectations and ambitious improvements in profitability. Want to see which aggressive targets underpin that estimate? Dive in to uncover the details powering this price target and the logic behind analysts' optimism.

Result: Fair Value of ¥3,422 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory investigations and execution risks around restructuring could quickly undermine the bullish case if these issues are not managed effectively.

Find out about the key risks to this Nidec narrative.

Another View: Market-Based Multiples

Looking at Nidec through a market multiples lens gives a different impression. Its price-to-earnings ratio is 13.7x, which is nearly identical to the Japanese industry average of 13.3x but well below the peer average of 33.8x. The fair ratio, based on longer-term fundamentals, sits much higher at 29.5x. Does this suggest the market is undervaluing Nidec’s potential or simply discounting risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nidec Narrative

If you want to analyze the facts for yourself or shape a different story about Nidec’s outlook, you can easily create your own narrative in under three minutes. Do it your way

A great starting point for your Nidec research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for opportunity to knock. Take charge by exploring other standout stocks across unique themes using the Simply Wall Street Screener. Missing these could mean leaving potential returns on the table.

- Tap into tomorrow’s healthcare breakthroughs by checking out these 33 healthcare AI stocks, where medical innovation meets artificial intelligence to reshape patient care and diagnostics.

- Unlock income potential and stability with these 22 dividend stocks with yields > 3%, featuring companies boasting attractive yields and consistent dividend records above 3%.

- Be ahead of the curve in the digital currency boom with these 81 cryptocurrency and blockchain stocks, spotlighting firms at the forefront of blockchain and cryptocurrency disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nidec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6594

Nidec

Develops, manufactures, and sells motors, electronics and optical components, and other related products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives