KVK (TSE:6484) Profit Margin Expansion Reinforces Bullish Views on Earnings Quality

Reviewed by Simply Wall St

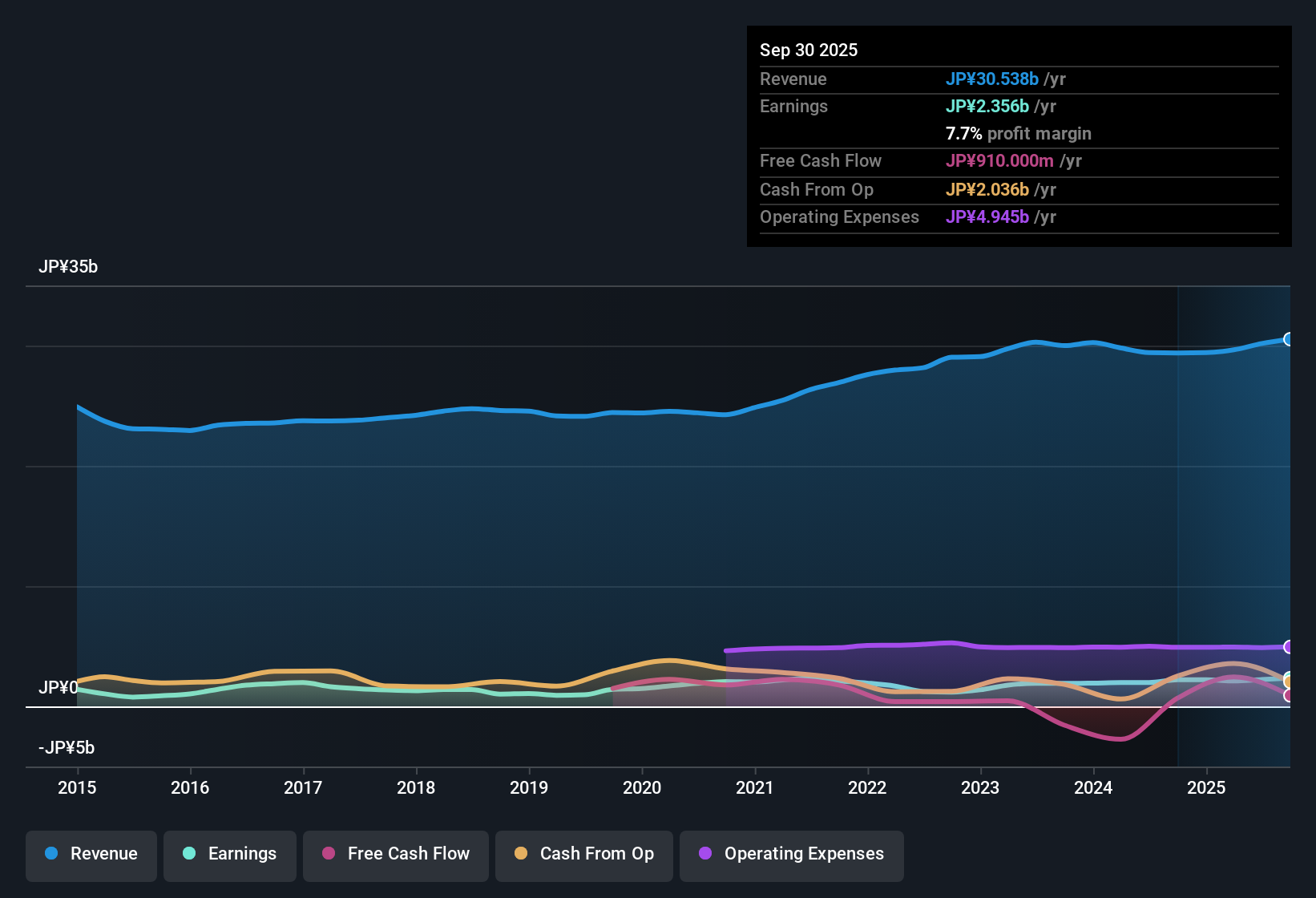

KVK (TSE:6484) posted net profit margins of 7.4%, up from 6.7% last year, reflecting improved operational efficiency. EPS growth reached 12.9% for the most recent period, surpassing its 1.6% annual average over the past five years and highlighting robust momentum. With shares trading at ¥2,305, well below an estimated fair value of ¥3,523.5 and at a price-to-earnings ratio of 8.2x compared to a peer average of 11.5x, investors are likely to view the combination of stronger margins and attractive valuation as a significant driver for sentiment.

See our full analysis for KVK.Next, we will see how these headline figures compare to popular market narratives and community viewpoints.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpacing Sector Trends

- KVK’s net profit margin improved to 7.4% from last year’s 6.7%, reinforcing a signal of stronger operational efficiency amid a competitive sector.

- Contrary to the view that profitability might stagnate as industry challenges persist,

- The notable lift in margins stands out compared to peers in the Japanese building industry and adds weight to the idea that management’s discipline is starting to pay off.

- This is especially relevant as similar sector companies have seen less pronounced shifts in margin performance.

Share Price Still Lags DCF Fair Value

- The current share price of ¥2,305 remains significantly below the DCF fair value estimate of ¥3,523.50, marking a discount of nearly 35% despite the company’s growth and profitability improvements.

- Some analysts highlight that this wide gap between market price and intrinsic value, if sustained, supports the case for re-rating.

- The company also trades at a price-to-earnings ratio (8.2x) lower than both the peer group (11.5x) and the broader industry (15.3x).

- This suggests that persistent undervaluation could become a catalyst if operational execution remains consistent.

Dividend Sustainability Draws Scrutiny

- While profitability and value fundamentals are trending positively, commentary from risk disclosures emphasizes that investors should monitor dividend sustainability closely as it remains an area of potential concern for those prioritizing income.

- Some analysts note that, although consistent margin improvements support ongoing dividends,

- Factors affecting future payouts may warrant careful attention, as the current sustainability is not ensured by recent growth momentum alone.

- It is important for income-focused holders to watch for any changes that could impact long-term yield stability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on KVK's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite recent margin gains, uncertainty around dividend sustainability raises concerns for investors who prioritize reliable income from their portfolio.

If stable payouts matter most to you, use our these 1999 dividend stocks with yields > 3% to uncover companies delivering attractive yields with greater consistency and resilience than KVK currently offers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KVK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6484

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives