- Japan

- /

- Electrical

- /

- TSE:6504

Fuji Electric (TSE:6504) Valuation After Launching Advanced FRENIC-MEGA (G2) Drive

Reviewed by Kshitija Bhandaru

Fuji Electric (TSE:6504) just made waves by unveiling the FRENIC-MEGA (G2) AC drive, an upgrade that rolls several drive technologies into a single smart solution. This isn’t just a product refresh; it could reshape how clients manage industrial operations, HVAC systems, and pumping applications. For investors, the launch signals a strategic focus on streamlining customer needs and enhancing performance, potentially giving Fuji Electric a new competitive edge.

The news comes during an already dynamic year for Fuji Electric’s stock. Over the past month and past three months, shares have climbed nearly 5% and a strong 49% respectively. The broader trend appears solid as well, with steady year-to-date and one-year gains on top of impressive long-term growth. While headlines from the company have been relatively steady, this launch could be seen as a material move to reinforce its position in vital industrial markets.

Given the momentum and the innovation on display, is the stock still trading at an attractive entry point, or has the market already factored in all that potential future growth?

Most Popular Narrative: 1.4% Undervalued

The most widely followed narrative on Fuji Electric suggests shares are trading slightly below fair value, with a 1.4% discount based on the latest consensus forecast and risk assumptions.

“Strong demand in energy management, semiconductors, and infrastructure upgrades positions Fuji Electric for sustained growth and improved profitability across key segments. Increased project bookings and capacity investments enhance future revenue visibility and earnings power, supported by long-term electrification and renewable energy trends.”

Curious why analysts believe so much upside remains? This narrative is built around a powerful recipe of future revenue growth and margin expansion, combined with bold estimates for how these drivers will reshape the company’s earnings outlook. Wonder what surprising assumptions and market comparisons justify the current price target? See the full narrative to find out the crucial numbers and forecasts guiding analyst expectations.

Result: Fair Value of ¥10,018 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, overseas sales weakness and rising input costs could challenge Fuji Electric’s growth story if global demand cools or if margin pressures intensify.

Find out about the key risks to this Fuji Electric narrative.Another View: Comparing Peer Prices

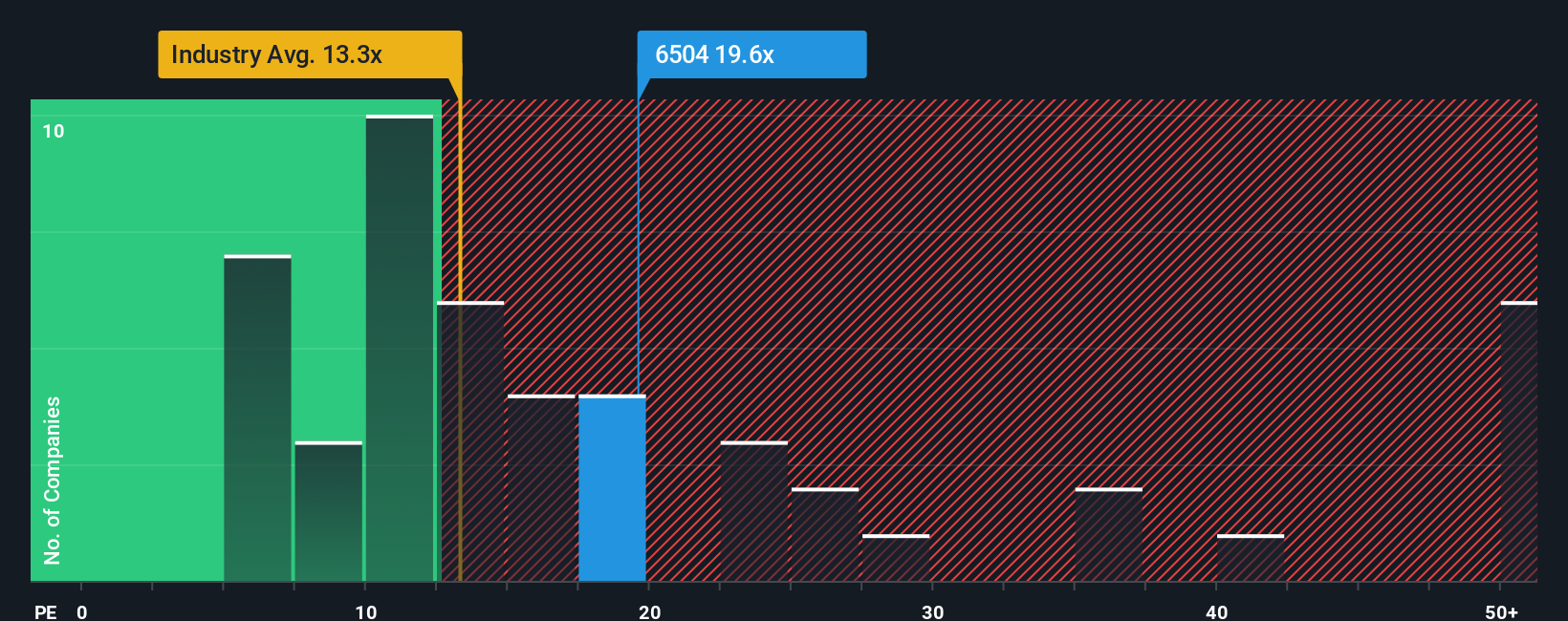

While the consensus points to fair or mildly undervalued territory, a look at how Fuji Electric is priced next to other Japanese electrical firms introduces a challenge. By this measure, the stock actually looks a bit expensive. Could this be a warning that the optimism is already baked in, or does the growth outlook justify paying a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fuji Electric Narrative

If you want to dig deeper or see things differently, exploring the underlying financials and charting your own view is quick and straightforward. Do it your way.

A great starting point for your Fuji Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take control of your portfolio’s future with these handpicked stock strategies, which could spotlight impressive opportunities you might otherwise miss. Don’t let them pass you by.

- Supercharge your returns by targeting companies with strong cash flows using our selection of undervalued stocks based on cash flows.

- Spot the next big thing in quantum breakthroughs and advanced computing with our finder for quantum computing stocks.

- Maximize passive income potential by tracking businesses with higher-than-average yields and solid payout histories in our list of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6504

Fuji Electric

Develops power semiconductors and electronics solutions in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives