Kurita Water Industries (TSE:6370) Valuation in Focus Following Upgraded Earnings Guidance and Dividend Hike

Reviewed by Simply Wall St

Kurita Water Industries (TSE:6370) has just released new consolidated earnings guidance for its next fiscal year, along with a higher second-quarter dividend. Both moves give investors fresh insight into the company’s outlook and commitment to shareholder returns.

See our latest analysis for Kurita Water Industries.

The strong 12.7% share price return over the past week and 21.6% gain in the last three months suggest investors are warming up to Kurita Water Industries’ renewed earnings outlook and higher dividend. However, the one-year total shareholder return sits at just 5.2%. Momentum appears to be building in the short term, reflecting optimism around the company’s growth potential and commitment to rewarding shareholders.

To see what else the market has to offer, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With steady revenue growth and robust profit forecasts, Kurita Water Industries' shares have rallied recently. With gains already on the board, investors may wonder whether there is still upside ahead or if future growth is fully priced in.

Price-to-Earnings of 31.3x: Is it justified?

Kurita Water Industries is trading at a price-to-earnings (P/E) ratio of 31.3, which puts the stock at a considerable premium to its industry peers and the broader market. Investors paying this multiple are expecting strong ongoing earnings growth or unique company advantages. However, the current valuation stands well above common benchmarks.

The P/E ratio measures the company's current share price relative to its per-share earnings. It is a widely used valuation metric, especially for companies in the machinery and industrial sector where earnings quality and future growth are under close scrutiny. A high P/E often signals high growth expectations, but if profit growth does not accelerate to justify the valuation, there is potential for the share price to lag.

Kurita’s current P/E is more than double the Japanese Machinery industry average of 13.5x. This indicates that the market is assigning a substantial premium to the company’s future prospects. It is also above the peer average of 23.7x and the estimated Fair Price-to-Earnings Ratio of 23.8x. These comparative figures suggest that the stock may be priced for perfection, with limited room for upside without significant outperformance.

Explore the SWS fair ratio for Kurita Water Industries

Result: Price-to-Earnings of 31.3x (OVERVALUED)

However, slower than expected revenue growth or weaker profit margins could quickly challenge the current optimism and put renewed pressure on Kurita Water Industries' valuation.

Find out about the key risks to this Kurita Water Industries narrative.

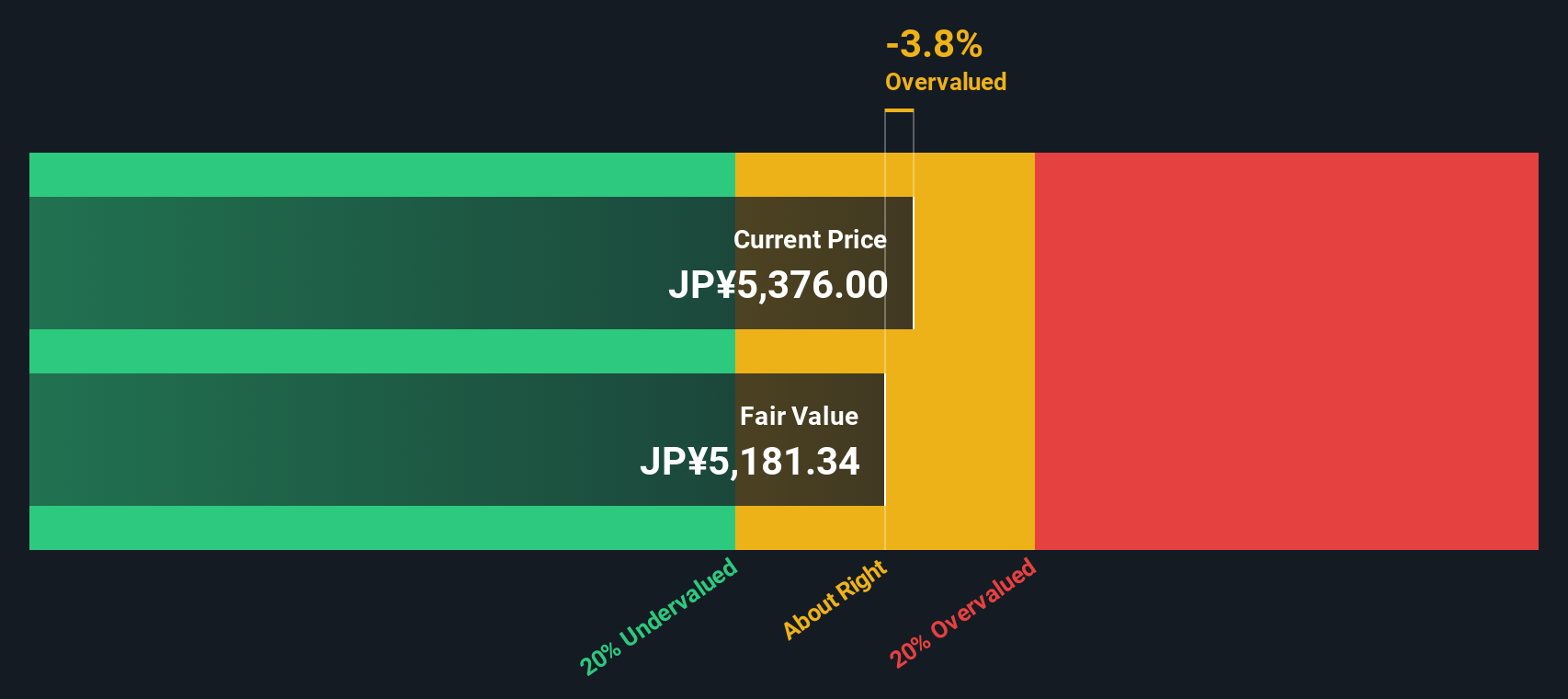

Another View: Discounted Cash Flow Tells a Cautionary Tale

Looking beyond market multiples, our DCF model arrives at a markedly different conclusion. Based on projected future cash flows, Kurita Water Industries appears overvalued, with its current share price sitting significantly above our estimate of fair value. Could the market be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kurita Water Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kurita Water Industries Narrative

If you see things differently or enjoy hands-on analysis, you can easily create your own take using our toolkit in just a few minutes. Do it your way

A great starting point for your Kurita Water Industries research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Take action now to broaden your horizons and uncover investment gems you might otherwise miss with our exclusive stock screeners.

- Spot companies reshaping healthcare by tapping into breakthroughs when you scan these 31 healthcare AI stocks.

- Boost your income potential and find reliable picks by browsing these 16 dividend stocks with yields > 3% with strong yields.

- Ride the future of innovation by searching these 26 quantum computing stocks specializing in next-gen computing technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kurita Water Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6370

Kurita Water Industries

Provides water treatment solutions in Japan, rest of Asia, North and South America, Europe, the Middle East, and Africa.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives