Tsubakimoto Chain (TSE:6371): Evaluating Valuation as Buyback Program Wraps Up

Reviewed by Simply Wall St

Tsubakimoto Chain (TSE:6371) has just wrapped up its previously announced share repurchase program, buying back 5.08% of shares. The completion of this buyback is drawing attention from investors interested in company direction and capital allocation.

See our latest analysis for Tsubakimoto Chain.

Tsubakimoto Chain’s buyback news comes after a year of solid momentum, with the stock’s share price rising nearly 15% year-to-date and its total shareholder return reaching 23% over the past 12 months. Long-term holders have enjoyed even greater rewards, with a 133% total return over three years. This suggests that investor sentiment around capital allocation and business prospects remains strong.

If you’re looking for your next idea, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With strong recent returns and the completion of a major buyback, the key question for investors is whether Tsubakimoto Chain’s current price offers value, or if the market is already anticipating further growth ahead.

Price-to-Earnings of 9.7x: Is it justified?

Tsubakimoto Chain shares are currently trading at a price-to-earnings (P/E) ratio of 9.7x, which is notably below both the peer average (16.5x) and the average for the Japanese Machinery industry (12.2x). At the last close price of ¥2,180, the stock appears more attractively valued than its direct competitors based on earnings.

The price-to-earnings ratio shows how much investors are willing to pay for every yen of the company’s earnings. In capital goods and machinery, a lower-than-peer P/E often signals that the market expects slower profit growth or has not fully recognized improvements in business fundamentals.

Market benchmarks provide reinforcement for this interpretation. Compared to the peer and industry multiples, the current P/E suggests the market could be underestimating the company’s profit potential or anticipating more modest growth ahead. Regression analysis also rates a fair P/E at 11.6x, which further supports the idea that the stock trades below an implied equilibrium level.

Explore the SWS fair ratio for Tsubakimoto Chain

Result: Price-to-Earnings of 9.7x (UNDERVALUED)

However, risks remain, including recent declines in quarterly net income and the stock trading slightly above its analyst price target.

Find out about the key risks to this Tsubakimoto Chain narrative.

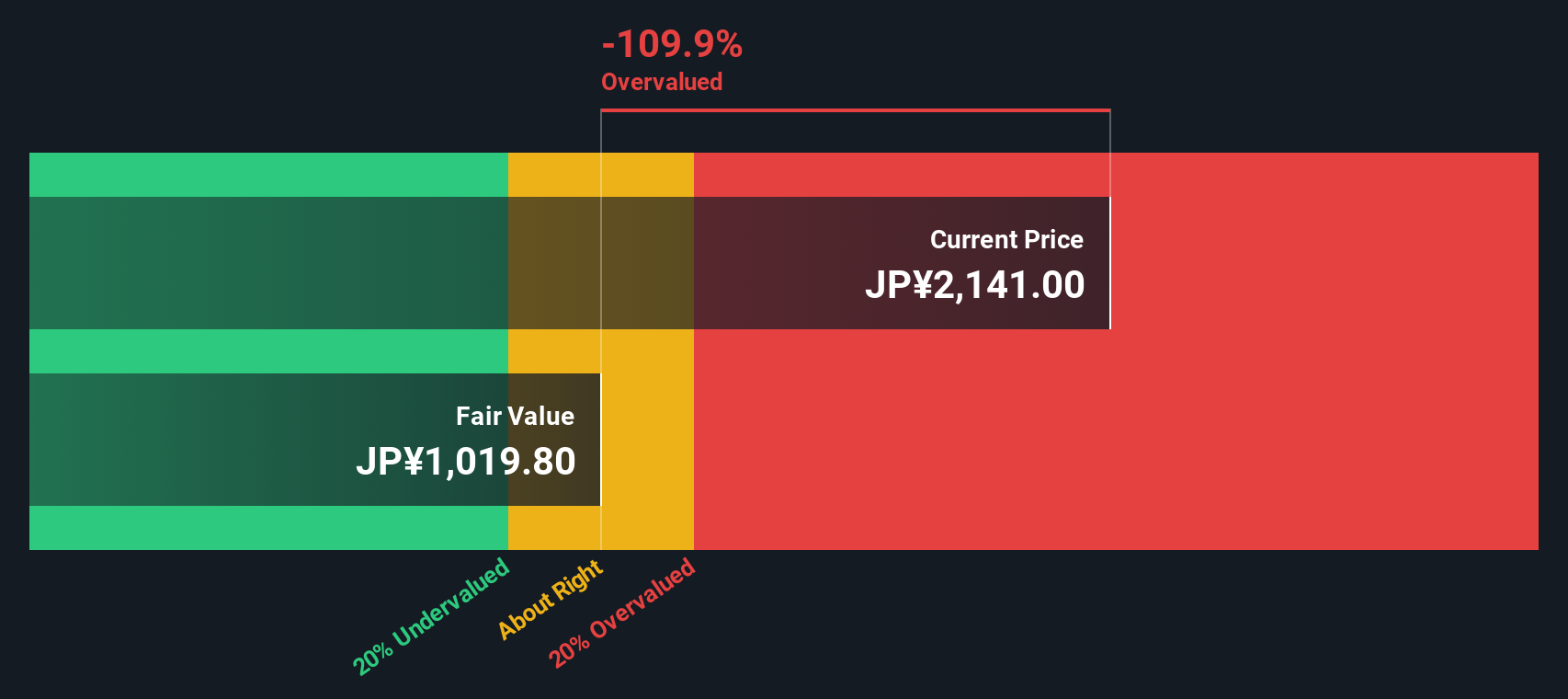

Another View: SWS DCF Model Flags Overvaluation

While the share price looks attractive when compared to earnings, our SWS DCF model offers a different perspective. It estimates Tsubakimoto Chain’s fair value at ¥1,021.71, which is well below the market price of ¥2,180. This suggests the stock may be overvalued on a discounted cash flow basis. Are investors placing too much faith in future growth, or is the model overlooking key business drivers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tsubakimoto Chain for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tsubakimoto Chain Narrative

If you have a different perspective or enjoy diving into the numbers firsthand, you can piece together your own take on Tsubakimoto Chain in just a few minutes. Do it your way

A great starting point for your Tsubakimoto Chain research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Opportunities?

Smart investors know that keeping an edge means acting quickly when new themes and trends take off. Don’t miss out—power up your portfolio with fresh ideas now.

- Capture passive income with robust yields by checking out these 15 dividend stocks with yields > 3%. This can give your investments a reliable boost in any market climate.

- Seize the potential of the tech revolution and search for tomorrow’s winners among these 25 AI penny stocks, which are at the forefront of artificial intelligence.

- Ride the next wave of innovation in digital assets by scanning these 81 cryptocurrency and blockchain stocks for companies impacting cryptocurrency and the blockchain economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsubakimoto Chain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6371

Tsubakimoto Chain

Manufactures and sells chains, motion control, mobility, materials handling systems components in Japan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success