Is a Potential Dividend Revision Shifting the Investment Case for Organo (TSE:6368)?

Reviewed by Sasha Jovanovic

- On October 31, 2025, Organo Corporation’s board convened to consider approval and revision of the year-end dividend, referencing a record date of September 30, 2025, as well as other matters.

- This decision regarding the dividend policy has the potential to directly influence shareholder expectations for returns and future capital allocation.

- We'll explore how the board’s focus on dividend revisions may affect Organo's investment narrative and shareholder outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Organo's Investment Narrative?

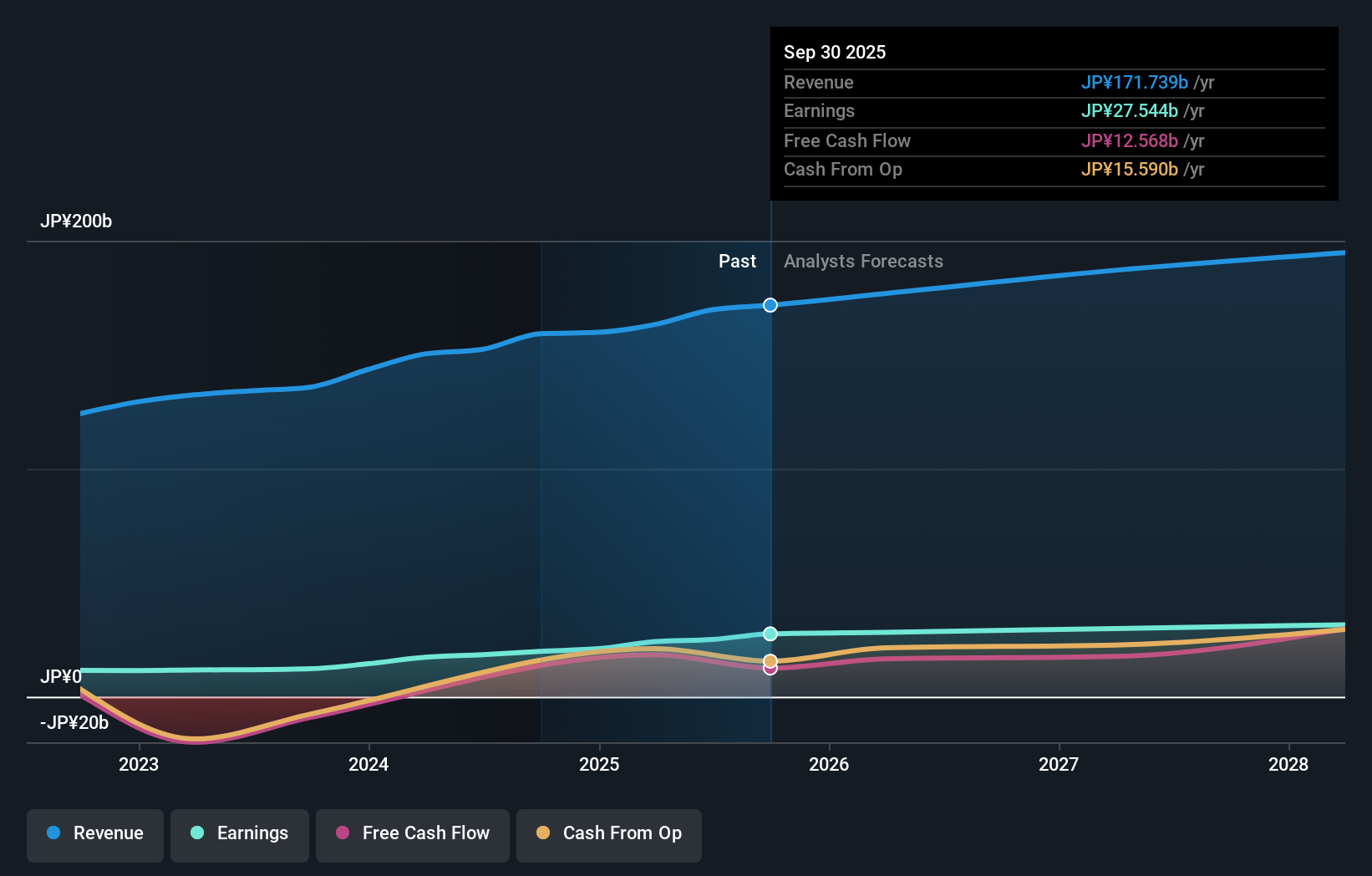

To be an Organo shareholder today, you’d need to believe in the company’s ability to keep growing profits and revenue faster than the broader Japanese market, even as industry risks and a higher Price-To-Earnings multiple compared to peers weigh on sentiment. The board’s October 31 decision to review and possibly alter its year-end dividend looks set to be an incremental, rather than transformative, catalyst in the near term. Given recent share price momentum and already elevated total returns, the market appears more focused on Organo’s track record of earnings growth (38.4% over the last year) and its strong profitability rather than modest dividend tweaks. That said, should the dividend revision involve a material cut or surprise, it could sharpen investor focus on capital allocation and heighten sensitivity to any future earnings disappointments.

But keep in mind, board churn and an inexperienced director group may add risk going forward. Organo's shares have been on the rise but are still potentially undervalued by 25%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Organo - why the stock might be worth just ¥17729!

Build Your Own Organo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Organo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Organo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Organo's overall financial health at a glance.

No Opportunity In Organo?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6368

Organo

Engages in water treatment engineering and performance product businesses in Japan, Taiwan, China, Southeast Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives