Daikin Industries (TSE:6367) Valuation: Is Market Optimism Justified After a 7% Share Price Gain?

Reviewed by Simply Wall St

See our latest analysis for Daikin IndustriesLtd.

Daikin IndustriesLtd’s share price has notched a solid 1-month gain, with momentum building despite a tougher start to the year. Over the past year, the stock’s total shareholder return of 3.8% shows modest progress in the context of shifting sentiment and ongoing sector volatility.

If you are watching this turnaround, it could be a great time to explore new opportunities and discover fast growing stocks with high insider ownership

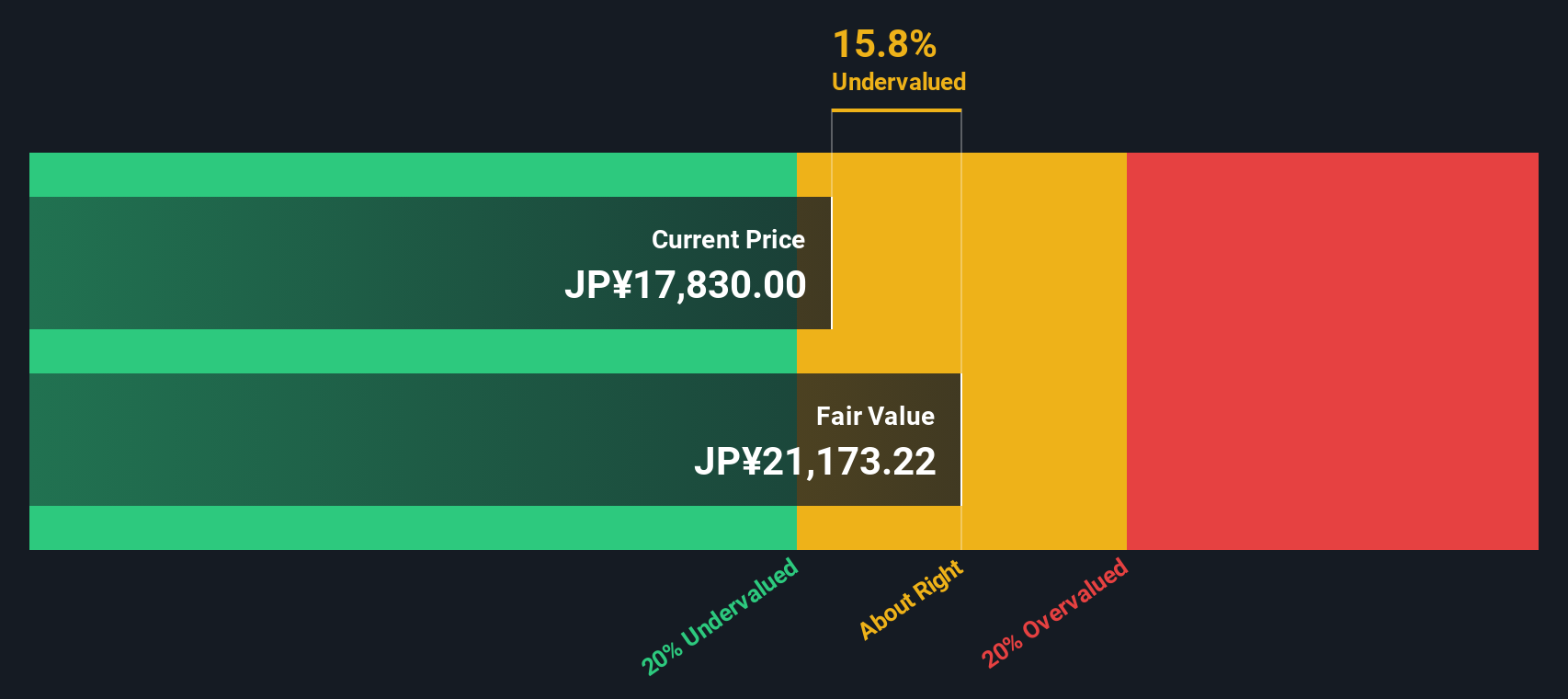

With shares climbing recently and a slight discount to analyst price targets still visible, the key question for investors is whether Daikin IndustriesLtd is undervalued, or if the market has already priced in its future growth potential.

Price-to-Earnings of 19x: Is it justified?

Daikin IndustriesLtd trades at a price-to-earnings (P/E) ratio of 19x, while peer companies average a much higher 32.7x. With the last close at ¥18,330, the market is currently valuing Daikin at a discount compared to similar-sized peers in the sector.

The price-to-earnings multiple is a common way investors gauge whether a stock is cheap or expensive relative to its earnings. For a company like Daikin IndustriesLtd, which operates in a mature but occasionally volatile capital goods sector, this comparison can provide insight into expectations for profit growth, market leadership, and operational efficiency.

A 19x P/E is lower than that of comparable peers. This suggests the market may be more cautious about Daikin’s growth potential or may be overlooking its recent profit momentum. When compared to the estimated Fair Price-to-Earnings Ratio of 22.3x, there appears to be room for the market to re-rate Daikin higher if positive trends continue.

Explore the SWS fair ratio for Daikin IndustriesLtd

Result: Price-to-Earnings of 19x (UNDERVALUED)

However, slower revenue growth or unexpected earnings volatility could challenge the recent optimism and affect Daikin IndustriesLtd's re-rating potential in the near term.

Find out about the key risks to this Daikin IndustriesLtd narrative.

Another View: SWS DCF Model Weighs In

Taking a different angle, our SWS DCF model estimates Daikin IndustriesLtd’s fair value at ¥21,191.87, which is well above its current price of ¥18,330. This suggests the shares are trading at a 13.5% discount. Can the market close this gap, or will uncertainty hold it back?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Daikin IndustriesLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Daikin IndustriesLtd Narrative

If you want to dig into the details yourself or approach the numbers from a different angle, you can quickly shape your own view. Do it your way.

A great starting point for your Daikin IndustriesLtd research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit your search to just one opportunity? Expand your investing potential by using handpicked screens designed to surface tomorrow’s market movers and income generators.

- Start building passive income streams with yields above 3% by scanning these 17 dividend stocks with yields > 3%, which consistently deliver solid cash returns.

- Watch the future unfold as you uncover these 27 AI penny stocks that use artificial intelligence to transform industries and drive exceptional growth.

- Gain an edge in value investing by targeting these 868 undervalued stocks based on cash flows, which are poised for re-rating as market sentiment catches up to their financial momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6367

Daikin IndustriesLtd

Manufactures, distributes, and sells air-conditioning and refrigeration equipment, and chemical products in Japan, the Americas, China, Asia, Europe, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives