Organo (TSE:6368) Margin Expansion Reinforces Profitability Narrative, Despite Share Price Volatility

Reviewed by Simply Wall St

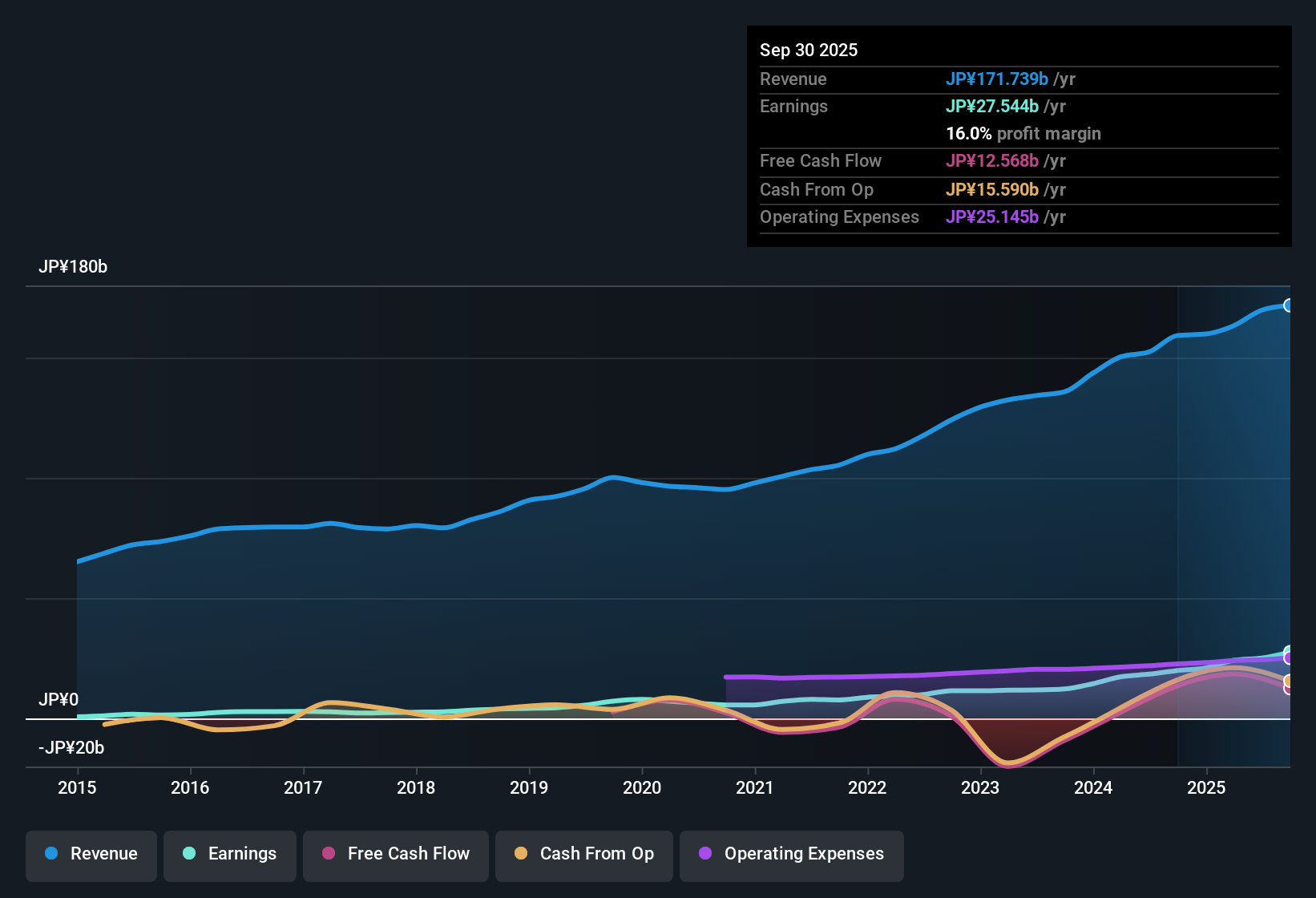

Organo (TSE:6368) delivered a robust 38.4% increase in earnings over its five-year average, with net profit margins rising to 16% from last year's 12.5%. Revenue is now forecast to grow 5.1% per year, ahead of the Japanese market's 4.5% pace. However, future earnings growth is expected to settle at 5.5% per year, which is below the broader market's 7.8% forecast. Investors are likely to view the combination of stronger margins, historical earnings quality, and relative valuation as positives, even as recent share price volatility affects the near-term outlook.

See our full analysis for Organo.Next up, we’ll see how these earnings results hold up against the big narratives in the market, highlighting where the numbers support the story and where things might look different.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Expand Beyond Industry Norms

- Net profit margins climbed to 16%, marking a significant leap from last year’s 12.5% and placing Organo’s profitability well above most Japanese Machinery peers.

- Analysts tracking the sector have noted that this margin resilience stands out, given that many peers are struggling to defend profitability.

- This above-average margin performance is heavily attributed to cost controls and operational efficiency. It directly reinforces recent positive commentary regarding Organo’s focus on sustainable and high-value solutions.

- However, the market’s optimism could be tested if future margin expansion slows. Further upside may hinge on continued growth in environmental infrastructure contracts and disciplined spending.

Growth Rate Lags Long-Term Market Trend

- Future earnings are projected to grow at 5.5% per year, noticeably trailing the Japanese market’s expected 7.8% pace despite Organo’s strong five-year average of 30%.

- Rather than the explosive growth enjoyed in previous periods, forecasts paint a steadier but slower trajectory.

- This aligns with prevailing views that Organo’s sector momentum is driven more by consistency and ESG tailwinds than breakout expansion figures.

- Some analysts note that while Organo’s historical performance outpaces the market, current projections suggest a normalization period rather than another growth spike.

Valuation Attractive Versus Peers, Discounted to DCF

- Organo trades at a price-to-earnings ratio of 22.2x, cheaper than the peer average of 25.8x but higher than the industry average of 13.3x. The current share price of 13,280.00 also sits well below the DCF fair value of 17,735.45.

- Organo’s discounted trading offers investors a compelling entry point by some measures, but market participants flag volatility risk. Recent share price instability contrasts with the company’s otherwise strong fundamentals.

- Despite relative valuation strength, short-term price swings could remain an overhang for those seeking stable growth exposure.

- Persistent value gap versus DCF suggests underlying investor caution, even as underlying profit and margin trends stay solid.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Organo's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Organo’s projected earnings growth is now slower than the market. This suggests steadier returns but less upside compared to faster-growing peers.

If you’re seeking companies delivering consistent earnings expansion year after year, check out stable growth stocks screener (2095 results) that can help you find steadier performers built for long-term confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6368

Organo

Engages in water treatment engineering and performance product businesses in Japan, Taiwan, China, Southeast Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives