Daifuku (TSE:6383) Valuation in Focus Following Leadership Transition Announcement

Reviewed by Simply Wall St

Daifuku (TSE:6383) has revealed a leadership transition, with COO Terai set to step into the CEO position on January 1, 2026. Current CEO Geshiro will move to chairman. Investors are reacting to how such executive changes could shape company strategy and performance.

See our latest analysis for Daifuku.

Daifuku’s recent CEO transition news adds momentum to a strong run, with a 1-day share price return of 2.2% and a 7.7% gain over the last month. In the bigger picture, the company is enjoying robust investor confidence, as shown by its year-to-date share price return of nearly 59% and a three-year total shareholder return of 119%. This highlights both short-term excitement and long-term value-building.

If leadership changes spark your curiosity about what’s next in the market, now is a perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Daifuku’s strong returns and new leadership on the horizon, the big question is whether the stock represents untapped opportunity for investors or if the market is already pricing in all future growth from here.

Price-to-Earnings of 26x: Is it justified?

Daifuku shares are currently trading at a price-to-earnings (P/E) ratio of 26x, which stands out as notably higher than both its sector and peer benchmarks.

The P/E ratio reflects how much investors are willing to pay for each unit of company earnings. For machinery companies, it signals the market’s confidence in ongoing profits and growth potential.

In Daifuku’s case, the premium multiple suggests investors are anticipating continued earnings expansion. However, the current figure of 26x is above the peer average (23.3x) and significantly higher than the Japan Machinery industry average (13.2x). This indicates the market may be pricing in strong expectations for future performance. When compared to the estimated fair P/E ratio of 21.3x, the current level also appears stretched, which could mean less margin for error if growth slows.

Explore the SWS fair ratio for Daifuku

Result: Price-to-Earnings of 26x (OVERVALUED)

However, slower revenue growth or a miss on profit expectations could quickly challenge the optimism that is currently reflected in Daifuku shares.

Find out about the key risks to this Daifuku narrative.

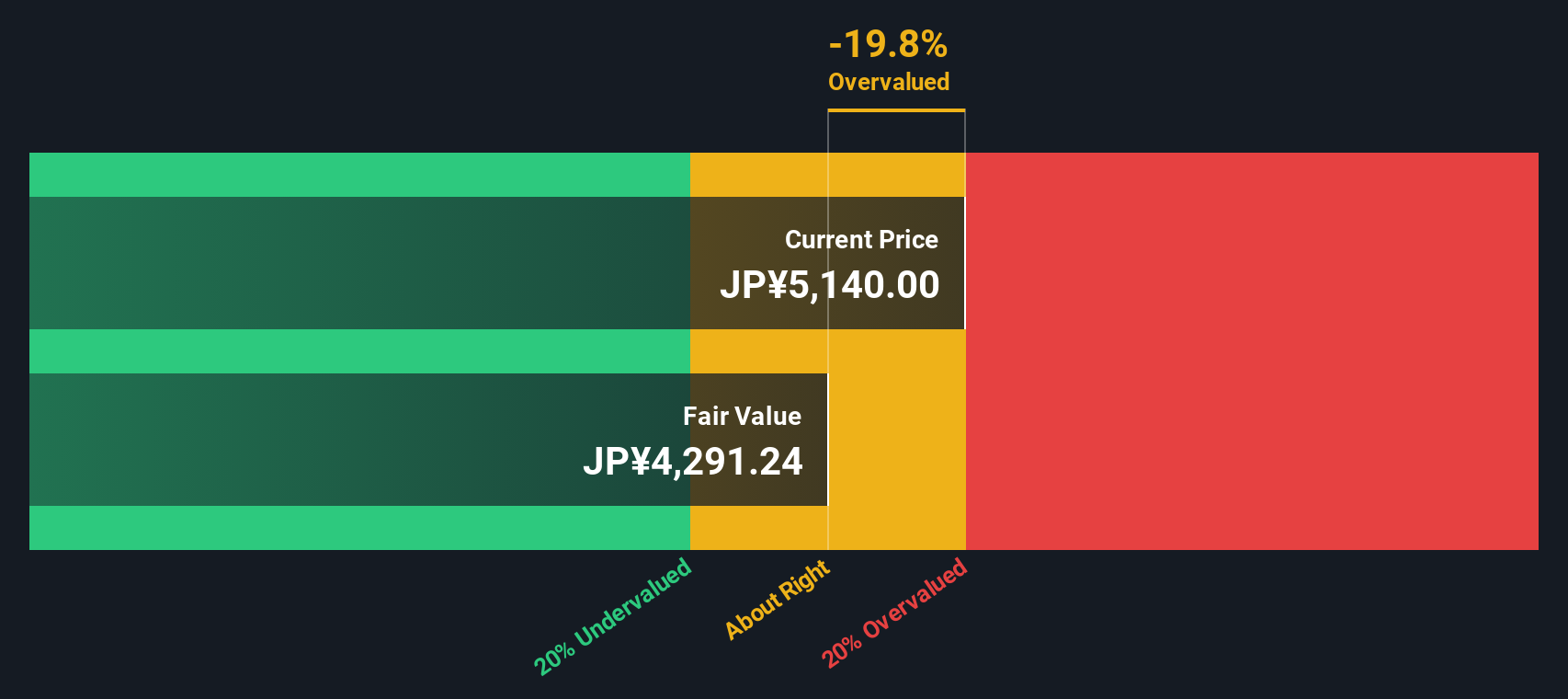

Another View: Discounted Cash Flow Perspective

Looking beyond earnings multiples, our SWS DCF model values Daifuku at ¥4,288, which is below the current share price of ¥5,136. This suggests the market may be a bit too optimistic about the company's future cash flows. Does this raise new questions about where value truly lies for Daifuku?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Daifuku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Daifuku Narrative

If you think the story behind Daifuku looks different to you, or want to dig deeper into your own research, you can build your narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Daifuku.

Looking for more investment ideas?

Why settle for just one opportunity? Let Simply Wall Street help you tap into exciting new stocks and bold investment themes with our powerful Screener tools.

- Maximize your growth potential by checking out these 863 undervalued stocks based on cash flows, which is packed with companies trading below their true worth, so you never overpay for opportunity.

- Start building steady income by reviewing these 14 dividend stocks with yields > 3%, which features stocks with attractive yields that could boost your portfolio’s cash flow.

- Get ahead of the curve with these 25 AI penny stocks, showcasing businesses that are shaping the future of artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6383

Daifuku

Offers consulting, engineering, design, manufacture, installation, and after-sales services for logistics systems and material handling equipment in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives