Glory (TSE:6457) Is Up 7.9% After Beating Forecasts Despite Earnings Decline—What’s Driving Resilience?

Reviewed by Sasha Jovanovic

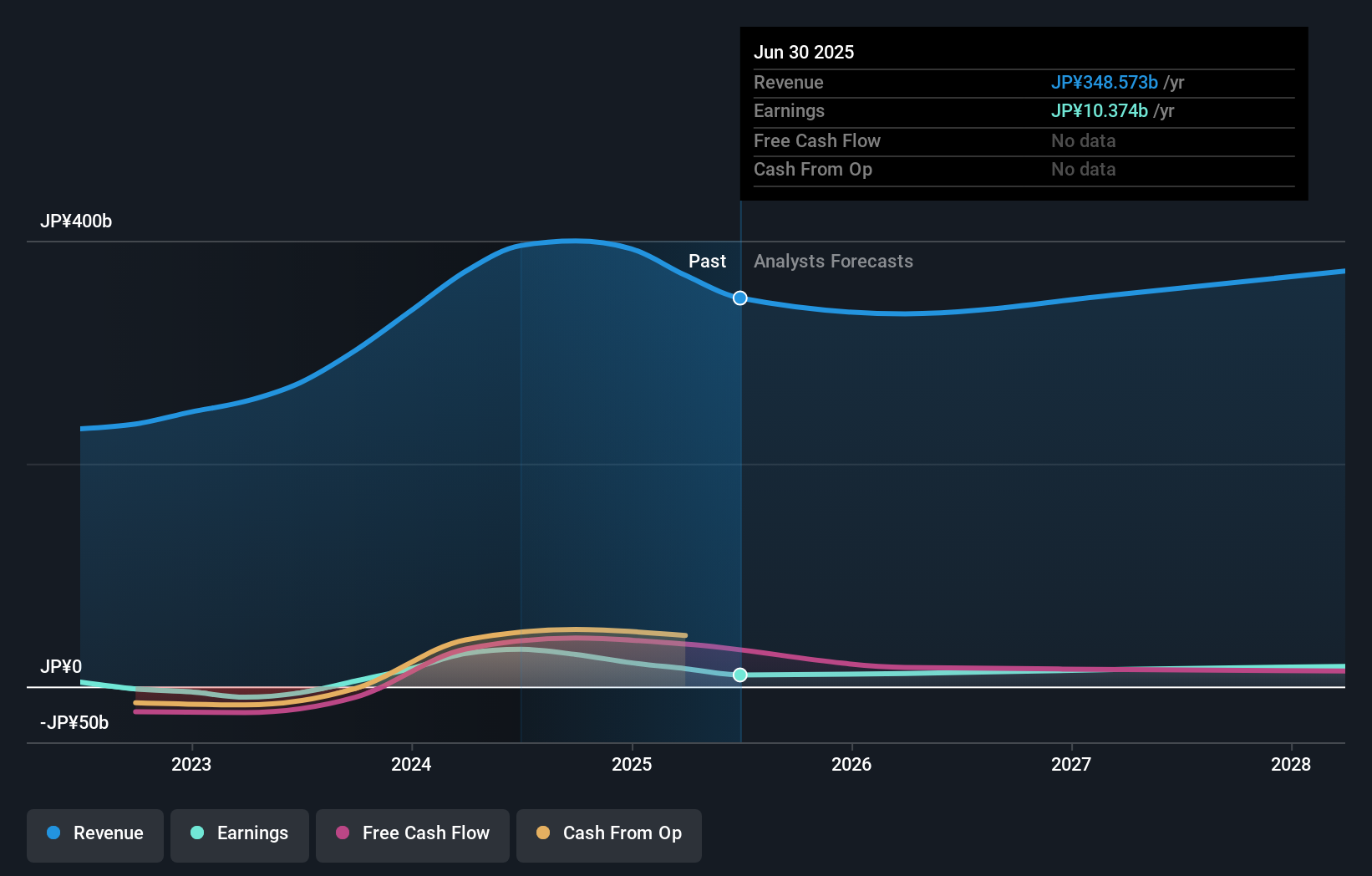

- Glory Ltd. recently reported a year-on-year drop in financial performance for the six months ending September 30, 2025, with net sales down 16.9% and net income down 57.1%.

- Despite these declines, the company exceeded its own interim forecasts thanks to robust demand for self-service products and operational efficiencies, and plans to shift to International Financial Reporting Standards from the next fiscal year.

- Let's explore what Glory's outperformance against internal forecasts and its focus on operational improvement could mean for its investment story.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

What Is Glory's Investment Narrative?

For anyone considering Glory Ltd., the big picture centers on how well the company can convert recent operational resilience into a more durable turnaround, especially after interim results beat its own forecasts despite year-on-year declines in sales and net income. The real short-term test comes from ongoing demand for self-service and automation solutions, which has cushioned Glory from sharper profit headwinds as labor shortages drive adoption in key markets. However, earnings risks have shifted: with profit margins thinner and guidance met only through cost cuts, future catalysts will likely hinge on sustained sales momentum rather than single-period efficiencies. The recent results, while better than internal expectations, don’t erase challenges like intense sector competition and a still-volatile dividend. Glory’s adoption of IFRS could improve reporting transparency, but it doesn’t fundamentally alter earnings or cash flow risks for now. Recent gains in the share price suggest optimism is building, yet the gap between improved performance and long-term profitability remains a point for careful scrutiny. On the flip side, earnings resilience is only as good as next quarter’s demand.

Glory's shares have been on the rise but are still potentially undervalued by 22%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Glory - why the stock might be worth as much as ¥3284!

Build Your Own Glory Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glory research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Glory research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glory's overall financial health at a glance.

No Opportunity In Glory?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6457

Glory

Develops, manufactures and sells cash handling machines in Japan, the United States, Europe, and Asia.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives