- Japan

- /

- Electrical

- /

- TSE:6503

Mitsubishi Electric (TSE:6503) Is Up 7.8% After Upward Guidance, Buyback and Dividend Hike—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In the past week, Mitsubishi Electric completed a major share buyback and declared a higher interim dividend of ¥25 per share, while also revising its full-year revenue guidance upward by ¥270 billion to ¥5.67 trillion, primarily due to favorable foreign exchange rates and increased sales in its Infrastructure segment.

- An additional development saw Mitsubishi Electric, in collaboration with academic institutions, advance efforts to set new global standards for measuring workplace thermal comfort, highlighting the company's commitment to innovation in building solutions.

- Next, we'll examine how these positive changes in guidance and capital returns may influence Mitsubishi Electric's investment narrative and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Mitsubishi Electric Investment Narrative Recap

For shareholders of Mitsubishi Electric, confidence rests on the company's ability to leverage long-term growth in automation and infrastructure, while steering through shifting global market forces. Recent increases in interim dividends and the upward revision in revenue guidance highlight short-term support from foreign exchange trends and robust Infrastructure sales; however, persistent pressures such as rising US tariffs and industry competition mean these catalysts offer only partial relief from structural risks.

Among various announcements, the completed share buyback stands out as most relevant, directly affecting shareholder returns and signaling the company's focus on capital efficiency. While the buyback may buoy investor confidence, it does not address underlying issues such as slowing growth in mature segments or the challenge of adapting to digital transformation, both of which will continue to influence Mitsubishi Electric's outlook.

Yet, in contrast to these positive headlines, investors should be aware that unresolved exposure to US-China tariffs could...

Read the full narrative on Mitsubishi Electric (it's free!)

Mitsubishi Electric's outlook forecasts revenue of ¥6,044.2 billion and earnings of ¥423.4 billion by 2028. This projection assumes annual revenue growth of 2.9% and an earnings increase of ¥57.5 billion from the current earnings of ¥365.9 billion.

Uncover how Mitsubishi Electric's forecasts yield a ¥3668 fair value, a 15% downside to its current price.

Exploring Other Perspectives

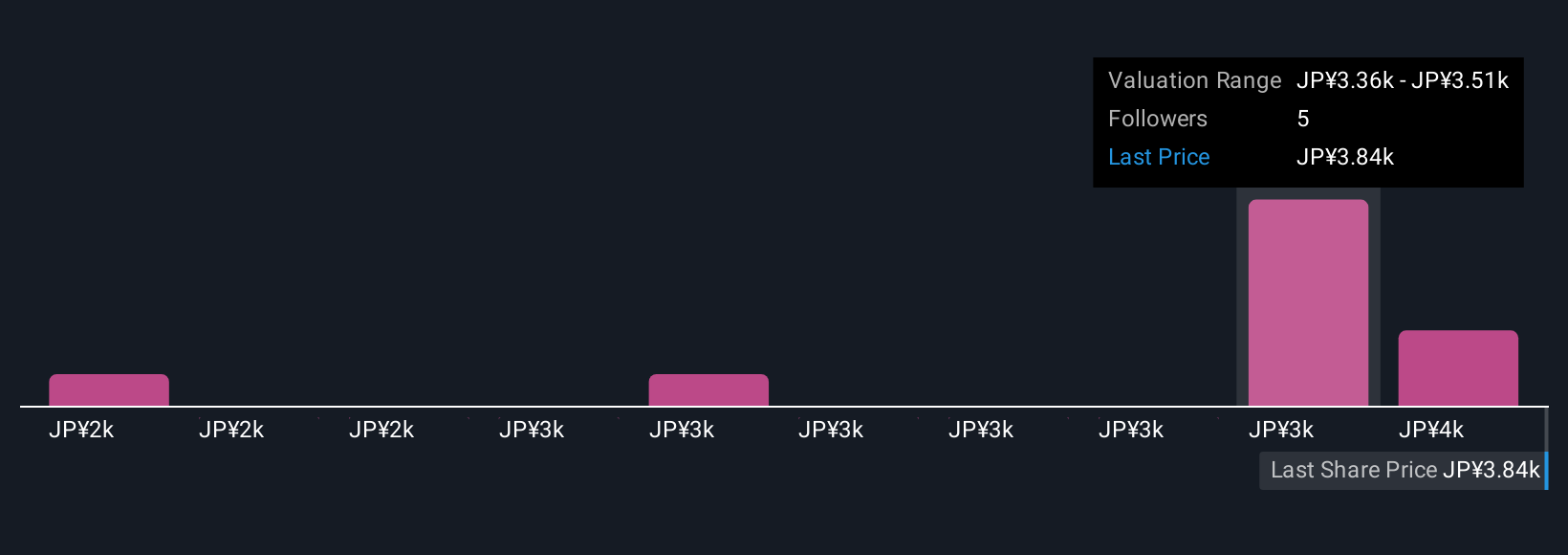

Simply Wall St Community members offered four fair value views for Mitsubishi Electric, ranging from ¥2,114 to ¥3,668 per share. This diversity of opinion comes as the company’s recent dividend and buyback moves reinforce capital returns but do not fully offset ongoing margin pressures from global competition, prompting you to consider several perspectives on the company’s future performance.

Explore 4 other fair value estimates on Mitsubishi Electric - why the stock might be worth as much as ¥3668!

Build Your Own Mitsubishi Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Electric research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mitsubishi Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Electric's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives