A Fresh Look at Makita (TSE:6586) Valuation After Upgraded Earnings Outlook

Reviewed by Simply Wall St

Makita (TSE:6586) raised its earnings outlook for the fiscal year ending March 2026. The company is now guiding for higher revenue, operating profit, and profit attributable to shareholders than previously expected. This signals a more optimistic business environment for the company.

See our latest analysis for Makita.

Despite Makita raising its earnings outlook and maintaining its dividend guidance, the market response has been subdued. The company’s share price has dipped 6.5% over the past month and is down 5.3% year-to-date. The one-year total shareholder return stands at -0.8%. Momentum over the past three years remains solid, with a 51.5% total return, which suggests that investors still see longer-term potential even as recent sentiment cools off.

If you’re keeping an eye on how industry leaders are faring, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Makita trading 24 percent below analyst price targets after its guidance upgrade, investors may wonder whether the market is overlooking an opportunity or if the current share price already reflects expectations for future growth.

Price-to-Earnings of 14.7x: Is it justified?

Makita shares are currently trading at a price-to-earnings ratio of 14.7x, which is lower than the peer average of 19.9x. This suggests that, compared to similar companies, the market is applying a discount to Makita’s profits at its last close of ¥4,450.

The price-to-earnings (P/E) multiple reflects how much investors are willing to pay for each unit of a company’s earnings. In the case of Makita, a lower P/E compared to sector peers can signal that the market perceives earnings growth to be slower or risks to be higher. It can also present an opportunity if the company outperforms these muted expectations.

Currently, Makita’s P/E ratio is not only attractive compared to peers but also sits well below the estimated fair P/E level of 18.8x. This leaves room for potential re-rating if the company continues to deliver stronger earnings or sentiment improves. A revaluation toward the fair ratio could lead to a higher share price if the market acknowledges Makita's improved growth or quality of earnings.

Explore the SWS fair ratio for Makita

Result: Price-to-Earnings of 14.7x (UNDERVALUED)

However, slower revenue and net income growth rates, or persistent negative share price momentum, could temper the argument for Makita being undervalued.

Find out about the key risks to this Makita narrative.

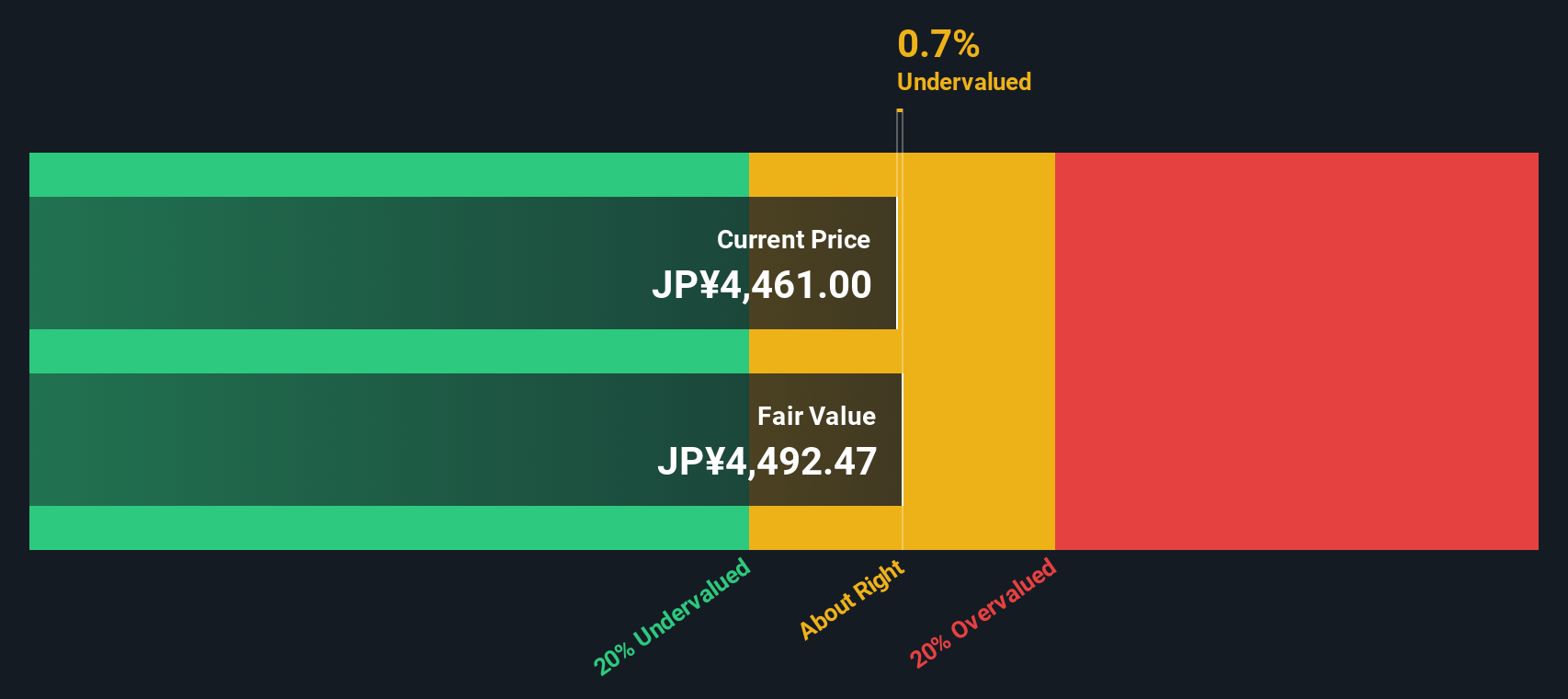

Another View: DCF Signals Limited Discount

Looking through another lens, our DCF model values Makita shares just 0.9% above their current price. This means Makita is only trading slightly below its fair value. The potential upside may be limited unless there is a shift in either future earnings forecasts or market sentiment. Does this minimal gap reflect the full picture, or is the market waiting for more convincing catalysts before closing the valuation gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Makita for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Makita Narrative

Keep in mind that you can always dig into the numbers yourself and shape your own interpretation in just a few minutes. Do it your way

A great starting point for your Makita research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve and spot opportunity before the crowd. Simply Wall Street's powerful Screener opens the door to some of the market's most compelling themes.

- Target your portfolio for future growth and uncover strong performers by checking out these 874 undervalued stocks based on cash flows based on robust cash flow analysis.

- Strengthen your income strategy immediately by tapping into these 15 dividend stocks with yields > 3% offering above-average yields for reliable returns.

- Get a front-row seat to innovation and disruption by searching through these 27 AI penny stocks that are redefining industries with leading-edge technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6586

Makita

Engages in the manufacture and sale of electric power tools, pneumatic tools, and gardening and household equipment in Japan, Europe, North America, Asia, Central and South America, Oceania, The Middle East, and Africa.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives