What MINEBEA MITSUMI (TSE:6479)'s Dividend Hike and Upgraded Earnings Outlook Mean For Shareholders

Reviewed by Sasha Jovanovic

- MINEBEA MITSUMI Inc. recently announced a second quarter dividend increase to ¥25.00 per share, up from ¥20.00 a year earlier, and raised its consolidated earnings guidance for the full year ending March 31, 2026, citing higher expected net sales and profits.

- The combination of a dividend hike and upward revision of earnings forecasts suggests strengthened operating performance and an emphasis on delivering greater value to shareholders.

- We'll examine how the increase in earnings and dividends could shift MINEBEA MITSUMI's investment narrative and future expectations.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MINEBEA MITSUMI Investment Narrative Recap

To be a shareholder in MINEBEA MITSUMI, you need to believe in its ability to drive sustainable growth by capitalizing on expanding capacity and strengthening core businesses, even amid sector shifts and macroeconomic pressures. The recent upward revision to earnings guidance and a dividend increase signal management's confidence and may reinforce the company’s positive momentum, but risks in key markets and ongoing foreign exchange challenges remain critical in the near term.

Of the latest developments, the most relevant is the raised consolidated earnings guidance for the year ending March 31, 2026. This directly supports optimism around near-term catalysts such as demand recovery and margin improvements in core segments, but highlights the importance of monitoring whether these gains are maintained despite external headwinds.

However, investors should be aware of lingering risks tied to foreign exchange rate volatility and the potential for revenue disruptions, particularly if...

Read the full narrative on MINEBEA MITSUMI (it's free!)

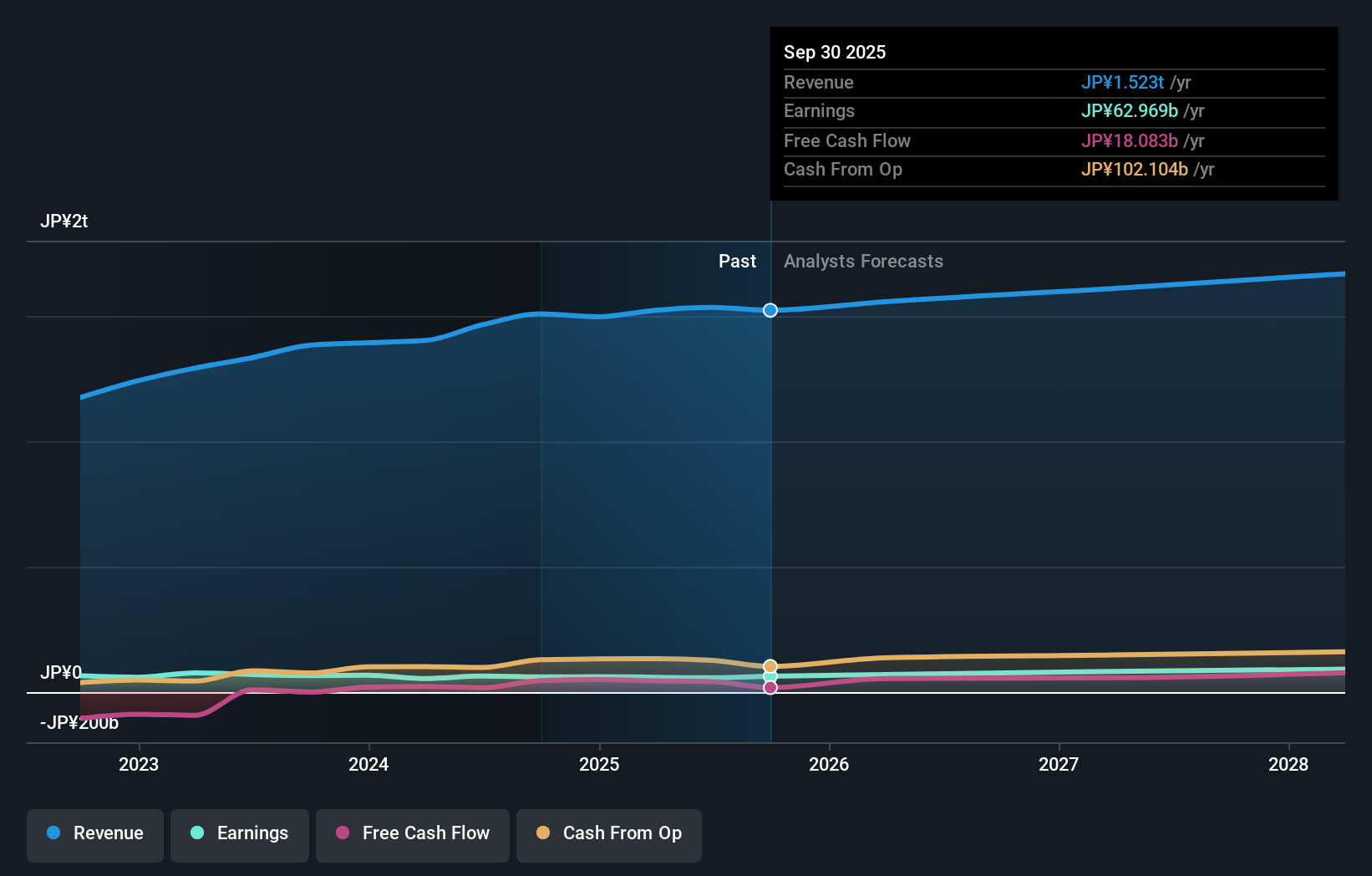

MINEBEA MITSUMI's outlook forecasts revenue of ¥1,644.2 billion and earnings of ¥88.6 billion by 2028. This scenario assumes an annual revenue growth rate of 2.3% and represents a ¥31.4 billion increase in earnings from the current ¥57.2 billion.

Uncover how MINEBEA MITSUMI's forecasts yield a ¥3221 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 1 fair value estimate at ¥4,834 per share, highlighting a singular but bullish outlook. With management’s focus on expanding production and profit margin improvement, it’s clear opinions can vary and it’s worth seeing how others view MINEBEA MITSUMI’s future prospects.

Explore another fair value estimate on MINEBEA MITSUMI - why the stock might be worth just ¥4834!

Build Your Own MINEBEA MITSUMI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MINEBEA MITSUMI research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free MINEBEA MITSUMI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MINEBEA MITSUMI's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6479

MINEBEA MITSUMI

Manufactures and supplies machined components, electronic devices and components, automotive, and industrial machinery and home security business in Japan and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives