- Japan

- /

- Electrical

- /

- TSE:6503

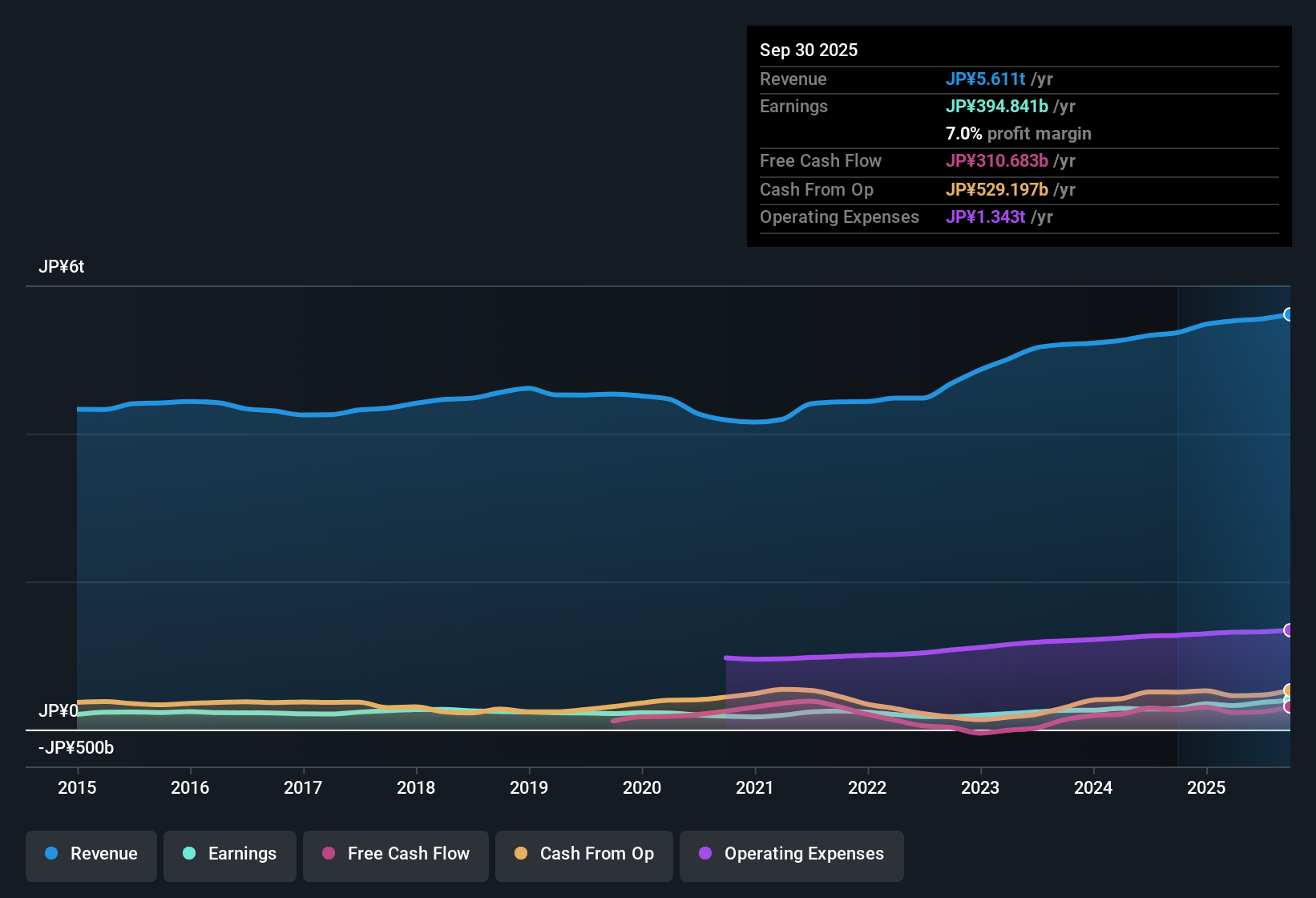

Mitsubishi Electric (TSE:6503) EPS Jumps 39%—Profit Surge Challenges Cautious Valuation Narratives

Reviewed by Simply Wall St

Mitsubishi Electric (TSE:6503) posted standout annual earnings, with EPS up 39.3% over the last year, outpacing its five-year average growth of 14.4%. Margins improved as net profit margin advanced to 7% from 5.3% the previous year. With a forecasted earnings growth of 5.64% and revenue expected to climb by 3.4% each year, investors see a mix of high-quality recent performance and steadier growth ahead. The share price is trading above discounted cash flow estimates.

See our full analysis for Mitsubishi Electric.Now, let’s see how these strong headline results stack up against the prevailing narratives driving sentiment around Mitsubishi Electric. Some expectations may be confirmed, while others could be up for debate.

See what the community is saying about Mitsubishi Electric

Analyst Price Target Now Near Market Price

- Mitsubishi Electric’s current share price of ¥4,317 is just 14.6% above the analyst consensus target of ¥3,766.27, highlighting how closely the company’s valuation is tracking expert forecasts despite a year of standout profit growth.

- Analysts' consensus view flags the limited disconnect between valuation and forecasted fundamentals:

- The difference of only ¥550.73 between market price and consensus target signals analysts see the stock as fairly priced, especially as predicted annual revenue and earnings growth (3.4% and 5.64% respectively) lag behind the broader Japanese market.

- The share price’s premium over DCF fair value (¥4,317 vs. ¥3,389.06) further underscores the point that investors may be paying up for quality and recent margin expansion but could face slower upside if growth expectations moderate.

Curious how the market's consensus narrative stacks up? See the most recent perspectives here. 📊 Read the full Mitsubishi Electric Consensus Narrative.

Price-to-Earnings Multiple Sits Between Peers

- The company trades at a PE ratio of 22.4x, which is higher than the Japanese electrical industry average of 13.4x but below the immediate peer average of 28.4x. This demonstrates a market premium that is not as aggressive as top competitors.

- Analysts' consensus view suggests this premium is justified by consistent profit and revenue momentum:

- Solid profit margins at 7%, up from 5.3% last year, reinforce the case for above-average valuation, particularly with margin improvement supported by record revenues in automation and electrification segments.

- However, as the forecasted PE ratio of 20.1x for 2028 would still be meaningfully above the global industry median, long-term outperformance will depend on the company's ability to maintain or accelerate these high levels of efficiency.

Margin Expansion Buoys Recurring Revenues

- Net profit margin stands at 7%, advancing from 5.3% the prior year, while analysts expect margins to incrementally rise to 7.0% over the next three years, signaling slow but steady efficiency gains.

- Analysts' consensus view emphasizes that margin improvements are not solely from cost control:

- Growth in high-margin, recurring revenue streams, such as service contracts and public utility deals, is expected to stabilize future earnings as traditional equipment cycles slow.

- Still, increasing competition from lower-cost Asian manufacturers and risks from shifting industry demand toward digital solutions could pressure future margins if the company fails to adapt quickly.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mitsubishi Electric on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your insights and craft your perspective in just a few minutes by Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mitsubishi Electric.

See What Else Is Out There

Despite record profit growth, Mitsubishi Electric's share price looks stretched relative to underlying earnings and revenue forecasts. This suggests limited near-term upside.

If you seek opportunities with more attractive current valuations, search for better-priced ideas among these 831 undervalued stocks based on cash flows where market pessimism could create real bargains right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives