Kanadevia (TSE:7004) Rebranding and Environmental Focus Drive Market Position Despite Profit Challenges

Reviewed by Simply Wall St

Kanadevia (TSE:7004) has recently made significant strides with its rebranding initiative, which has not only enhanced its market presence but also improved internal processes and employee engagement. The company has seen a substantial boost in its environmental segment, with a JPY 5 billion increase reflecting effective cost management. However, challenges remain, such as a drop in net profit margin and earnings, largely due to setbacks in offshore wind power investments. The report will cover Kanadevia's strategic strengths, financial vulnerabilities, emerging market opportunities, and external threats affecting its position.

Unlock comprehensive insights into our analysis of Kanadevia stock here.

Unique Capabilities Enhancing Kanadevia's Market Position

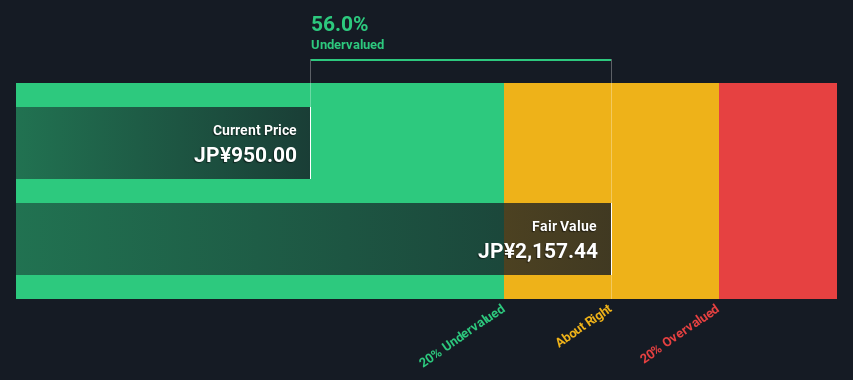

Kanadevia's rebranding initiative has been a pivotal move in enhancing its market presence and aligning its corporate culture with strategic objectives. This shift is not merely cosmetic but aims to invigorate employee engagement and streamline internal processes. The environmental segment has also seen a marked improvement, with a JPY 5 billion boost, reflecting effective cost management and operational efficiency. Moreover, the upward revision in order intake from JPY 620 billion to JPY 680 billion underscores strong market demand and effective sales strategies. These elements, combined with a stable dividend history and a low payout ratio of 22.1%, suggest a solid financial foundation. Furthermore, the company is trading significantly below its estimated fair value, indicating potential undervaluation compared to peers.

Vulnerabilities Impacting Kanadevia

Kanadevia faces several challenges. The net profit margin has decreased to 2.9% from the previous year's 3.7%, and earnings have declined by 8.5%. Such financial setbacks highlight vulnerabilities in investment strategies, particularly in offshore wind power, leading to a JPY 2.5 billion loss in nonoperating income. Additionally, the Machinery & Infrastructure segment has experienced a JPY 2 billion deterioration, pointing to operational inefficiencies that need addressing. These issues are compounded by increased inspection costs in the engine business, which could further strain profitability.

Emerging Markets Or Trends for Kanadevia

Opportunities abound for Kanadevia, especially in the environmental segment, where forecasts have been increased by JPY 70 billion, driven by strong project pipelines and favorable exchange rates. The growth in the O&M business, now comprising 29% of the total market, reflects a successful pivot towards service-based revenue streams, offering stable and recurring income. Achieving midterm management targets ahead of schedule further demonstrates the company's strong execution capabilities, positioning it well for future growth.

Market Volatility Affecting Kanadevia's Position

However, Kanadevia must navigate several external threats. Ongoing investigations into inappropriate conduct pose significant compliance risks, potentially leading to regulatory scrutiny and impacting the company's reputation. Economic uncertainties and competitive pressures could also undermine the anticipated benefits of the rebranding efforts, affecting market positioning and customer perception. Furthermore, project cost overruns, particularly in offshore wind power, highlight the need for improved project management and cost control measures to mitigate financial losses.

Conclusion

Kanadevia's strategic rebranding and focus on the environmental segment have strengthened its market position, evidenced by increased order intake and improved cost management. However, challenges such as declining profit margins and setbacks in offshore wind investments highlight areas needing strategic attention. The company's pivot towards service-based revenue streams and early achievement of management targets indicate strong growth potential. With its current market price significantly below its estimated fair value, Kanadevia presents an attractive investment opportunity, suggesting that its current market challenges may be temporary and that the company is well-positioned for future success.

Make It Happen

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Kanadevia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:7004

Kanadevia

Kanadevia Corporation design, constructs, and manufactures energy-from-waste plants, desalination plants, and water and sewage treatment plants in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.