- Japan

- /

- Electrical

- /

- TSE:6503

Is Mitsubishi Electric (TSE:6503) Fairly Priced? A Fresh Look at Its Recent Valuation Surge

Reviewed by Simply Wall St

Most Popular Narrative: 8.9% Overvalued

According to the most widely followed narrative, Mitsubishi Electric is currently seen as overvalued by nearly 9% compared to its calculated fair value, based on analyst projections and future earnings assumptions.

Expansion in the Energy Systems and Public Utility segments is driven by ongoing investments in power distribution and the transition toward electrification and energy efficiency. These efforts are supported by worldwide decarbonization initiatives. This should result in higher recurring revenues and improved net margins as Mitsubishi Electric benefits from secular shifts to sustainable infrastructure.

Curious what makes Mitsubishi Electric's future so intriguing to analysts? The narrative relies on a transformative shift in industrial demand and a series of ambitious forecasts that go beyond historical growth. Think you know what’s really driving their elevated price tag? Take a closer look at the balance of growth, margins, and market expectations embedded in the fair value calculation—it may surprise you.

Result: Fair Value of ¥3,393 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.However, industry shifts toward advanced digital offerings and fierce competition from lower-cost manufacturers may challenge Mitsubishi Electric’s growth and margin expectations in the coming years.

Find out about the key risks to this Mitsubishi Electric narrative.Another View: Discounted Cash Flow

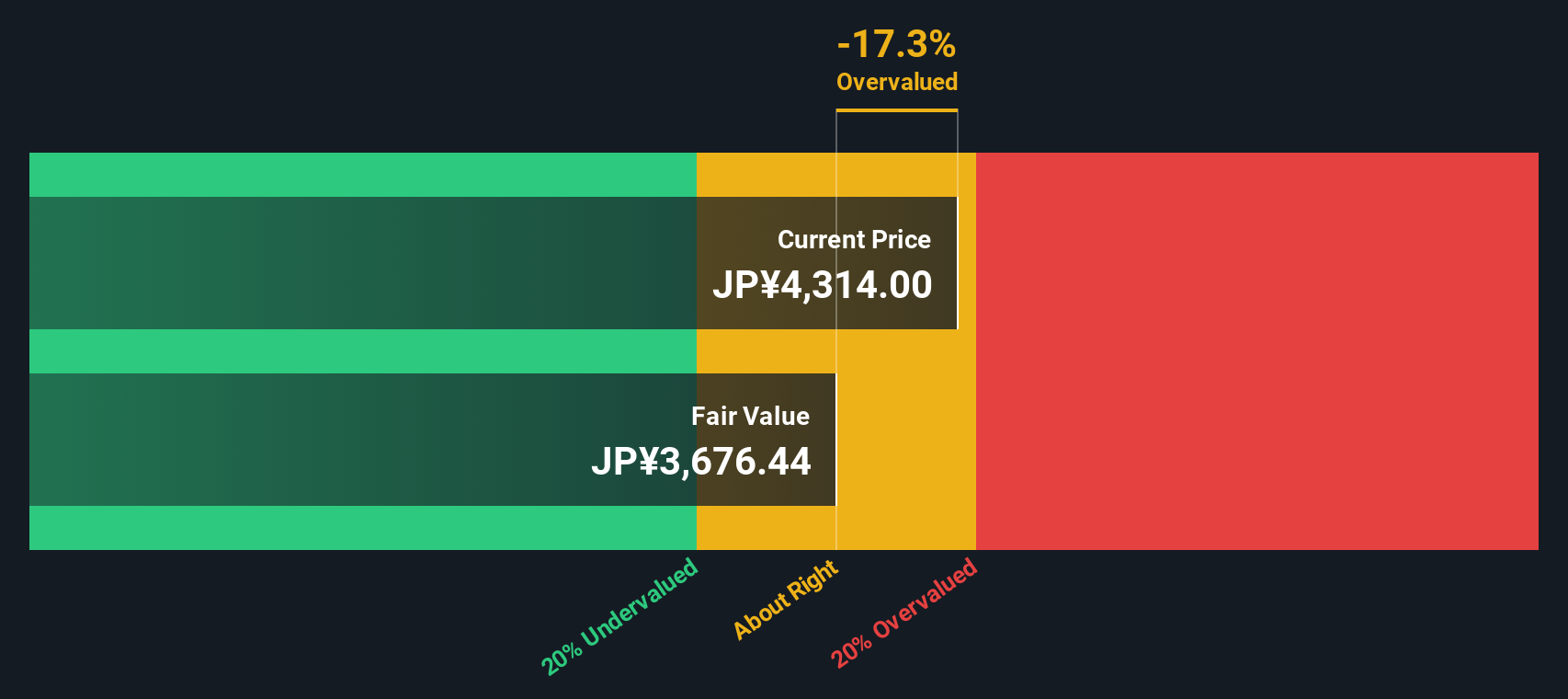

Looking from another angle, our DCF model provides a fundamentally different approach to estimating Mitsubishi Electric’s value. At present, it suggests the stock may be slightly overvalued. Does this finding reinforce or challenge the analyst consensus?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mitsubishi Electric Narrative

If you see things differently or want to investigate your own ideas, you can create your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mitsubishi Electric.

Looking for More Smart Investment Opportunities?

Don’t let your next winning idea pass you by. Tap into distinct investment themes and spot hidden gems with Simply Wall Street’s powerful screeners designed for the savvy investor.

- Tap into strong income potential and secure steady returns by picking from yield-focused picks in our selection of dividend stocks with yields > 3%.

- Spot dynamic opportunities as artificial intelligence reshapes entire industries by using our gateway to AI penny stocks.

- Break ahead of the market by finding companies trading below intrinsic value with our specialist tool for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives