Kurita Water Industries (TSE:6370) Valuation Under the Spotlight After Strategic Lithium Partnership Announcement

Reviewed by Simply Wall St

Kurita Water Industries (TSE:6370) has entered a three-way partnership with Northern Lithium and Evove to deliver the UK’s first commercial-scale lithium supplies using advanced direct lithium extraction technology. This move places Kurita at the forefront of Europe’s energy transition strategies.

See our latest analysis for Kurita Water Industries.

Kurita’s share price has shown renewed momentum lately, with a 13.7% gain over the last month and a 9% jump in just the past week, as investors respond positively to its strategic expansion into sustainable lithium supply and advanced technologies. Over the longer term, total shareholder returns have been steady, up nearly 7% in the past year and more than doubling over five years. This signals that optimism around future growth is building.

If this step into energy transition has sparked your curiosity, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

But with shares near all-time highs and recent gains outpacing the broader market, investors are left weighing whether Kurita’s strong outlook is undervalued or if enthusiasm for growth is already reflected in the price.

Price-to-Earnings of 31.6x: Is It Justified?

Kurita Water Industries is currently trading at a price-to-earnings (P/E) ratio of 31.6x, which stands out as significantly higher than both its industry peers and the broader market. The last close price was ¥5,844, placing the stock well above the JP Machinery sector average for earnings-based valuation.

The price-to-earnings ratio measures how much investors are willing to pay for each unit of company earnings. For a business like Kurita, operating in a mature yet innovation-driven sector, this metric gives insight into whether the market expects strong profit growth or is overvaluing current performance.

In Kurita's case, the 31.6x P/E multiple looks stretched when set against the industry average of just 13.7x and a peer group average of 18.9x. This could signal that the market is pricing in hefty future growth or superior business quality. It may also reflect overenthusiasm for the company's latest strategic moves. Compared to the SWS-calculated fair P/E ratio of 23.2x, the current level is notably ahead and may suggest future valuation pressure unless earnings rise rapidly.

Explore the SWS fair ratio for Kurita Water Industries

Result: Price-to-Earnings of 31.6x (OVERVALUED)

However, slower earnings growth or shifts in investor sentiment could challenge the current valuation and prompt a reassessment of Kurita’s growth outlook.

Find out about the key risks to this Kurita Water Industries narrative.

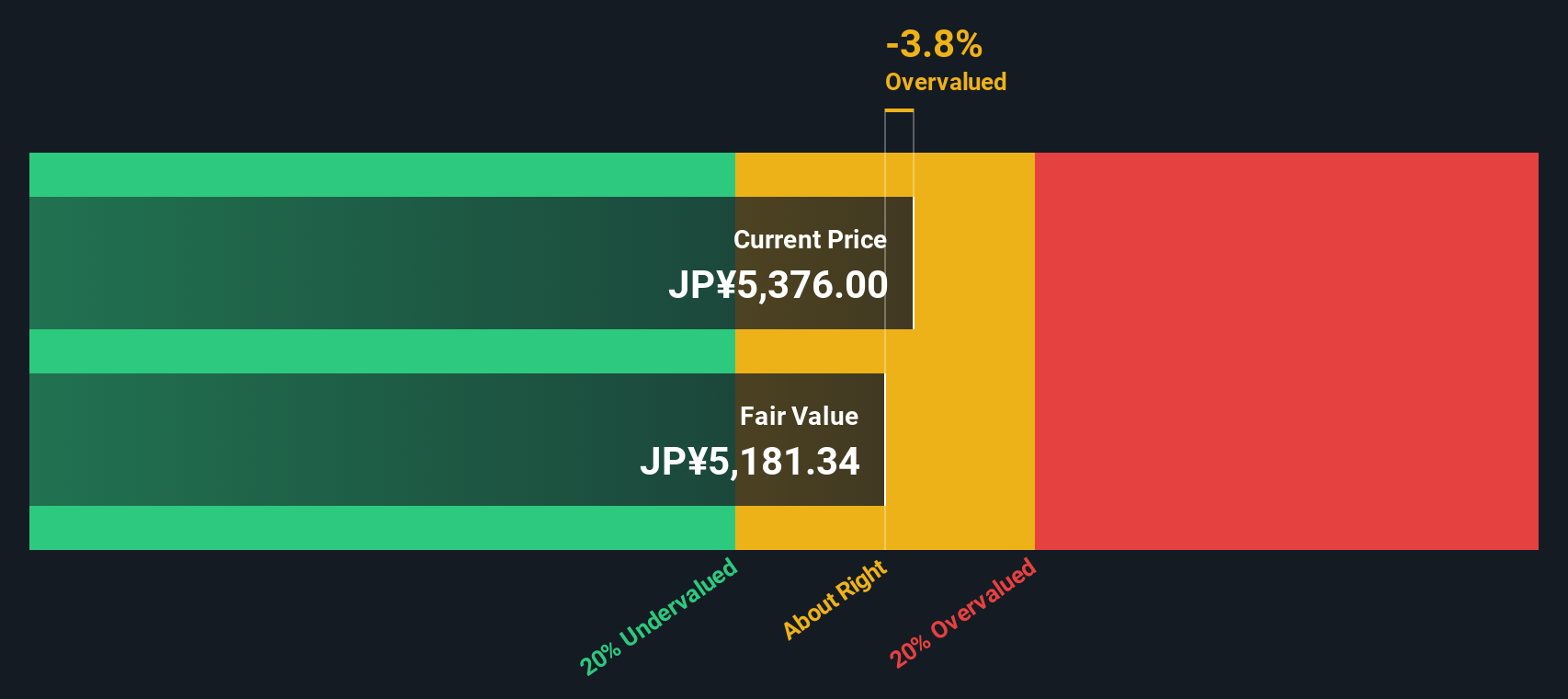

Another View: Discounted Cash Flow Paints a Different Picture

While the price-to-earnings ratio suggests Kurita shares look expensive, our SWS DCF model presents a different perspective. According to this method, the current share price of ¥5,844 is actually above the fair value estimate of ¥5,229, so the stock may be overvalued based on future cash flows. Does this challenge the market's optimism, or is there more to the growth story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kurita Water Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kurita Water Industries Narrative

If you want to dig deeper or come to your own conclusion, you can explore the numbers and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Kurita Water Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Actionable Investment Ideas?

Take the next step and turn today’s momentum into your advantage by targeting smart opportunities other investors could be missing with our powerful screeners.

- Capitalize on the shift to advanced healthcare by targeting leaders in medical innovation with these 33 healthcare AI stocks.

- Lock in consistent yield and strength by focusing on these 17 dividend stocks with yields > 3%, which offers reliable returns above 3%.

- Seize the upside of a rapidly transforming economy by backing visionaries at the forefront with these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kurita Water Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6370

Kurita Water Industries

Provides water treatment solutions in Japan, rest of Asia, North and South America, Europe, the Middle East, and Africa.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives