- Japan

- /

- Electrical

- /

- TSE:6504

Fuji Electric (TSE:6504) Is Up After Dividend Hike and Earnings Upgrade Is Management’s Optimism Justified?

Reviewed by Sasha Jovanovic

- On October 30, 2025, Fuji Electric Co., Ltd. announced an increase to its interim dividend to ¥91.00 per share and revised its consolidated earnings guidance upward for the fiscal year ending March 31, 2026.

- This dual move signals that management is increasingly confident in the company’s financial outlook and its ability to deliver enhanced returns to shareholders.

- Given the upward revision of earnings guidance, we will examine how this development impacts Fuji Electric's investment narrative and future expectations.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Fuji Electric Investment Narrative Recap

To be a shareholder in Fuji Electric, you need to believe in the company’s ability to capitalize on global electrification and infrastructure upgrades, while managing its reliance on the domestic Japanese market. The latest increases to interim dividend and earnings guidance are positive signals, but don’t fully resolve short-term questions about margin recovery and overseas revenue growth, which remain key catalysts and risks respectively.

The company’s upward revision to its consolidated earnings guidance, raising full-year sales and profit targets, stands out as the most relevant recent announcement. While this upgrade reflects management’s view of the company’s near-term performance, whether this translates into sustainable long-term benefits will depend on progress in expanding international sales and restoring margins.

However, investors should also be mindful that despite strong domestic figures and higher dividends, Fuji Electric’s growing fixed costs and its exposure to local economic trends mean...

Read the full narrative on Fuji Electric (it's free!)

Fuji Electric's outlook anticipates ¥1,278.5 billion in revenue and ¥105.6 billion in earnings by 2028. This scenario implies a 4.1% annual revenue growth and an increase of ¥13.9 billion in earnings from the current ¥91.7 billion.

Uncover how Fuji Electric's forecasts yield a ¥10245 fair value, a 5% downside to its current price.

Exploring Other Perspectives

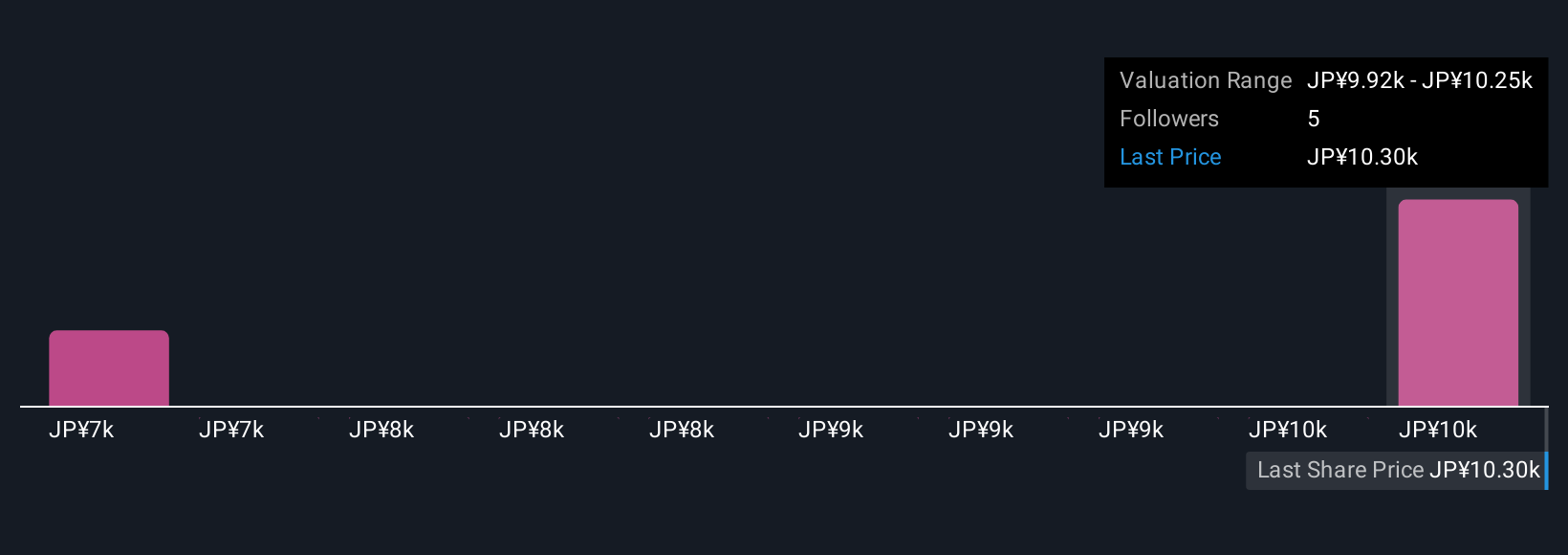

Three members of the Simply Wall St Community estimate Fuji Electric’s fair value between ¥7,000 and ¥10,245. Some focus on the company’s dependence on the Japanese market, raising important considerations for future growth and resilience.

Explore 3 other fair value estimates on Fuji Electric - why the stock might be worth 35% less than the current price!

Build Your Own Fuji Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fuji Electric research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Fuji Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fuji Electric's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6504

Fuji Electric

Develops power semiconductors and electronics solutions in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives