- Japan

- /

- Electrical

- /

- TSE:6594

Nidec (TSE:6594) Expands Global Reach with Stellantis Partnership and Strong Earnings Growth

Reviewed by Simply Wall St

Nidec (TSE:6594) continues to demonstrate its financial strength with a projected 21% annual earnings growth, significantly outpacing the Japanese market average. Recent developments include strategic partnerships with Stellantis and Guangzhou Automobile Corporation Group, which are set to expand Nidec's presence in the automotive sector. However, the company faces challenges such as a low ROE of 5.7% and a 30.9% decline in operating profit before tax, highlighting areas for improvement. The following report will explore Nidec's competitive advantages, internal limitations, growth strategies, and key risks impacting its future success.

Get an in-depth perspective on Nidec's performance by reading our analysis here.

Competitive Advantages That Elevate Nidec

Nidec has demonstrated strong financial health, with its earnings forecast to grow by 21% annually, significantly outpacing the Japanese market's growth rate of 7.9%. This impressive growth trajectory is supported by a 32% increase in earnings over the past year, surpassing the industry average of 11.6%. The company has also improved its net profit margin to 3.8% from 3.2% last year, showcasing high-quality past earnings. Dividends have been consistently reliable and increasing over the past decade, supported by a low payout ratio of 36.3%, indicating strong coverage by earnings and cash flows. Strategic partnerships, such as the joint ventures with Stellantis in Europe and Guangzhou Automobile Corporation Group, further bolster Nidec's competitive position by expanding its automotive business and leveraging global opportunities.

Internal Limitations Hindering Nidec's Growth

Nidec faces certain internal challenges. The company's Return on Equity (ROE) stands at 5.7%, which is considered low compared to the industry threshold of 20%. Additionally, revenue growth is forecasted at 5.5% per year, falling short of the significant growth benchmark of 20%. The decline in operating profit before income tax by 30.9% to ¥100.2 billion highlights potential challenges in cost management or pricing pressures. Currency exchange impacts have also adversely affected profitability, as noted by CFO Akinobu Samura, reflecting vulnerabilities in international operations. Struggles in specific segments, such as the machinery sector, indicate ongoing challenges despite signs of recovery.

Potential Strategies for Leveraging Growth and Competitive Advantage

Nidec's opportunities for growth are substantial, particularly in the rapidly expanding water cooling module business, which is seeing increased demand, especially in data centers. The company is also undergoing organizational changes aimed at creating synergies, such as the integration of Nidec Mobility and Nidec Elesys, which are expected to enhance operational efficiency and capabilities. Geographic expansion, including the completion of a second factory in India and Europe, positions Nidec to tap into new markets and customer bases. These initiatives could significantly enhance Nidec's market position and capitalize on emerging opportunities.

Key Risks and Challenges That Could Impact Nidec's Success

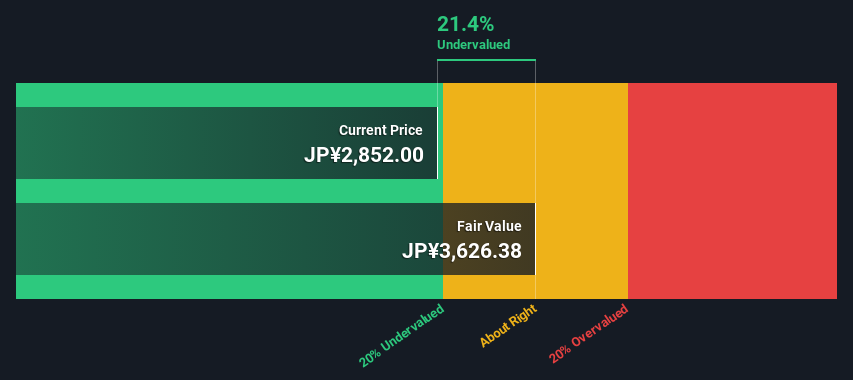

Looking ahead, Nidec faces several external risks. Economic and market uncertainties, as acknowledged by CEO Mitsuya Kishida, could pose significant challenges to growth and profitability. The company also encounters operational difficulties in Europe and the U.S., which may require strategic adjustments to maintain performance. Furthermore, the rapidly evolving electric vehicle (EV) market presents competitive pressures, necessitating continuous innovation and partnerships. The high Price-To-Earnings Ratio of 33.2x, compared to the peer average of 20.6x and the industry average of 11.7x, may deter some investors despite the company's undervaluation relative to its estimated fair value.

Conclusion

Nidec's impressive earnings growth forecast of 21% annually, supported by a 32% increase in past earnings, positions it well above the Japanese market's growth rate, highlighting its strong financial performance. However, internal challenges such as a low Return on Equity of 5.7% and a modest revenue growth forecast of 5.5% present hurdles that need addressing to sustain this trajectory. Strategic initiatives, including expansion into new markets and integration of operations, offer substantial growth opportunities, especially in high-demand sectors like data centers. Yet, external risks such as economic uncertainties and competitive pressures in the EV market could impact future performance. The company's high Price-To-Earnings Ratio of 33.2x compared to peers may deter some investors, emphasizing the need for strategic adjustments to maintain investor confidence and capitalize on its growth potential. Despite the lack of a specific valuation summary, Nidec's strategic partnerships and operational enhancements are pivotal in navigating these challenges and leveraging its competitive advantage for future success.

Summing It All Up

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Nidec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:6594

Nidec

Develops, manufactures, and sells motors, electronics and optical components, and other related products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.